Stock Buyback Binge Continues

Extension of ZIRP suggests company share repurchases will remain elevated…but will the correction have an effect?

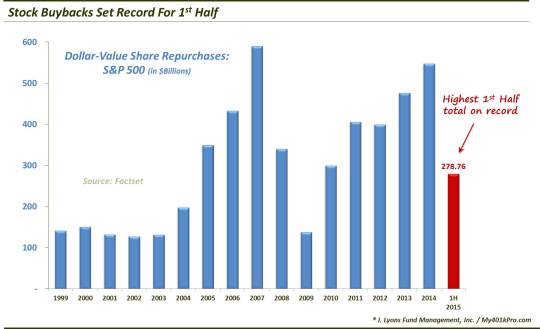

One contingent that was particularly happy to see the Fed leave rates at 0% was corporate America. Rock bottom financing has fueled the stock buyback binge for several years as companies can borrow money much cheaper than what they are reaping through their share repurchases. Whether or not that is a prudent use of resources is another matter. But one thing is certain – the binge has continued. According to he most recent data from Factset, companies in the S&P 500 spent $134.4 billion on share repurchases in the 2nd quarter. And while that figure was down slightly from the 1st quarter, the $278.8 billion total for the 1st half of 2015 was the highest figure on record for a first half of a year, surpassing the previous high set in both 2007 and 2014.

A couple other statistics from the report from Factset:

- Information Technology Tops Buyback Spending; Financials & Industrials Lead YoY Growth: The Information Technology sector spent $35.9 billion on buybacks in Q2, which was more than any other sector. The Financials and Industrials sectors led all groups in year-over-year growth for quarterly buybacks, posting growth rates of 29.8% and 17.1%, respectively.

- Buybacks to Free Cash Flow Ratio Exceeds 100%: Companies spent more on buybacks in Q2 on a trailing 12-month basis than they generated in free cash flow (FCF). The aggregate Buybacks to FCF ratio for the S&P 500 exceeded 100% for the first time since October 2009.

- Buyback Yield Hits Lowest level since April 2011: The

12-month basis shares repurchased represented 2.8% of the aggregate shares outstanding in the S&P 500. This constituted the smallest buyback yield for the index since April 2011, when the ratio was 2.7%.

- Pharma/Biotech Led the QoQ Buyback Decliners: Pfizer, a consistent participant in buybacks, experienced the largest quarter-over-quarter decline of any S&P 500 company in Q2 in dollar terms (-$6.2 billion). Also, of the other 8 companies showing declines of >$1 billion, 3 were pharma/biotech companies: Gilead, Abbott Labs and Johnson & Johnson.

We mentioned above that we have wondered whether stock buybacks are the most prudent use of corporate capital. This imponderable gets at the main objective of corporate management. Is it to maximize shareholder value? Or is it to keep the company best positioned, strategically, for the long-term? Is it inherently both? Can it be both? Or is there a duration conflict involved in which the effort to meet, or exceed, quarterly earnings estimates is in competition with the longer-term best interests?

One factor that has had us wondering about this issue for some time is the lack of growth in core capital expenditures (CapEx). We wrote the following in a March 27 piece on the widening gap between stock prices and CapEx:

In the conundrum over the gap between CapEx and stocks, buybacks are squarely in the cross hairs. Now it is unknown, and perhaps unknowable, if companies are putting off CapEx in favor of buybacks. However, we do know that buyback activity has been at or near historic levels recently.

Now there, of course, is not a perfect relationship between CapEx and buybacks. However, given the recent levels of corporate stock buybacks, it is not a stretch to think that some CapEx may be getting put on the back burner in favor of buybacks, or any number of financial engineering mechanics given the favorable environment for that stuff. Consider this: if the growth of CapEx had kept pace with the S&P 500′s rise over the past 2 years, it would equate to about $24 billion more in CapEx per month. Buybacks are currently running at about $12 billion more per month than 2 years ago. So that’s half the difference there.

Also consider this: from 2000 to 2014, CapEx has grown a mere 11%. Buybacks, on the other hand, are up by 263%. Now, we’re not inside every corporate board room, but we do have to wonder, is there too much “shareholder value” going on relative to longer-term “strategic position”? What happens when the Goldilocks, ZIRP-funded, leveraged stock binge/revolving door corporate windfall comes to an end? (And it won’t necessarily take an end to ZIRP to bring that about.) What tangibles will companies be left with? As we finished the CapEx piece:

Now, once again we are not economists. Perhaps our readers have some good explanations for what is going on here – or perhaps would vouch for our [CapEx vs. buyback] thesis. Otherwise, we will simply leave you with some open-ended questions that we have posed before. We won’t endeavor to answer them – and frankly would be more than a little concerned to hear what they are.

1) To what extent have stock buybacks cut into CapEx?

2) What happens to balance sheets in a real stock correction given the level of buybacks?

3) With profits and margins recently at peaks (maybe), what happens when companies are forced to spend again on CapEx?

If 2 and 3 occur, what sort of EPS theatrics will companies resort to in order to meet estimates?

Well, #2 has certainly unfolded this quarter to some extent. And given the continued buyback binge, 3rd quarter earnings should be pretty interesting.

__________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.