Stocks Entering Best Quarter Of Presidential Cycle…Sort Of

Since 1900, the 3rd quarter of election years has been the best performing quarter, on average, of the entire Presidential Cycle; although more recent results have not been quite as positive.

Perhaps as much as any time in recent memory, there seem to be numerous, potentially significant, cross-currents blowing in both directions in the stock market. At probably the bottom of the priority totem pole among such currents, for us, is seasonality. At any given time, there are plenty of other variables that we are more comfortable with in taking our cues on the market. That said, seasonality can, at times, have a very strong influence on markets. Furthermore, in the long-run, there have been few trading systems that would have kept pace with even a rather simple seasonality system. And one of the seasonal patterns with a respectable track record pertains to the Presidential Cycle.

Again, the Presidential Cycle refers to the behavior of the stock market vis-a-vis a 4-year Presidential term. Throughout time, stocks have tended to do very well during some periods of the Cycle, and not-so-well during other parts. It is not a fool-proof system, but it has behaved consistently enough to seriously consider its statistical merit. Therefore, while we do not directly incorporate it into our investment process, all things being equal, the Cycle can seemingly explain a good portion of the market’s movement. The problem is, all things are never equal, which makes it difficult to trust the Cycle with one’s funds.

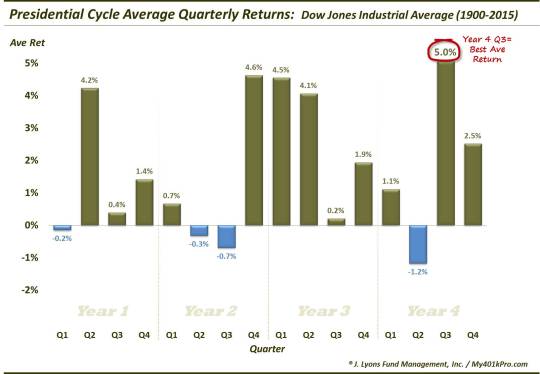

Assuming, however, that one could reasonably rely on the Cycle, it may be entering a particularly interesting period. Specifically, since 1900, the best performing quarter of the Presidential Cycle, using the Dow Jones Industrial Average, has been the 3rd quarter of election years, i.e., the quarter we just entered on July 1. During the 29 cycles since 1900, the 3rd quarter of election years is the only quarter with an average return better than 5%.

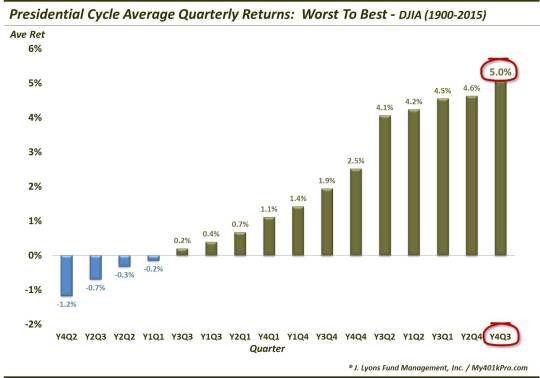

Here are the returns listed from worst to best.

So, all things equal, bulls should be able to take command over the next few months. There are just a few caveats , however, that may prevent one from becoming blindly bullish.

First – again, things are not always equal, or ever. Thus, there are a myriad of factors that could derail a potentially very positive 3rd quarter. One need only look at last quarter to see that the pattern does not always work. As we posted at the end of March, the 2nd quarter of election years is actually the worst performer of the entire cycle. However, stocks were still able to put in a respectable, if not overwhelming quarter.

Secondly, the quarter’s average return benefits, in part, from one very large quarter back in 1932. That quarter saw the DJIA gain 67%, the second largest of any quarter since 1900, behind only the 2nd quarter of 1933 (+77%). Without that one quarter, the election year’s average 3rd quarter return would drop all the way to +2.7.

Lastly, and speaking of 1933, some folks would take exception to our including results back to 1900. Specifically, Jeff Hirsch of the Stock Trader’s Almanac and Tom McClellan of the McClellan Market Report would, I believe, advocate for beginning the study in 1934, following passage of the 20th Amendment. The Amendment, among other things pulled forward the inauguration date and Congressional start date to the January following the election. And while we would still default to the “more data is better” philosophy, perhaps they are onto something.

That is because if we start in 1934, the average return for the 3rd quarter of an election year drops to +0.9% and to the back half of all returns. Furthermore, just half of the quarter’s returns over the time frame were positive, placing it with the 1st quarters of Year 1 and Year 2 as the least consistent gainer.

So while seasonality in general, and the Presidential Cycle specifically have respectable track records, there are plenty of other factors that we would focus on first as inputs into our investment decision-making process. To the extent that the cycle is a gentle influence on prices, we consider it a positive one for the duration of this quarter given the quarter’s status as the best-performing quarter of the cycle. However, based on more recent performance, we would have to temper that enthusiasm a bit.

__________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.