Large Cap Growth Stocks Recapture “Pivotal” Level

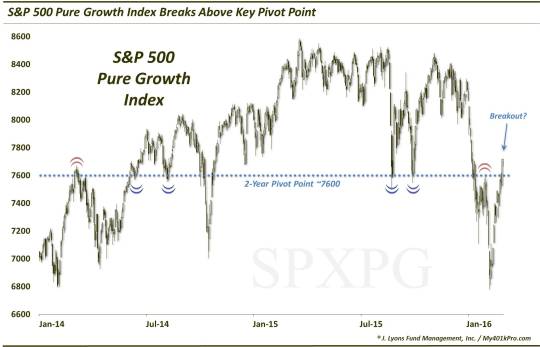

The S&P 500 Pure Growth Index has broken above a key level that has alternately served as support AND resistance over the past 2 years.

When traders mention “pivot points”, they are referring to levels on a chart that serve as both support and resistance, depending upon whether prices are above or below the level. Basically, they are like any support or resistance levels, except that they have been tested from both sides. Consider them support/resistance lines with experience. One case in point, with current ramifications, can be seen in the chart of one of the market’s former leaders, the S&P 500 Pure Growth Index (SPXPG).

Notice on the SPXPG chart how in the past few years, prices have alternately been repelled by the level near 7600, both from below and from above. This is a good example of a pivot point.

First, in early 2014, the 7600 area served as resistance, repelling prices lower for about 4 months. Finally, in mid-2014, the SPXPG broke above that level. Thus, what was resistance became support, and it did indeed provide such support on two occasions soon after.

Fast forward to 2015 and we see the 7600 level again serving as support at both the August and September lows. After finally dropping below there early this year, what was support once again became potential resistance. And the late January bounce did find resistance again right at the 7600 level.

After subsequently testing (and undercutting) the January lows, the SPXPG has bounced to once again challenge the 7600 pivot point area. And in yesterday’s rally, the index surpassed the level, closing around 7719. So, for the moment, the 7600 pivot point has been reclaimed and, once again, turns the former resistance into potential support.

What’s the takeaway? Simple: if prices are above the 7600 level, the area should act as support. If prices fall back below the line, it should serve as resistance. Thus, if this former market leader – large-cap growth – is to return to leadership status, it would do well to hold above this “pivotal” level.

_______

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.