Impressive Bounce For Stocks Following Re-test — But Will It Last?

The stock market has shot up following last week’s retest of the August lows – but is it sustainable or just temporary?

As investors digest the magnitude of the rally in stocks over the past 7 days, the focus turns to addressing an important question. Is this rally confirmation of a successful retest and a springboard to further gains…or simply a short-covering, mean-reverting, dead-cat bounce? We took a look at seemingly similar rallies historically to see if they might offer clues.

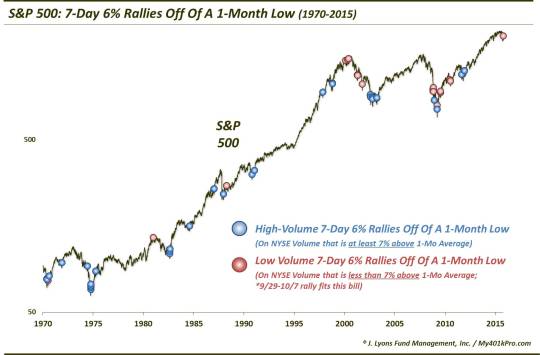

First, the stats on this rally. Since bottoming on September 28, the S&P 500 has rallied more than 6% in just 7 days. Going back to 1950, this is the 68th such rally originating from a 1-month low. Of those, the current rally is one of the smallest, though that is almost by definition as its 6% gain is the impetus for setting the parameter there. The largest gain of this kind occurred off the cyclical bottom in March 2009, at a monster +17%.

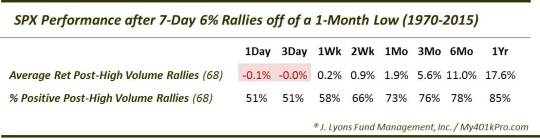

So how have stocks done following such surges off of 1-month lows? After some choppiness in the short-term, they tended to continue the rally, most strongly in the intermediate-term.

Additionally, let’s look at the potential risk/reward setup here. One way to do this is by looking at a comparison between the median Maximum Gain following these rallies vs. the median Drawdown, i.e., max loss. As shown, the max gains outweigh the drawdowns on each time frame. That is another positive spin on this data point. Although, it is important to keep in mind that there were several drawdowns that were much worse than the median shown.

So the historical forward performance suggests the bulls have an edge in the “will it or won’t it continue” debate. However, the edge isn’t overwhelming. Therefore, we broke the data down a little bit in search of more specific and relevant clues.

Interestingly, one factor we looked at was the location of the S&P 500 relative to its 200-day moving average. As it turns out, just 16 of the 68 rallies resulted in prices being above the 200-day moving average. Again, that is after the rally. I’m not sure what the takeaway here is other than the fact that these slingshot rallies often occur within the confines of a bear market, or at least a very weak market backdrop.

One other breakdown we administered was the amount of volume occurring

during the 7-day streaks

relative to the recent trend. While we are not huge proponents of focusing on volume, in these unique circumstances it is reasonable to believe that volume may be of some significance. The rally through yesterday came on volume that was roughly 6% above the average volume of the previous month. Again, we made that our approximate line of delineation.

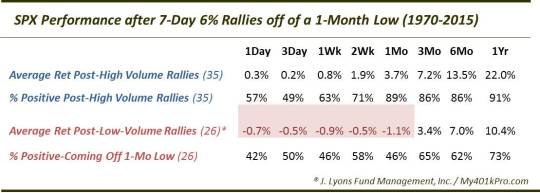

Thus, here is a look at the rallies that occurred on volume that was more than 7% greater than the 1-month average volume, versus those that occurred on lower volume than that, including rallies occurring on below-average volume.

It’s pretty clear across the board that those rallies occurring on heavier volume showed better persistence going forward than the lower-volume rallies. So that is perhaps a minor strike against the bulls here. Although, many of the main culprits behind the weak returns among lower-volume rallies actually displayed below-average volume. Our present volume circumstances are not that anemic.

What is the takeaway? The great debate right now revolves around the questions of was the retest successful and a solid market bottom in?…or is this bounce merely a flash-in-the-pan, doomed to fail, followed by new lows? We obviously cannot definitively answer that. However, the evidence presented here based on historically (somewhat) similar rallies strongly suggests that, while heavier volume would have been preferable, this rally can continue in the intermediate-term.

_______

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.