Value Stocks Get Their Turn To Shine

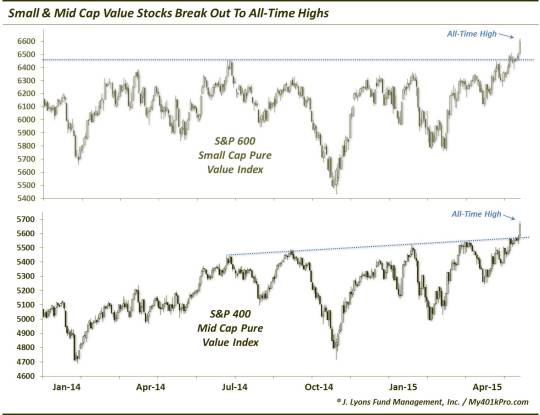

In early February we highlighted the emerging strength in small and mid-cap growth stocks. After languishing for over a year, they finally experienced breakouts, of which they have since built upon. Even during the 12+ months in which these growth stocks struggled, however, they had for the most part enjoyed the upper hand over their value counterparts. That said, their relative advantage has not been along a straight line. While growth has been the overall relative winner during that time, value stocks have had their moments to shine as well. Yesterday was such a moment. For the first time since last July, both small-cap and mid-cap pure value stocks registered convincing breakouts to all-time highs. (FYI, the “pure” growth and value indices include just those stocks within the larger universe that fit more stringent criteria consistent with each style as opposed to broader growth and value indices that, by rule, encompass all of the constituents of their larger universe.)

As the chart shows, the small-cap pure value index shot above lateral resistance to a new high. Meanwhile, the mid-cap pure value index broke above an ascending trendline to score its first new high of significance in nearly a year. While we have broader, long-term concerns about the market, there is little to argue with regarding the bullishness of such breakouts – unless, of course, they immediately fail.

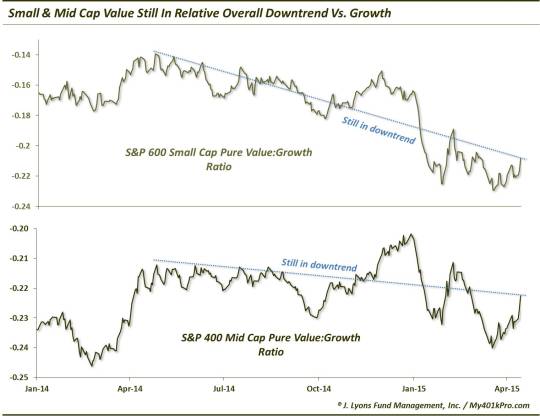

Additionally, over the past few years, growth and value have consistently ping-ponged back and forth in terms of short-term leadership. Therefore, the breakout does not guarantee that these value stocks will either A) continue their strength on an absolute basis or B) take over the leadership mantle from growth stocks overall. It is appropriate to keep in mind that on a relative basis, growth still holds the advantage over value for the time being. Witness the general downtrends that remain intact in the respective pure value indices versus their growth counterparts.

Thus, until the downtrends versus growth stocks are broken, value stocks are still at a relative disadvantage. However, as we said, on an absolute basis, the breakouts in the small and mid-cap pure value indices are a positive for those style segments (again, as long as they do not fail immediately). It is also a constructive sign for the overall market in the near-term that more and more broad averages continue to make new highs.

________

“In Abe we trust” photo by Benjamin Mischler.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.