European Equities: Rolling Over…Or Overdue?

European stocks just set an ignominious record.

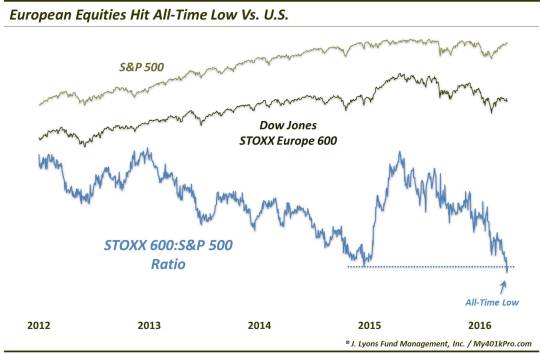

In terms of global reach, the post-February equity rally has been a fairly broad advance. Some markets, most notably the U.S., have resumed their former relative strength while other regions, like emerging markets and Latin America, have seen strong mean-reversion bounces from very oversold levels, One region conspicuously lagging during this rally, however, has been Europe.

After bouncing into mid-March, bourses across the European continent have struggled to maintain any momentum. In fact, as of today, many of the broader European averages are trading back at late-February levels. Furthermore, on a relative basis, European stocks have lagged so badly that they have now set a new record for futility. Specifically, when measuring the performance of the Dow Jones STOXX Europe 600 Index versus the S&P 500, the resultant relative ratio just dropped to an all-time low (since the beginning of our data in 1998).

Zooming in, we can see more easily how the STOXX 600:S&P 500 ratio has, importantly, just dropped below the former all-time low set in December 2014.

So is this new relative low another nail in the coffin for European stocks, or are the forces of mean-reversion due to take hold at any time? We could see either outcome – or both, depending on the time frame.

Obviously, the last time the ratio was down near current levels, European stocks embarked upon an impressive mean-reversion bounce. However, the difference is that in December 2014, the technical picture for European stock markets was much brighter than it is currently.

While the ratio was plumbing lows at the time, it was more a result of U.S. markets that continued to make successive new highs throughout 2014. And although European stocks were failing to do likewise, they did at least repeatedly test their prevailing highs on numerous occasions. And eventually, in January 2015, they broke out in strong fashion to new highs. That breakout led to a furious 4-month rally that helped European stocks erase several years worth of relative under-performance.

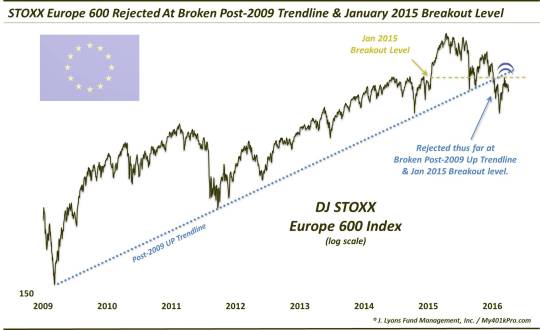

Currently, the technical picture is not so bright. First of all, the STOXX 600 is a good 25% off of its April 2015 highs. Secondly, the index has actually breached the level of its January 2015 breakout. And while this test/failure at that breakout area is not yet definitively decided, the potential breach is certainly discouraging, as is the fact that the test is occurring so soon after the breakout.

On top of that disappointment, the STOXX 600 has also failed soundly in its attempt at recovering its broken post-2009 and post-2012 Up trendlines (which just so happen to line up in the same vicinity as the 2015 breakout point). In contrast, we have seen multiple indices in the U.S. succeed in recovering their corresponding broken trendlines.

So is it possible that European stocks might enjoy a mean-reversion bounce following their pronounced under-performance of the past month? Of course, anything is possible – especially in the “whatever it takes” era. Although there is really no way to game-plan for it (nor do we recommend attempting it), don’t forget that in this era, once a country or region’s equity markets suffer enough damage, either on an absolute or relative basis, one can expect the local central bank cavalry to come to the rescue.

Even so, such relief may only be short-term in nature. We have seen the shelf-life of recent central bank stimulus attempts becoming shorter and shorter. Furthermore, again, there is considerable technical resistance standing in the way of a more substantial bounce. The fact that prices have already failed at that resistance – and feebly, at that – suggests that the area will be a tough nut to crack.

Thus, while European stocks may be “due” for a relative snapback bounce, until further notice expect any snapback to be limited in scope. The evidence continues to suggest that the relative European downtrend is still firmly intact. Furthermore, the technical picture suggests that European stocks have considerable resistance overhead and, in fact, may have already begun to roll over once again.

__________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.