Bad Breadth Milestone A Warning For Stocks?

We’ve been discussing the weakening market breadth recently, especially as it pertains to New Highs vs. New Lows. Again, our contention is that the more stocks participating in a rally, the healthier the rally is. The most recent example of this weak breadth was Wednesday’s post on the fact that Nasdaq New Highs-New Lows have not hit a 52-week high in over 400 days. Today brings another example from the NYSE. Despite the NYSE Composite being within 2% of its 52-week high, the number of New Highs on the exchange versus New Lows actually hit a 6-month low today (*based on preliminary readings.) This is just the 8th such occurrence in the past 20 years.

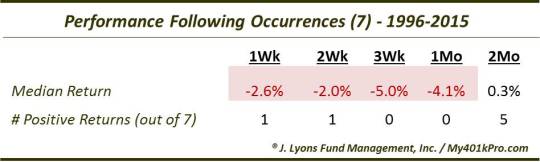

Such breakdowns in breadth in the past 20 years with the NYSE Composite in close proximity to its 52-week high have not worked out well. As the chart indicates, this development has led to intermediate-term weakness, without fail. The prior occurrences in April 2004, May 2006, July 2007, May-June 2013 and September 2014 led to negative returns out 3 weeks and 1 month every time, with median returns of -5.0% and -4.1%, respectively. Here are the numbers:

The good news is that after 2 months, returns gradually came back in line with historical norms. The other good news is that prior to 1996, returns after such developments were not unanimously negative. October 1995 occurrences led to essentially no drawdowns afterward. The only other occurrences since 1970 came in 1971, 1983, 1985, 1991 and 1993. While the returns were mixed in the intermediate-term, they were not as bad as those in the past 20 years.

What’s our ultimate takeaway from this development? We like to weight recent occurrences of these types of studies more heavily. Therefore, we’d consider it a negative factor for this market. That said, weakness has only been manifested over the intermediate-term. Therefore, the negative expectations, at least based on this study, probably expire after a month or two.

Generally speaking, it’s more evidence of the thinning out of this rally that has been accumulating lately.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.