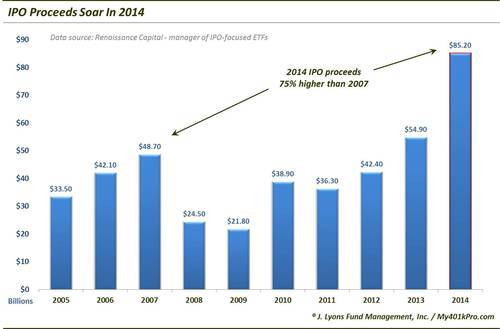

IPO Proceeds Soar In 2014

As we touched on many times throughout the year (especially in recent weeks), 2014 was a year of records in the U.S. stock market. Thanks to favorable conditions, you can add another record to the list: IPO Proceeds. As our Chart Of The Day shows, according to Renaissance Capital the amount of money raised through Initial Public Offerings during the year was the highest, by far, in at least 10 years.

2014’s total IPO proceeds registered $85.2 billion, more than 50% higher than 2013’s record level. Furthermore, it was 75% above the last cycle’s high mark of $48.7 billion. Also of note, the $28.5 billion raised in September alone was over $10 billion higher than any month previously. And the $38 billion raised in the 3rd quarter alone equaled the average annual level of IPO proceeds from 2005 to 2013.

Our focus on the comparison versus 2007 is more informal than scientific. Simply exceeding the previous cycle high does not necessarily imply impending doom (after all, 2013’s total was higher than 2007). Plus, all cycles are different. However, if there is relevancy there, the exceeding of that 2007 level is not a comforting development, particularly given the margin by which it has now exceeded it.

We are not condemning the vast number of companies, or the underwriters in the process, for going public last year. On the contrary, they absolutely should take advantage of favorable financing and capital market conditions to do so.Think of it as the owners selling shares of their company to the public at a, presumably, high price. That does not mean an individual IPO cannot appreciate in value from here. We simply mean that, in general, conditions point to an extended equity market that offers a good risk:reward proposition for company owners in which to pass off some risk to other investors.

That so many investors are eager to adopt that risk suggests that we may add this development to the list of “frothy” conditions that are piling up in the market now. This list includes things like margin debt, valuation, investor stock allocation, corporate buybacks and simply market prices versus the long-term trend. Again these “long-term” conditions can persist for awhile. Therefore, they should not be used as a trigger for a bearish market stance. However, we would think of them as indicators for how much potential risk is in the market should the trend indeed turn lower. At this point, we assess that potential risk level to be considerable.

________

More from Dana Lyons, JLFMI and My401kPro.