August 24 – A True Market Washout

It doesn’t happen too often, but occasionally we witness a true stock market “washout”. That is, a selloff marked by extremely one-sided (to the downside) trading action. Such days are exhibited by market participants that just want out at any price. The result is a day in which all market statistics are overwhelming skewed negatively. Such was the case today, August 24.

Here are but a few examples from the New York Stock Exchange:

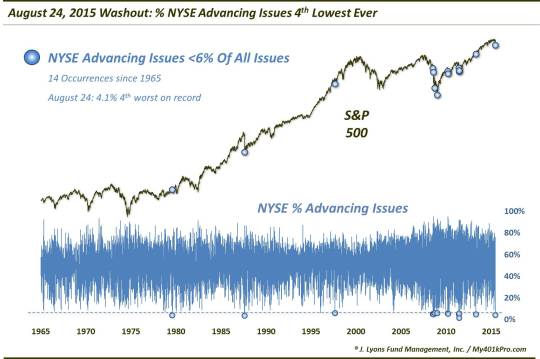

Today saw the 4th lowest % of NYSE Advancing Issues – 4.1% – since 1965. Each of the other 13 occurrences with less than 6% Advancing Issues saw the market form at least a short-term bottom within a day – except for one: the fall of 2008. That selloff, while not much longer in duration, did suffer extensive damage in subsequent days.

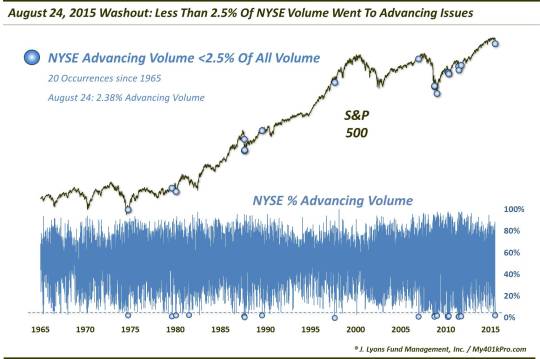

Today saw just 2.38% of the volume on the NYSE go into Advancing Issues. Since 1965, there have been just 20 days with less than 6% Advancing Volume. Again, the market bottomed almost instantly (if temporarily, at times) following most such readings.

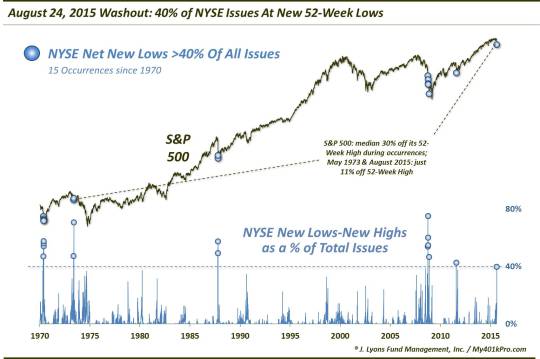

New 52-Week Lows Minus New Highs accounted for 40% of all issues on the NYSE. Readings that high have only occurred 15 times since 1970. This series was especially accurate in identifying intermediate-term market lows.

One reason why, perhaps, is that the market was already extremely washed out coming into most of these day. The S&P 500 was a median of 30% off of its 52-week high during these occasions. That makes the current case unique as the index is just 11% off its high. This is not unprecedented, however. In May 1973, the S&P 500 was off 11% from its 52-week high. Instead of putting in an intermediate-term bottom, the market would eventually go on to accelerate its cyclical selloff, suffering a steep drawdown in the longer-term. The parallels to the current case should not be totally discounted.

Based on history, such washed out readings like we saw today should signal a coming end to the initial part of this decline in the next day or two. However, considering the selloff began with the major averages near their 52-week highs, a resumption in downside pressure would not be a surprise following whatever type of bounce materializes over the next few days or weeks.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.