Small-Cap Value Stocks Take Express Elevator Back Up

After testing colossal support in late January, small cap value stocks have exploded to the upside…but is there any more room to rise?

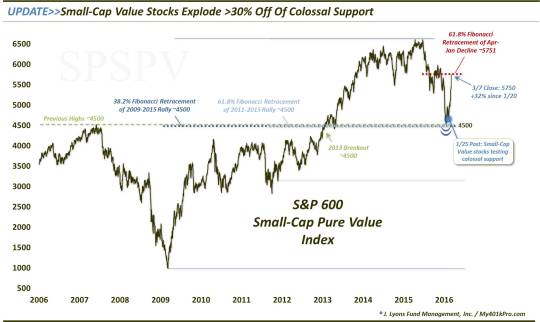

Back on January 6, we noted the likely “significance” of the day due to a plethora of stock indices that were suffering key breakdowns. In our view, the breakdowns opened up considerable, immediate downside in the indices as we noted in the post on that day. Included among those indices breaking down was the S&P 600 Small-Cap Pure Value Index. In an October post, we had noted the immediate potential for an additional 15% of downside to near 4500 in the case of a break of the 5300 level – which it eventually broke on January 6. Well, the index wasted no time in realizing that downside, hitting the 4500 level just 7 days later. As we stated in a January 25 post, the index had taken the (Elevator) Shaft down to that support level.

As the name implies, this “Pure” Value index includes only those S&P 600 stocks exhibiting true “value” characteristics. This is in contrast to the plain S&P 600 Growth and Value Indices which split all 600 stocks into one of the two categories, and sometimes both.

Regarding the 4500 level, this is how we described its potential as far as providing support in that January post:

“Bulls better hope it is successful because we are talking about some magnitudinous support here (yeah, I said it). The prior all-time highs in 2006 and the 2 most important Fibonacci Retracement levels, 61.8% and 38.2%, measured from the 2 most important lows in the history of the index, 2011 and 2009, respectively, represent the most significant potential support that the index will encounter, in our view.

…

if this general level fails to hold in this S&P 600 Small-Cap Pure Value Index, then God help anyone still on this elevator.”

Well, fortunately for the bulls (and everyone on this elevator), that area did indeed prove to be the “ground floor” for the decline as it would go no lower that that. We also noted in the January post, “the Small-Cap Pure Value Index also tends to exhibit the highest volatility, or beta, of any of the style indices. That is, it moves the most, up or down. And it has moved recently, to the downside.”

Fast forward to today and we see the index moving fast again – only to the upside. In fact, as much as any market index, it has taken the express elevator off of that January support, jumping some 30% over the past 6 weeks! This big picture chart shows the longer-term levels of significance, as well as the significance of the January breakdown – and the subsequent rebound.

This close-up shows the recent action a little clearer.

So what are the prospects like now for the Small Cap Pure Value Index? Well, on the plus side, we will say that it is definitely a positive that the index A) held the support level that we noted it “should” and B) responded, i.e., bounced, so forcefully at the support. Regarding that latter point, the speed of the recovery is typically a positive sign for an index’s prospects going forward. Similar to a “breadth thrust” that we have discussed recently, a strong reaction off of a low often foreshadows a solid recovery in the longer-term as well.

On the negative side, the index is running into a couple points of potential resistance. For one, it is testing the vicinity of the January breakdown. Furthermore, it closed 2 days ago almost precisely at the 61.8% Fibonacci Retracement of its decline from the April 2015 all-time top to the January low. This should at least provide some resistance in the short-term.

How it reacts here may also be telling in terms of its longer-term prospects. If it consolidates more or less sideways in this area, or at least does not pull back to far or too quickly, it will bode well for further upside. However, if it does an immediate u-turn and craters again, it will be a particularly bad omen. The early returns aren’t too good here as, after topping out 2 days ago, the index plummeted over 4% yesterday. That is not the reaction here that the bulls want to see. However, this is way to early to call at this point.

Lastly, we have an x-factor. We mentioned the speed of the index’s recovery and its typically positive ramifications. However, sometimes it can be too much of a good thing. A strong rebound is one thing, but a 30% jump in 6 weeks in alarming. So alarming as to trigger our skeptic’s antennae. The rise may be legit, but there is something about the magnitude of the move that is a little unnerving – or downright weird.

In any event, this is one index that is a bit off most peoples’ radars, which is good because we often find it useful as a risk on/risk off barometer. Thus, we will be closely monitoring the variables mentioned above for clues as to whether the elevator still has some upside stops to make – or if it is again destined for the basement.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.