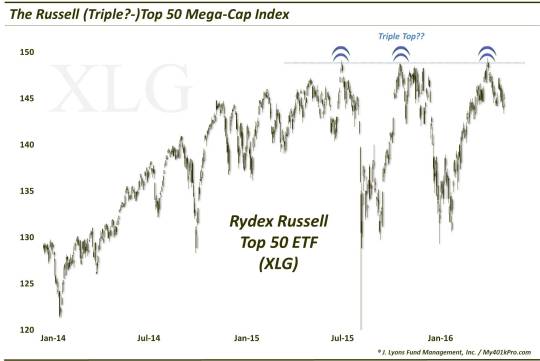

A Peculiar Large Cap Top?

An index of the largest stocks in the market just formed an apparent triple top – but is it a legitimate concern?

One topic on most market strategists’ minds (whether they admit it or not – we do) is has the stock market topped? Specifically, has the post-2009 cyclical bull market topped? And one consideration for many (whether they admit it or not – we are guilty, at times) is does it look like a top? Now that should

probably be very low on the “top” checklist. Indeed, we have a set of metrics and indicators which are much more accurate in assessing the likelihood of a top (of some magnitude) than the so-called eyeball test. However, it is a tempting exercise to engage in as it involves all of glancing at a chart in order to form an opinion.

In reality, identifying a top is an extraordinarily difficult proposition – and for the most part, a fruitless one. How many tops are there in a cycle? Yes, just one. And yet, market participants want to continuously label each hiccup along the way a potential top (guilty again, to an extent). Our advice is to manage your process

in real-time

(we believe in an active risk-managed approach) without regard for imponderables such as trying to guess a top.

Besides, in our view, accurately identifying a top by merely observing its chart pattern has become more and more difficult in recent years. One likely reason is the recent proliferation of technically-oriented traders and investors. Once a critical mass is reached in terms of eyeballs, conventional patterns and interpretations cease to reliably persist. If everyone is watching the same stimuli, after all, how can it possibly work? Heaven knows the majority of traders are not successful in this business.

One such supposedly “traditional” topping pattern can be seen in today’s Chart Of The Day. The security is the Rydex Russell Top 50 mega-cap ETF (ticker, XLG). The Top (no pun intended) 50 index comprises the 50 largest stocks in Russell’s entire universe. The pattern that we are highlighting is a potential “triple top”. As the name implies, the pattern consists of three peaks in very close proximity. TA textbooks would suggest this is a very bearish pattern and possibly setting the stage for a serious decline.

In reality, we could probably count on one hand the number of triple tops we’ve seen actually pan out of late (we’ve seen other veteran technicians express the same view). Yet, the pattern continues to draw significant attention. Whether its due to a successful (long ago) track record, or merely the alliteration of its name, the triple top is still a popular call-out among market watchers. However, again, we’ve seen the pattern eventually fail far more times than not, i.e., a failure here meaning the XLG would negate the triple top by breaking out to new highs.

Perhaps the closest recent potential example to panning out was the tri-decadal triple top in the Value Line Geometric Composite (see our 5/8/2015 post). However, even that version saw the index

temporarily

break out following the third “peak” before dropping back.

And therein lies a possible scenario that would “sort of” satisfy the triple top and forecasts for a top in the XLG. Because, if there has been any version of a topping pattern in recent years that has been somewhat predictable and reliable, it has been the false breakout. This goes back to the notion of everyone watching the same stimuli. In those cases, the market will generally do whatever will harm the most people.

So what are the odds that the Russell Top 50 has formed a bull-killing triple top? Better than spotting a unicorn, though, not by much as they are probably just about as rare. So while the triple top can’t be ruled out, we would certainly not be surprised to see new highs in the XLG before the ultimate top is in – even if it is almost immediately following.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.