The Janu, er, December Effect

What used to be the “January Effect” of out-performance by small cap stocks has moved to December

Typically in life, we see that when a trend is identified, it begins to evolve for the sake of exploitation by some party. It is just human nature. Take the whole “Black Friday” phenomenon, for example. It used to be that the Friday after Thanksgiving brought about all matters of deals and specials for shoppers when stores opened – at their normal time. Then some stores began to open earlier and earlier to get a jump on the competition. Eventually, with an online presence, retailers began to offer Black Friday deals all week long – then all month long. At this point, I’m half expecting to get a load of spam telling me about next year’s Black Friday specials.

It is the same way with markets. Although, there are some seasonal trends that have persisted, for whatever reason, for decades (e.g., the “Sell in May” phenomenon), others evolve as market participants begin to anticipate the trend’s occurrence. As such, we see some of these trends gradually shift earlier and earlier as traders attempt to get a jump on the competition by getting aboard sooner. One example is the so-called “January Effect”.

The January Effect refers to the tendency of small-cap stocks to outperform in January. This tendency, most likely due to tax-related issues involving the turn of the year, was fairly consistent and became widely known – too widely known, in fact. As more and more traders began to pile into small-cap stocks in anticipation of the January Effect, the trend began to get pulled forward. Nowadays, it may as well be called the “December Effect” as the small-cap relative strength has moved to the 12th month in recent years.

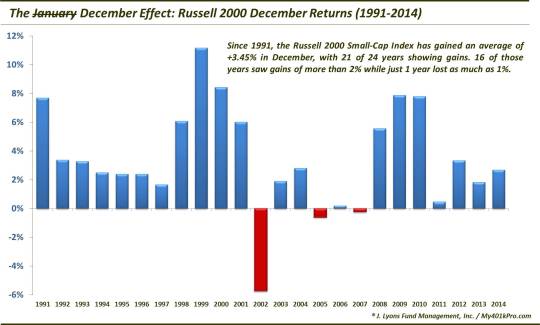

Notice the consistently strong small-cap performance in December since 1991, as measured by the Russell 2000 Small-Cap Index.

Since 1991, the Russell 2000 has seen December gains in 21 of 24 years. And only one of those three losers (2002) saw the Index down as much as 1%. Conversely, 19 of the years saw the Russell 2000 up by at least 1%, and 16 by as much as 2%. That is pretty consistent as far as financial markets go.

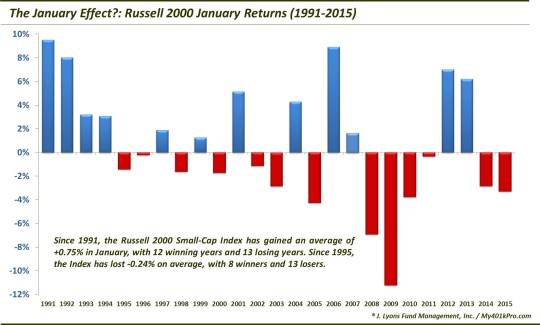

What about January, the namesake of the phenomenon in question? Well, since 1995 especially, the only real “Effect” the month has had on returns has been to depress them.

13 years since 1995 have seen the Russell 2000 lose ground in January versus just 8 winning years. The average return is actually negative, at -0.24%.

Perhaps this recent shift forward in the so-called “January Effect” into December is mere coincidence. We don’t know for sure. The argument would seem pretty statistically compelling, however, that there is a real structural shift in “effect” here based on the consistent out-performance by small-caps in December recently.

_______________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.