A LOT Riding On Last Day Of The Quarter

Could the fate of the rest of this Presidential Cycle be riding on the stock market’s close tomorrow? Okay, that may be a bit hyperbolic. However, given the current level of the Dow Jones Industrial Average (DJIA), there is an interesting historical context depending on where the Index closes the 2nd quarter of 2015 tomorrow. As a refresher, the Presidential Cycle is a 4-year cycle in the stock market coinciding with the presidential election cycle. It is noteworthy due to the stock market’s historical tendency to behave in a certain, consistent manner during the various parts of the cycle. We are currently in Year 3 of the Presidential Cycle, the mid-way point of which is tomorrow.

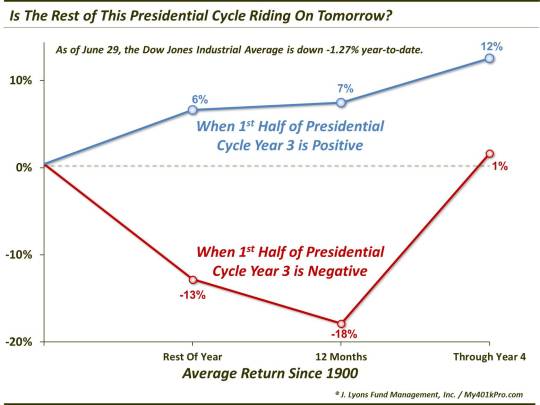

Looking historically, since 1900, there has been a stark contrast in how the DJIA fared over the balance of the Presidential Cycle (i.e., the next year and a half) based on whether it was up or down during the 1st half of Year 3. This contrast is especially interesting, and relevant, given the fact that, following today’s near-2% rout, the index is currently down -1.27% year-to-date.

As the chart shows, since 1900, there has been a substantial difference in the performance over the rest of the Presidential Cycle depending upon whether the DJIA closed the 1st half of Year 3 higher or lower. The contrast was most striking over the next 2 quarters (i.e., rest of the year) and 4 quarters.

- Following POSITIVE Year 3 1st Half’s, the DJIA has averaged +6.2% for the rest of the year, +7.0% over the next 12 months and +12% for the rest of the cycle.

- Following NEGATIVE Year 3 1st Half’s, the DJIA has averaged -13% for the rest of the year, -18% over the next 12 months and +1.2% for the rest of the cycle.

Now the DJIA’s performance in one period and subsequent periods are not mutually exclusive. That is, the action in one quarter or half or year, etc. can and does have an effect on subsequent periods. With all apologies to the random market advocates, markets do exhibit identifiable momentum traits. The point is, weakness in the 1st half of the year may signify a weak overall investment climate, and thus, unsurprisingly, weak subsequent performance. In other words, it is probably not a fluke – or surprising – that the DJIA’s performance following a weak 1st half has been followed by weak subsequent action.

But that is the point of these studies: that action is not random and that performance is not a coin flip. Therefore, while the final result of the 1st half of this year may not guarantee the DJIA’s fate over the next several quarters, it should not be dismissed as meaningless either.

One caveat is that there have been 24 positive Presidential Cycle Year 3 1st Half’s since 1900, and a grand total of 5 negative ones. Perhaps that is not surprising given that Year 3 is historically the strongest year of the cycle. So maybe only 5 negative occurrences diminishes the statistical robustness of the average forward returns. On the other hand, perhaps it enhances the case for poor returns going forward if the DJIA cannot manage a positive 1st half close tomorrow. The thinking there is that, given the inability of the index to manage a positive close – despite the substantial positive seasonal tailwinds – it may be suggestive of larger overall negative forces in the market.

One more caveat is that there has not been a negative 1st half of the year for a Year 3 since 1939. Perhaps seasonal tendencies are different now than they were back then. Then again, perhaps – again – it is testimony to the DJIA’s inability to benefit from a strong seasonal tendency that has aided it for the past 76 years.

Regardless of whether there are contemporary changes to Presidential Cycle influences or not, the numbers are what they are. If the Dow Jones Industrial Average can muster a +1.3% gain tomorrow, the historical odds favor better performance for the index over the next 2-6 quarters. If the DJIA cannot muster such a gain, it may have its work cut out for it.

_____________

Photo from Facebook/Absolute Africa.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.