Can Dual Support Keep The Little Stocks Propped UP?

2 key lines of support are currently converging in the vicinity of the Russell 2000 Small-Cap Index – will the area hold up?

Over the past 6 weeks, stocks have been subjected to sporadic bouts of selling pressure. But while there has certainly been evidence of cracks in the broad market, bears have been unable to deliver a really serious blow. Each time the selling has threatened to cascade into something more substantial, the major averages have managed to rebound smartly. While some have wondered how buyers have been able to suddenly appear just in the nick of time, we would suggest that where they appeared is the key. In the large-cap averages, e.g., Dow, S&P 500, etc., support has twice come in at the area of the July breakout. For the Russell 2000 Small-Cap Index (RUT), the key support is arguably in the form of 2 Up trendlines, 1 long-term and 1 intermediate-term.

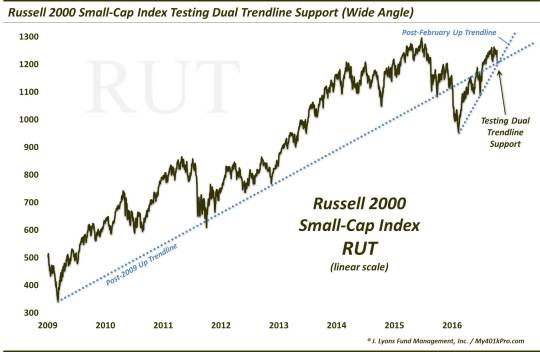

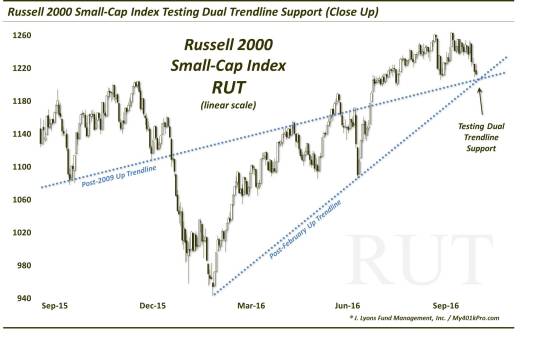

The long-term Up tendline (on a linear scale) stems from the 2009 lows and connects the lows in late 2011 (save for 1 false breakdown day), late 2012 and late 2015. The RUT eventually broke down below the trendline in January of this year and encountered resistance at the line several times as it tried to recover it during the post-February rally. Eventually it was able to reclaim the line in July and has, thus far, been able to remain back above the trendline.

Speaking of the post-February rally, the intermediate-term trendline stems from the February lows and connects the June post-Brexit lows. Presently, these 2 trendlines are intersecting near the 1205 area. That makes this level, in our view, a critical area to hold for small-cap bulls.

Here is the chart back to 2009 showing the 2 trendlines.

Here is a closer-up look at the 2 trendlines.

With the Russell 2000 coming perilously close to the aforementioned level (its low so far today is 1210), this area obviously looms large. If the RUT can continue to hold above the trendlines, the bulls will remain in control and the intermediate-term rally in small-cap stocks can persist further. Should the level give way, however, the bears may have their chance to finally deliver a more serious blow. Either way, the area marking the convergence of these 2 trendlines would appear to be a key one to focus on in determining the likely direction of small-caps.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.