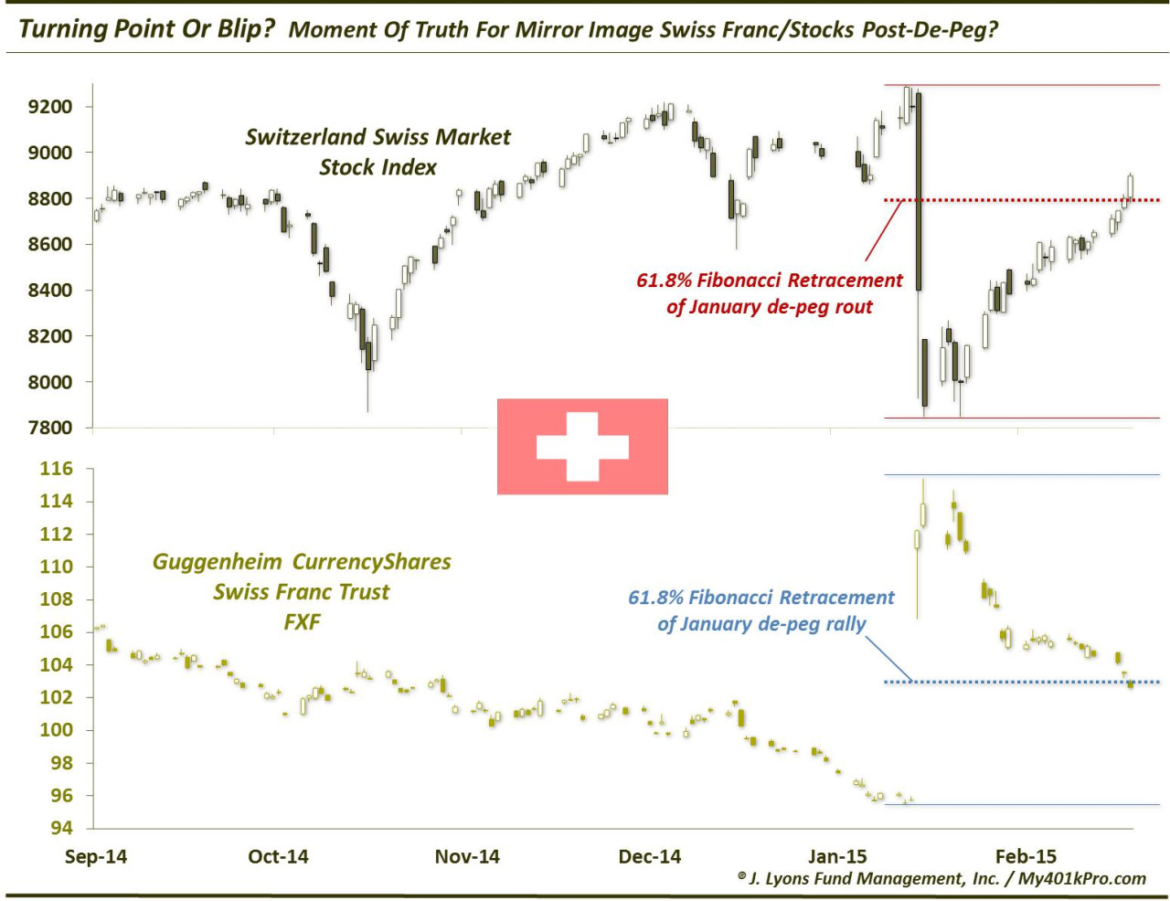

Moment Of Truth For Mirror Image Swiss Stocks, Franc Post De-Peg?

The Swiss National Bank sent ripples throughout the financial world on January 15 when they unexpectedly removed the cap on the Swiss Franc versus the Euro. The Franc jumped almost 30% versus the Euro that day. The same day, Switzerland’s main stock average, the Swiss Market Index (SMI), dropped nearly 9% due to the strength in its home currency (the move also produced material for our most popular chart we’ve ever Tweeted: the SMI going from 52-week high to 52-week low in the same week).

A funny thing has happened since, however. The Swiss Franc has drifted steadily lower while the SMI has rallied. What we like about this move is the evidence it offers regarding price discovery that occurs when market forces take over. Why have markets moved counter to the initial reaction ever since the Swiss Franc’s de-pegging? For one, we wonder if the folks at the SNB are keen traders (it is a for-profit entity, after all). Perhaps they are are forecasting a major turn forthcoming in the Euro’s prospects. We don’t know the answer, which is fine because, for two, we don’t care why the markets are behaving as they are. We only care about the “what”, not the “why”.

The “what” is that the SMI and the Swiss Franc are potentially at key junctures currently following the de-pegging. If anyone needs convincing that the SMI’s price action is mainly a result of the movement of its currency, they need just look at the above chart. The Swiss currency and stocks have been an exact mirror image of each other since January 15. And at the moment, they may be at a make or break point as it pertains to the lasting impact of the SNB’s move.

The Swiss Franc, as represented by the Guggenheim CurrencyShares Swiss Franc Trust (ticker, FXF), is now hitting the 61.8% Fibonacci Retracement of its moonshot on January 15. Conversely, the Swiss Market Index is at (or slightly above) the 61.8% Fibonacci Retracement of its decimation following the de-peg. Perhaps it won’t have an impact. But it is possible that this area could mark the moment of truth for the Swiss Franc and stocks as it relates to the lasting effect of the de-peg.

If the moves in the respective markets are halted here, perhaps they begin a move back in the direction of their initial reactions following the SNB’s move. In that case, the removal of the currency cap may turn out to be an inflection point. If, however, the markets slice right through this 61.8% level, the SNB’s move may just turn out to be a blip in the course of the financial system.

________

More from Dana Lyons, JLFMI and My401kPro.