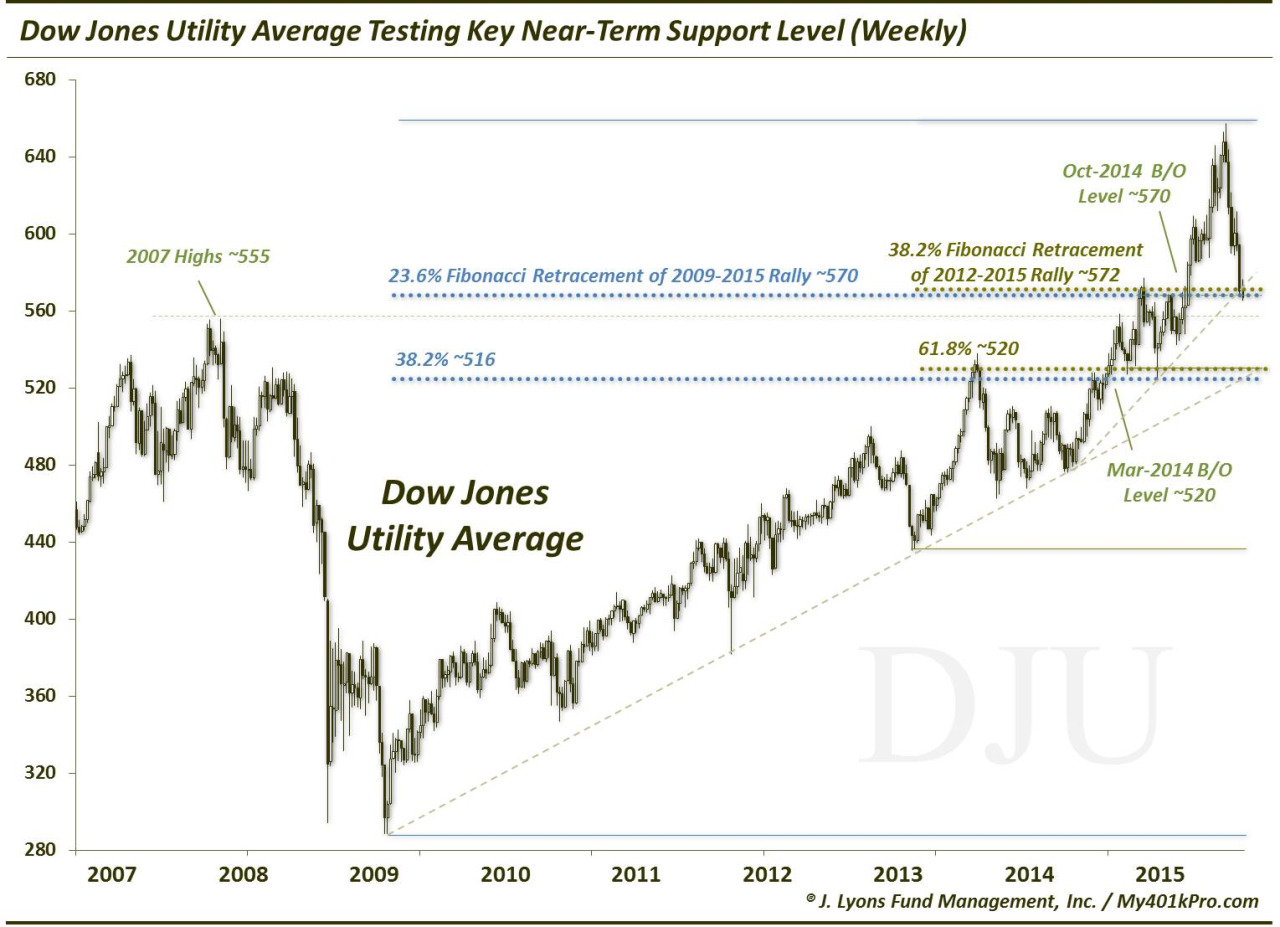

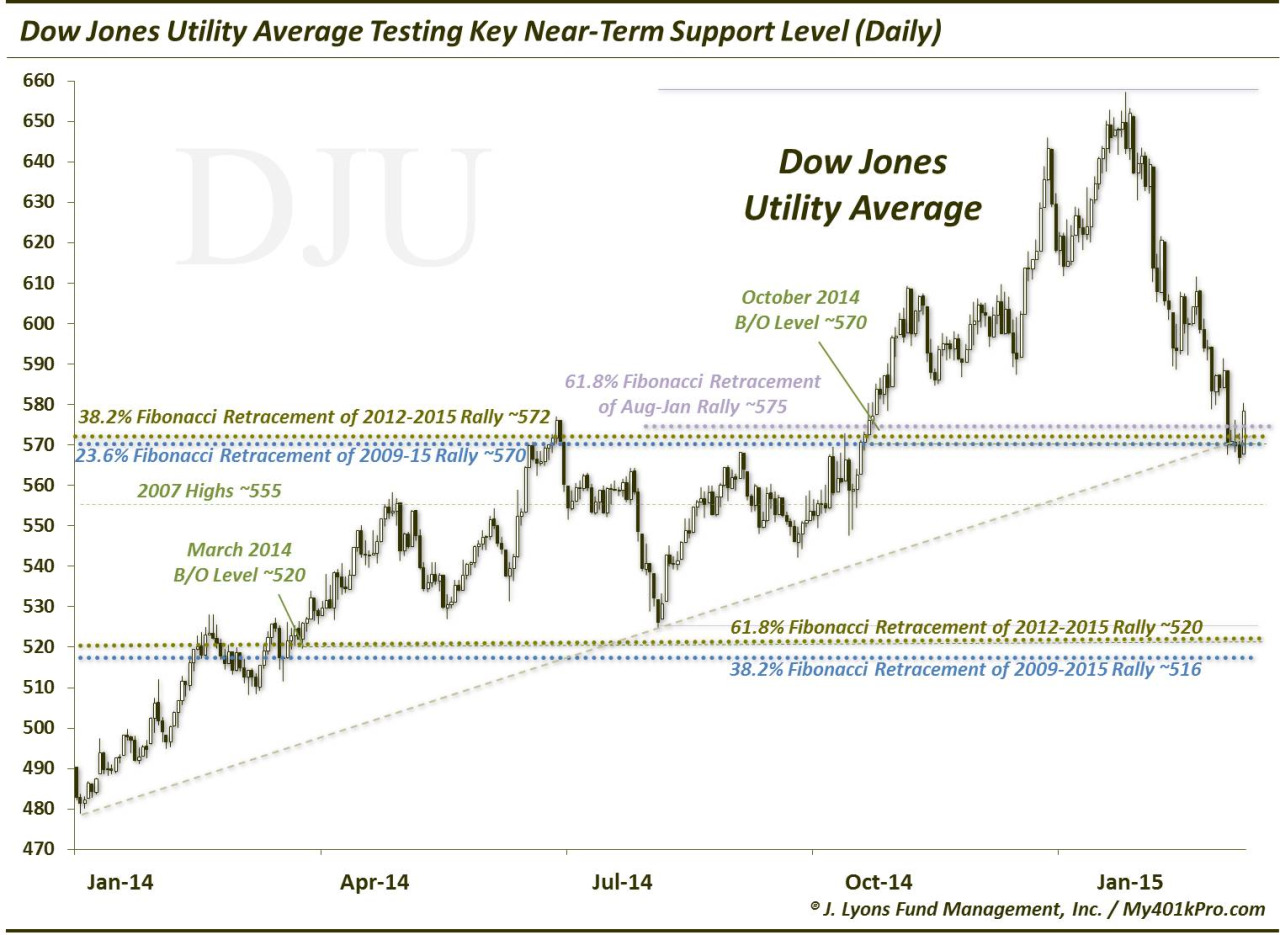

Utility Sector Testing Key Near-Term Support Level

With a gain of roughly 26% last year, the utilities were one of the best-performing sectors in 2014. With bond yields dumping, investors ran to anything with a competing yield and utilities have traditionally fit that bill. That strong run ended abruptly, however, at the end of January. As bond yields have jumped since then, Utilities have slumped, losing about 13% in the past 6 weeks. This decline has taken the Dow Jones Utility Average (DJU) down to its first key support level around 570, in our view. This area marks a confluence of important studies, including:

- 61.8% Fibonacci Retracement of August-January Rally ~575

- 38.2% Fibonacci Retracement of 2012-2015 Rally ~572

- 23.6% Fibonacci Retracement of 2009-2015 Rally ~570

- Post-January 2014 UP Trendline ~570

- October 2014 Breakout Level ~570

Should the DJU hold this area, the first major test of resistance on the upside may come in the 600-608 range which would mark the 38.2% Fibonacci Retracement of the current post-January decline, the 50-day simple moving average and the tops in November, early December and late February. If it can surpass that level, perhaps new highs are in store for the DJU. If not, the real possibility exists that the January highs will mark the top for some time.

We’re getting a little ahead of ourselves, however. The first test is here near 570. If it fails, the next key level below is near 520, in our view. The studies there mirror those at the 570 area:

- 61.8% Fibonacci Retracement of 2012-2015 Rally ~520

- 38.2% Fibonacci Retracement of 2009-2015 Rally ~516

- Post-2009 UP Trendline ~520

- March 2014 Breakout Level ~520

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.