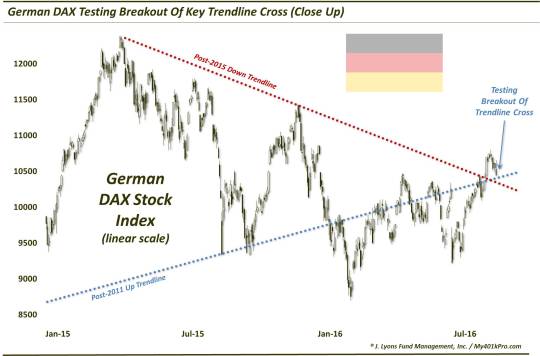

German Stocks Try To Defend Key Breakout Level

The German DAX scored a big technical breakout 2 weeks ago; it is now undergoing a critical test of that breakout level.

As U.S. equity-centric fund managers, our focus is not typically on international markets, except as it relates to our relative strength-based fund selection model. However, there are certain foreign markets that are obviously more significant than others in their influence on global equity movements. Additionally, there are certain junctures on a chart that are more important than others in determining the likely direction of prices. Put those two variables together and you have the makings of a highly meaningful chart that begs one’s attention. This combination also accounts for the 3rd Chart Of The Day and associated blog post in the past 8 weeks pertaining to the German DAX Stock Index.

Of course, the DAX is Germany’s main stock index and, outside of some of the broad, continent-wide indices, perhaps Europe’s most important as well. Given Germany’s status as Europe’s economic linchpin, the DAX is always on our radar as a key barometer of the health and direction of European equities. As such, the 3 recent ChOTD’s and posts (including today’s) are indicative of the significant developments of late in the German (and thus, Europe’s) equity market.

The first post came on June 29th as we suggested it was imperative that the DAX hold key, post-Brexit support that it was testing at the time (German Stocks Facing Must-Hold Level). Specifically, the support was in the form of the post-2009 Up trendline (on a log scale). The index was indeed able to hold the trendline, bottoming within 2 days of the post. Since that hold, the DAX has rallied as much as 17%.

About 3 weeks ago, the rally had led the DAX to another critical juncture, in our view. Specifically, it was the convergence of 2 key trendlines (on a linear scale this time): the post-2011 Up trendline and the post-2015 Down trendline (German Stocks At A Crossroads). We felt that the DAX’s reaction at that convergence would dictate the direction of the market for some time. Break above the trendlines, it was advantage bulls. Fail there and the bears would be in control. Well, after an initial week-long rejection, the DAX was able to break through that convergence of technical resistance – and with authority, rallying 3.5% in a week.

However, after that 1-week push, the rally petered out and the index began to pull back. Fast forward to today and the DAX is now testing the level of that trendline convergence breakout.

A closer look:

This test bears the same implications as the last one. That is, holding above the breakout level of the trendline convergence would be bullish. Fail to hold and we have a likely false breakout, giving the advantage to the bears. Of course, the 2 trendlines are now diverging so it is possible that price falls below the Up trendline, yet holds the down trendline. We’ll call that scenario a draw.

At the moment, though, the 2 trendlines are still close enough together that a move above or below could happen easily and swiftly so keep your eye on the ball.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.