Can The 4th Quarter Save 140-Year “Year 5″ Streak In Stocks?

4th quarters in years ending in “5″ have typically been big…but will it be enough to save 140-year streak of positive “year 5′s”?

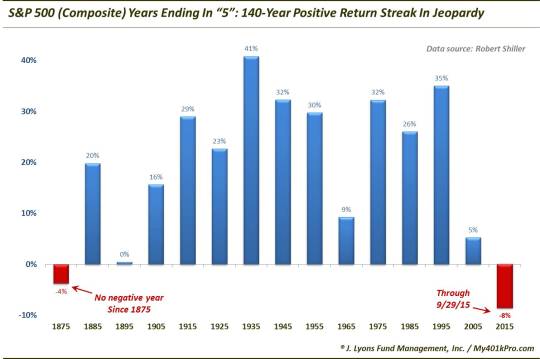

Way back on January 3, we posted a note on an interesting and unusual streak. Using the S&P 500 (and the S&P Composite from Robert Shiller, pre-1950), every year ending in a “5″ has posted a positive return since 1875. In other words, the last 13 “5″ years have left stock investors “high-fiveing” each other. We will say right off the bat that, no, we do not, nor do we recommend basing one’s investment approach on this phenomenon. It is likely mainly due to coincidence, with a healthy dose of positive Presidential Cycle “Year 3″ tailwind mixed in for several of the years. Nevertheless, it is a consistent and compelling track record.

Of course we had to jinx it. At least the streak is in serious jeopardy at the moment, with the S&P 500 down roughly 8% going into the 4th quarter.

The S&P 500 needs to close the year above 2058.90 to avoid breaking the 140-year old streak. That’s a gain of over 8% from current levels. A pretty tall task for the upcoming 4th quarter, huh? Actually, according to today’s Chart Of The Day, all it would take is an average “5″ year 4th quarter to close the year positively.

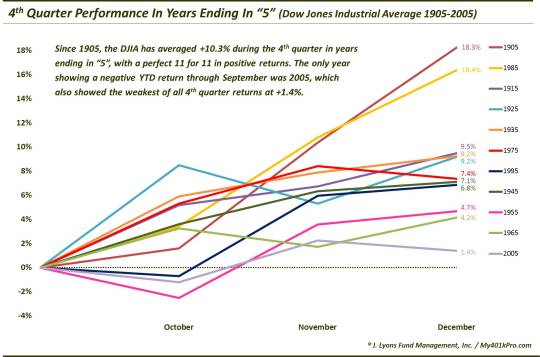

We looked at the performance of the Dow Jones Industrial Average (we have more confidence in that quarterly data than the S&P) in the 4th quarter of every “5″ year since 1900. As it turns out, all 11 of the years have displayed positive performance, with an impressive +10.3% average return.

As the chart shows, the positively skewed performance is not the result of any “outlier”-type years either. One may argue that there are technically 2 outlier years in 1905 and 1985 (I like to chalk 1985 up to the Bears winning Super Bowl XX…but that’s probably just another coincidence), at +18.3% and +16.4%, respectively. However, the majority of the years (6) saw 4th quarter returns between +4.2% and +9.5%. So the consistency of this phenomenon has been impressive.

Again, we are not trying to claim that there is something magical about year “5′s”. Nor are we suggesting one go out and leverage their portfolios long for the 4th quarter based on this phenomenon. However, considering the history and consistency of the streaks surrounding year “5′s”, they are at least noteworthy. And with all of the bad news stemming from the stock market in the 3rd quarter, it is at least one dose of positive coverage, albeit unorthodox.

Can the 4th quarter bail investors out of the hole they’re in? Only time will tell, but they do have 11-for-11 and 13-for-13 streaks on their side. Then again, after a 12-game winning streak, even the ‘85 Bears lost a game.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.