Could Stocks AND Bonds Be Topping?

There is always a small but vocal contingent of market pundits calling for a stock market top. In the past few years, there has been a very large but now sheepishly quiet contingent of analysts calling for a top in bonds (i.e., rise in rates). One thing you don’t hear too often, however, is a call for a major top in stocks and bonds. Now that would be a double whammy for investors! If you want to be an alarmist, why not go all out, right? Well, despite the hyperbolic tone, we are not actually “calling” for a major top in both stocks and bonds at this time (although, there are definitely plausible cases for both.) What we are saying is that at least some short-term headwinds may be facing both asset classes. At least that is one read based on today’s Chart Of The Day.

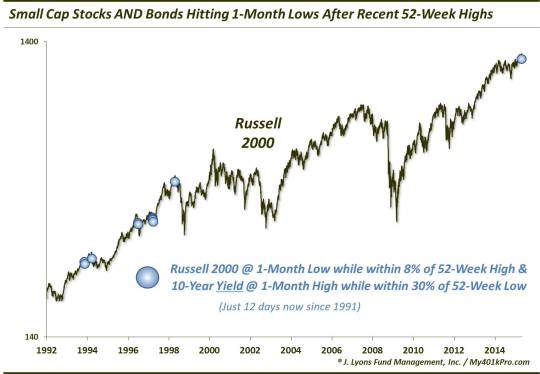

Yesterday, these markets achieved an unusual short-term double whammy. Both stocks (as represented by the Russell 2000 small cap index) and bonds (represented by the 10-Year Treasury Note) put in a 1-month low. As the chart shows, this has not been a common occurrence, especially with both asset classes reasonably close to their respective 52-week highs.

Since 1991 (the beginning of our Russell 2000 data), yesterday marked just the 12th day on which the Russell 2000 closed at a 1-month low and the U.S. 10-Year Yield closed at a 1-month high. And it was the first time since 1998.

We added the qualifier that, despite their recent bout of selling, both assets need to be somewhat close to their 52-week high (for the Russell 2000, it is 8% and for the 10-Year Yield, it is within 30% of its 52-week low). We added this qualifier for a few reasons. For one, we posed the question of whether or not these assets were topping. There cannot be a top without being at, or near, highs. Secondly, there were a handful of other occurrences that happened after significant selling in bonds had already occurred (e.g., the 1994 bond bear market and the 2013 “taper tantrum”). Again, we are looking for periods comparable to our present case and those, in particular the 1994 example, do not fit.

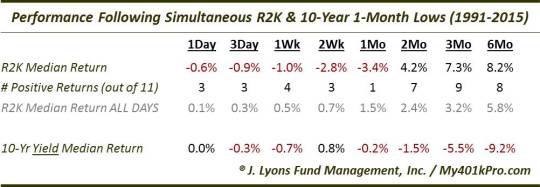

So what was the aftermath following these events? Well, with one exception, it hasn’t historically been a doomsday scenario. However, for stocks, it has led to some consistent further short-term pain. Here is the aggregate performance of the Russell 2000 following the previous events.

As the table shows, the short-term brought continued weakness in the Russell 2000. The median return was negative from 1 day out to 1 month. At the 1-month mark, the median return was -3.4% with just 1 of the 11 prior occurrences showing a positive return. After that 1 month time frame, however, the intermediate to long-term returns reverted back to normal, or even better than normal. An occurrence in April 1998 (the doomsday exception) was the only one that really saw bad longer-term results as it was down 21% 6 months later. By and large, however, this phenomenon has tended to be a concern only in the near-term.

Incidentally, for bonds, it was the same story. The 10-Year showed weakness for a couple weeks before turning around and rallying over the longer-term. By 2 months out, 10 of the 11 occurrences saw bond prices higher (and rates lower). Therefore, in the bond market, this was more of a buy signal than anything negative.

One of the reasons this phenomenon is so rare is that during times of equity stress, the bond market is typically the beneficiary of money flows. Perhaps, this is an indication that investors are not that concerned about the recent weakness in stocks that they feel they need the safety of bonds. Thus, perhaps it is perversely a good sign for stocks that bonds have sold off alongside them. It certainly does not appear from today’s strong (albeit, deceiving?) bounce back in stocks that investors are too concerned yet. Although, the Russell 2000 did demonstrate severe relative weakness during the day. And the bond market continued its selling pressure today. So in a way, we got a dose of some of the typical weak aftermath of this double whammy, whether on an absolute or relative basis.

Back in the 1970′s and 80′s, there was a game show called “Press Your Luck” in which participants would watch their “chances” spin around a board filled with squares of various dollar amounts to win. However, on some of the squares was a fiendish monster called a “whammy” that could take away their money. If the equity and bond market happened to both experience an end to their respective bull markets, it would indeed be a “double” whammy, with investors watching much of their money “taken” away. Though we have our reasons for concern in both markets, we are not arguing that it is in the cards at this time. It will take, for one, more selling pressure to break the backs of these bull markets and potentially lead to something more serious.

Is the recent selling the beginning of this? Again, we have our concerns but it would be a preposterous reach to make that claim after such a relatively limited decline. However, with both the Russell 2000 and the 10-Year closing at 1-month lows, there is valid reason for concern in the short-term, at least according to historical precedent. As we showed, this development may not be a long-term double whammy, but traders buying stocks here in the near-term may be pressing their luck.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.