Does Lack Of Volume Matter At New Highs?

Volume has long been a topic of debate on Wall Street. Some folks argue that elevated volume is needed to “confirm” price moves. Others say it is irrelevant. In general, we fall into the “irrelevant” camp as far as volume is concerned. Yes, one can point to plenty of examples when increased volume seemed to lend legitimacy to a move in the market (the secular bull market kickoff in 1982 always comes to mind). However, there are just as many examples of “legitimate” moves that occurred in the absence of heavy volume (e.g., almost the entire post-2009 stock rally). In fact, in some ways we prefer lower volume moves as it can be an indication that the certain asset is flying “under the radar”. Overall, our focus is mainly on the “intermediate-term” duration (i.e., “months”) and in that time frame, we have not found volume to be especially relevant.

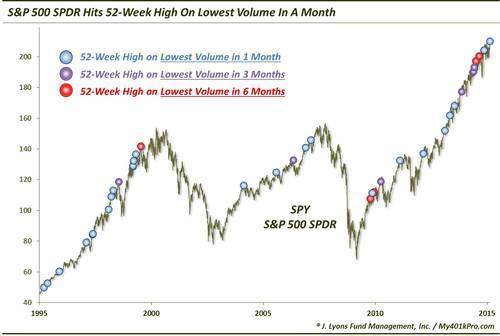

Yesterday’s low-volume new high in the S&P 500 sparked some renewed debate in financial circles about the importance of volume. So we thought we’d take another look. As it turns out, gauging by the S&P 500 SPDR ETF (SPY), yesterday’s 52-week high was accompanied by the lowest volume in over a month.

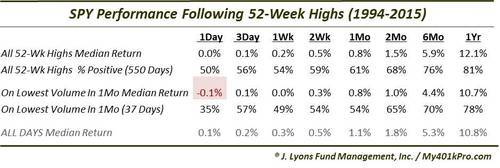

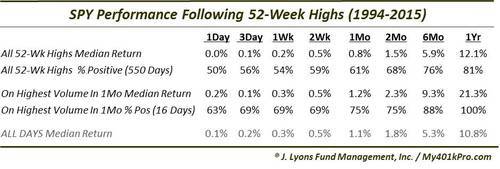

As one might imagine, this has been a somewhat rare occurrence since the inception of the SPY, although perhaps not as rare as one might has guessed. Since 1994, there have been 550 new 52-week highs in the SPY (not including year-end holiday trading). Incidentally, that equates to exactly 10% of ALL days. Of those 550 new highs, 37 (or 6.7%) have been accompanied by the lowest volume in at least 1 month. Did the low-volume make a difference in the SPY’s returns going forward? Let’s take a look.

As the table shows, returns following 52-week highs in the SPY have been slightly better than the those following all days. This should alleviate the concerns of folks who are scared to buy with the market or a stock at a 52-week high. Looking at the low-volume new highs (specifically, those occurring on the lowest volume in 1 month), we don’t see much of a difference from the total sample of new highs. Perhaps in the very short-term, the low-volume has led to slightly lower returns. They are certainly not statistically significant, however.

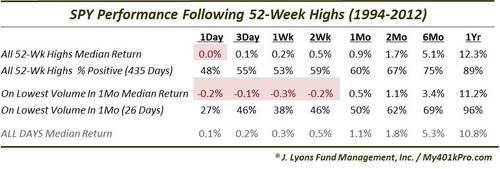

Volume advocates may have a claim, though, if we narrow the criteria a bit. For one, if we exclude the recent 2-year straight-up run in stocks, the returns after 52-week highs on 1-month volume lows are dampened a bit in the near-term (naturally, most sample returns would be dampened by excluding this period).

We hesitate to exclude a 2-year period in a study. It’s a slippery slope when one starts to do that. However, the past 2 years have been extraordinary to say the least. And the 19-year period from 1994 through 2012 is not an insignificant length of time for a study of this nature. Even still, results following the low-volume highs before 2013 were only dampened in the short-term, i.e., only out a couple weeks. Thus, for all but very short-term traders, it does not seem to make a significant difference.

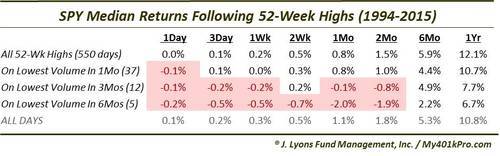

If we take a more extreme definition of “low volume”, we find a bit more evidence for the relevance of volume in making a new high. For instance, since 1994, there have been 12 days that saw the SPY make a 52-week high on the lowest volume in 3 months and 5 days that saw the lowest volume in 6 months. Returns following those days did see meaningfully lower returns, at least out to 2 months.

Of course, one mitigating factor here is sample size. A sample of just 5, or even 12, events in over 20 years does not instill a lot of confidence in the findings. Still, if one had to side with one camp or another based on them, it would be toward the “volume matters” camp.

Lastly, just for giggles, we took a look at what has transpired following “high volume” 52-week highs. This has no relevance on the contemporary low-volume developments, but may give weight to the volume argument, one way or another. Since 1994, there have been 16 days on which the SPY made a 52-week high accompanied by the highest volume in 1 month. Here is the fund’s performance going forward.

This may be the strongest argument yet for the relevance of volume, at least as it pertains to this study. While there is again a pretty small sample size, the excess performance following these “high volume” new highs is impressive, especially in the intermediate-term of 1 month to 1 year. We’ll store this one in the vault should we happen across one of these new highs in the future. In the meantime, we’ll throw the “volume is relevant” crowd a bone for this table.

So what does this study tell us about the importance of volume? In general, we have found that 52-week highs in the SPY accompanied by a 1-month low in volume have led to minimally lower returns, and only in the very short-term. Looking at results prior to 2013 amplify the underperformance a bit, but again, only in the short-term. If we narrow the sample to new highs occurring along with a 3-month or 6-month low in volume, the returns are meaningfully lower out several months. The problem there is a small sample size. And while not relevant to this study, considering the outsized returns following new highs accompanied by the highest volume in a month tilts the argument even more to the notion of volume being relevant.

In summary, the “volume of evidence” regarding the impact of low volume on new highs leans toward volume being relevant. However, the relevance is mainly in the short-term and the statistical significance is still up for debate. It is likely not something that would cause one to alter their investment process, except for perhaps very short-term traders. However, what evidence we did find does favor the argument that volume matters.

________

More from Dana Lyons, JLFMI and My401kPro.