How Likely Are New Stock Highs In April?

With the month of March and the 1st quarter just about in the books, it’s time to take a peak ahead. Spring has arrived and it begs the question, should investors harbor the same optimism toward the stock market’s prospects that they have for the weather forecasts (after all, it is nearly 40 degrees here in Chicago as I write.) We have covered many of the market’s competing crosscurrents recently, including those on the positive side of the ledger (e.g., the NYSE Advance-Decline Line confirming the recent highs, the Equal-Weight S&P 500 hitting a relative new high vs. the cap-weighted index) and those on the negative side (several other key Risk Sectors beginning to be reined in, the Smart Money trading patterns shifting, et al.). Looking from a strictly seasonal perspective today, we do find some cause for optimism for stocks in the month of April.

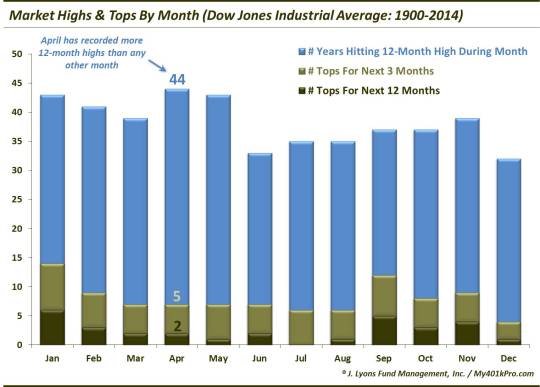

We’ve presented statistics in the past on months that are most likely to form tops (January and September). In order for a month to form a top, it obviously must make a new high during the month. So we looked at our “monthly top” data to see which months were historically most prolific in hitting new 12-month highs, irrespective of the tendency to form a top. As it turns out, using the Dow Jones Industrial Average (DJIA) since 1900, April has recorded more 12-month highs than any other month:

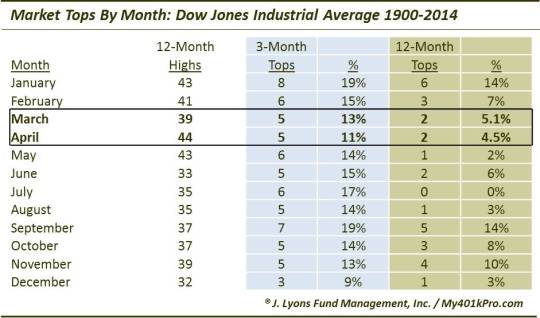

For those who prefer a table format:

44 out of 114 years, or 38.5% of the time, April was able to score a new 12-month high at some point during the month. That is 1 better than 2nd place finishers January and May. Of course, it should go without saying that April’s past success in hitting new highs does not guarantee that it will do so this year. Furthermore, while April has hit the most 12-month highs, it has also failed to do so more than 6 out of 10 times.

So are there any factors that may clue us in to whether the odds of a new high in April are better or worse than the 38.5%? Looking at March may be helpful in that regard. Earlier this month (the first day of the month, in fact), the DJIA was able to record a new 12-month high. Looking at the stats for March, of the previous 39 times that the DJIA hit a high in March, it only marked a top for the next 3 months on 5 occasions. So that is good news regarding the next several months, if not specifically for April. Looking just at April, of the 39 years that the DJIA made a 12-month high in March, it went on to also make a new high in April on 30 occasions. So that 30 for 39, or 77%, also bodes well for April. It is certainly an an improvement over 38.5%.

Now the fact that the March high was made on the 1st day of the month – or more relevantly, that prices are now over 2% below those high levels – may make a difference. It is certainly a higher bar to clear than if, say, the DJIA closed at a 12-month high on the last day of the month. Of the 30 times that a March high was followed by a April high, March had closed at an average of 1.5% below the high. 10 of those 30 times, April was able to overcome a deficit of at least 2% below March’s high at the March-end close. Of the 9 times that April failed to hit a high following a March high, the average March close below is high was more than 4%. So that is at least a higher bar to clear than in our present circumstance.

Whenever we post statistics about seasonality, we try to emphasize that these are merely historical tendencies based on unique circumstances pertaining to each individual year. 2015 is not like any other year. That’s why it has a different number assigned to it. Seasonality should merely be treated as a slight headwind or tailwind to the market. Other factors present in the market at this time carry much more influence on the fate of stocks. However, based just on the historical trends that we have highlighted, at least the wind should be at our backs going into April.

________

“Matojo” photo by *k59.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.