What’s Next For Stocks After The New Year’s Day 1 Hangover?

After getting hammered on the first trading day of 2016, what can we expect from the stock market?

Happy New Year, stock investors! Equity markets around the globe rang in 2016 with hefty losses. The heaviest selling was seen in Shanghai but the damage found its way to New York, in spades. While U.S. stocks did close well off of their lows, the

Dow Jones Industrial Average (DJIA) still lost 1.58%, the worst first day showing for a year since 2008 – and 1980 before that.

What is the significance beyond this first day hangover, if any? No doubt countless traders and research shops have taken a look at the phenomenon and any findings here may be redundant. Furthermore, the sample size of large day 1 losses is quite small and each year unique in its circumstances. That said, we too took a historical look at weak first days, so please bear with us.

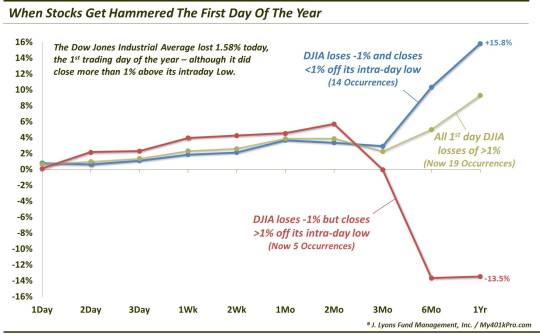

So what did we find? Was there a continued hangover in the days or weeks or months to follow? Well, after looking at the 18 prior instances since 1900 in which the DJIA lost at least 1% on the first trading day of the year, we found that…no, in general, a very weak first day did not presage further declines to come.

Of course, the forward performance was not unanimously positive following all events. However, on average, returns were above average, particularly in the shorter-term. From 2 days to 2 months out, at least two thirds of the events saw positive returns, with the average return well above normal.

As you may have noticed regarding similar studies, we like to try to find a “differentiator” among the sample. That is, is there a set of circumstances within a subset of the occurrences that has led to a more consistent or “predictable” result. We place that word in quotes because prediction, per se, is folly in financial markets. However, it is all about putting the greatest odds in one’s favor when making an investment decision and that is what we are after when targeting these differentiators. And while the technique may further reduce an already statistically insignificant sample size, at times, the results can be consistent and compelling enough to consider it a possible edge.

In this case, the differentiator we looked at was the size of the intraday comeback. As we mentioned, stocks did close well off of the low – by 1.13% for the DJIA. Looking at other “1st days” that closed down at least 1%, but off of the lows by at least 1%, we did find some interesting results.

Now there were only 4 prior such years: 1930, 1932, 2000 and 2001. Thus, again, we cannot put blind faith in the results. However, on average, those years tended to do better in the shorter-term (out to 2 months), but worse (much worse) in the intermediate to long-term. Judging by the location of the market cycle in the years mentioned, that longer-term relative weakness should not be a shock.

Here is a chart of the forward returns after A) all -1% days (tan line) in the DJIA on the first day of the year, B) those that closed more than 1% off of the low (red line) and C) those that closed within 1% of the low.

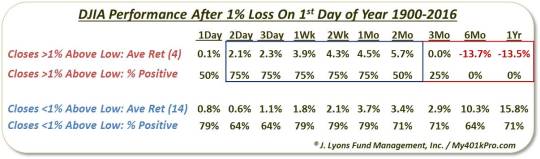

Here is chart of the latter 2 samples presented in table form.

Again, as the chart and table indicate, large day 1 losses that close significantly off the lows tend outperform handily out to 2 months. On the other hand, from 3 months out to a year, it is a much different story. Each of the four events declined out to 6 months and a year, by over 13% on each time frame. Furthermore, the average drawdown (not shown) over the 1 year period following the four occurrences is -28.6%. Meanwhile, the average 1-year drawdown for the other 14 occurrences was less than 10%.

So is the stock market’s big drop on the first day of the year something to lose sleep over? By itself, no (though, we do have plenty of other concerns). From 2 weeks to 2 months following prior big “day 1″ losses, 14 of the previous 18 occasions saw higher prices. Furthermore, based on a limited number of examples, the sizable rally off the lows today may increase the rally potential in the short-term. However, in the longer-term, these “off the lows” closes have unanimously brought eventual further declines.

________

New Year’s hangover photo from Houston.culture map.com.

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.