5 Most Viewed Posts (& Charts) Of 2015

These were the posts, and accompanying charts, that readers clicked on most in 2015.

As we wrap up 2015, we are looking back at the key moments, trends, stats and, of course, charts that defined the year in the financial markets. As we post this, the S&P 500 is exactly 0.12% away from its 2014 close. However, despite that mundane sounding action, there was again no shortage of noteworthy and – and chart-worthy – developments in 2015 from across the equity, bond, commodity and currency markets. So while years from now, historians may glance at the return of the S&P 500 and yawn, in the moment we certainly know better.

The following 5 posts and charts may not necessarily represent what we consider to be our most important posts or the most significant events of 2015.

We will touch on that topic in an upcoming post on our “editor’s picks” for Charts Of The Year. However, these 5 posts received the most hits (an average of 120K each) from readers this year on the JLFMI blog.

We recognize that the clicks and views are largely a function of those outlets, such as YahooFinance, Marketwatch, Bloomberg, See It Market, Zero Hedge, Abnormal Returns, Quantocracy and others, that have generously shared our charts and research throughout the year. We greatly appreciate everyone’s efforts in that regard. Thank you all for sharing!

Here are our Top 5 Most Viewed Posts & Charts of 2015 (click on the titles to read the posts):

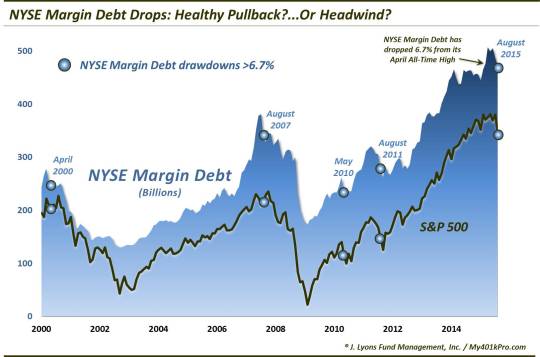

#5) Margin Debt Drops: Healthy Pullback, Or Budding Headwind? – September 25

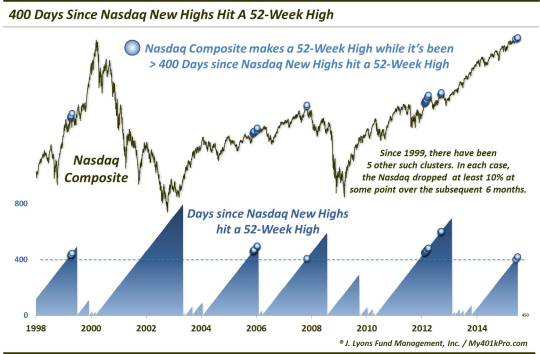

#4) Individual Stocks Struggling To Keep Up With Nasdaq Rally – June 24

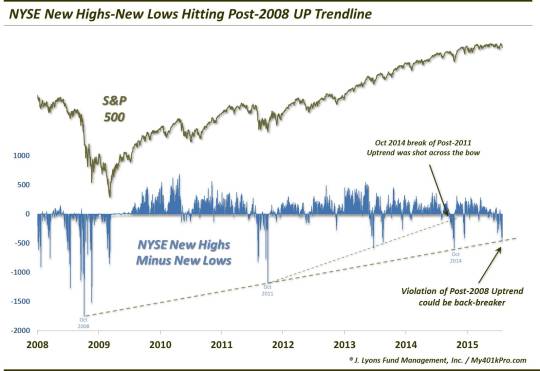

#3) It’s Bounce Or Else For This Key Stock Market Gauge – July 28

#2) Bad Breadth Milestone A Warning For Stocks? – June 26

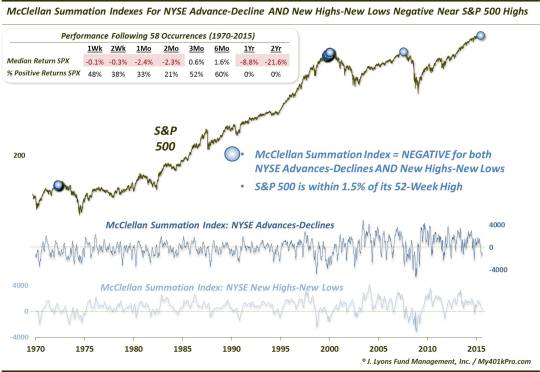

#1) The Summation Of All Fears – July 30

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.