Was The 52-Week High Worth The Wait?

The S&P 500 finally hit a 52-week high today for the first time in more than a year; historically, similar waits have led to more upside.

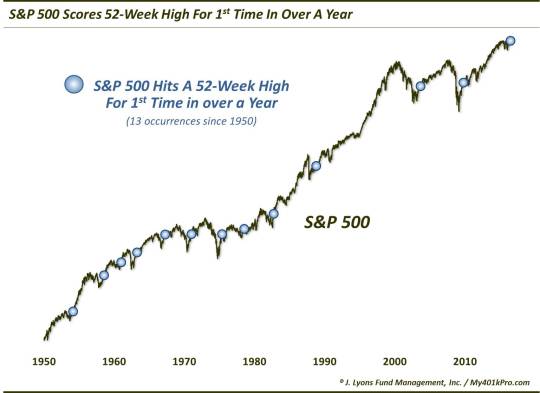

While the S&P 500 missed out on an all-time high today by 92 cents, it did receive consolation in the fact that it was a 52-week high. It was also the first such high in more than a year. Since 1950, this was the 13th time the index has had to wait more than a year to hit a new 52-week high.

How did the index respond following the previous 12 long waits? Quite well, thank you very much.

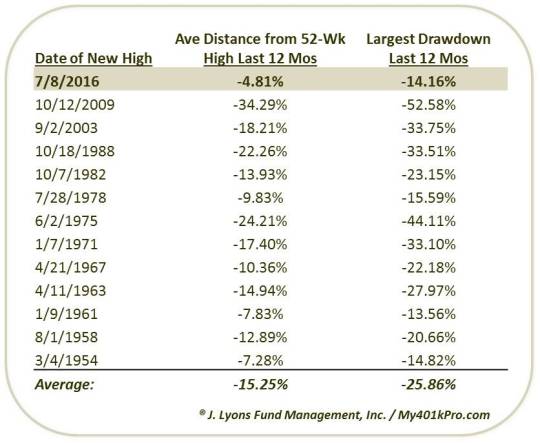

As the table shows, the median return was positive across every time frame, from 1 week to 2 years. Not only that, but gains were unanimous 1 and 2 years later.

So is it clear sailing then from here? Well, while the returns are certainly encouraging for bulls, there are always risks involved. One “caveat risk” here – like so many studies we’ve looked at in recent times – is that our present circumstances are quite different than the historical precedents. Namely, the other events had been coming off much more relative weakness than is the case here.

So does this mean the S&P 500 has more left in the tank since it has not had to spend as much fuel catching up to new highs? Or does it mean that there is less reversion fuel as the rubber band was not as stretched to the downside? Obviously there is no way to know for sure, but we do have a suspicion that it could be the latter, based on other observations we’ve been noting.

Regardless, the numbers say there should be more upside ahead. And despite the rash of “false breakouts” in recent years, that should be the assumption, especially if the S&P 500 can tack on that 93 cents to reach an all-time high.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.