The Good, The Bad & The Ugly From 2015

A brief sampling of the best, worst and toughest financial markets of 2015.

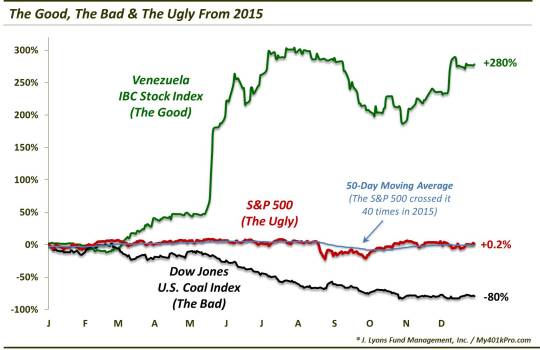

Like any year, 2015 had its share of good markets (mainly stocks in or related to F.A.N.G.), bad markets (essentially all commodities, currencies, most bonds and the majority of stocks) and the ugly (most actively managed funds). Among the market segments and indices that we track, today’s Chart Of The Day presents the winners of each of the three categories this year (through 12/30/2015).

The Good: On the heels of a 40% jump in 2014, Venezuela’s main IBC Stock Index was up a cool 280% this year. Although, due to currency devaluation, you’d be lucky if you kept any of those 28,000 basis points.

The Bad: Coal stocks were an example of another trend that persisted this year. After closing 2014 some 87% off of its 2008 high, the Dow Jones U.S. Coal Index lost another 80% in 2015. That’s why we don’t go bottom-feeding when selecting investments.

The Ugly: There were much worse markets in 2015, but the S&P 500 was just plain ugly for anyone trying to figure it out. For one, as of the 2nd to last day of the year, the index was exactly 0.2% away from its 2014 closing price. Furthermore, along the way, it suffered stints of maddening behavior.

From February 3 to August 19, the S&P 500 never closed more than 2.2% away from the 2085 level, up or down. That’s over half the year, or 138 days! Then it dropped 11% in a week! Then, in one month (October), it gained back the entire decline!

On top of that, imagine you were using the 50-day moving average to stay on the correct side of the trend, as many traders do. Well, the index crossed up or down through the 50-day no less than 40 times – on a closing basis! Good luck with that strategy.

In the end, we should not be surprised by the challenges presented by the S&P 500 in 2015. It is another example – actually, the best example – of a lesson we have written about several times. That is, the more popular an index or security is among traders, the less apt it will be to conform to traditional technical analysis – and the more difficult it will be to trade. Just think of the other market participants in the index as competition. And what index has more competition in the entire world than the S&P 500? Everyone thinks they have to have an opinion on the S&P 500. A bit of advice, if we may: if you are just starting out in this trading thing, try trading something besides the S&P 500…anything else.

Anyway, here’s to another interesting year in 2016. You can bet there will be plenty more good, bad and ugly.

________

Photo is a poster of the 1967 Sergio Leone film starring Clint Eastwood.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.