Will Election Surprise Be A Gift To Investors?

When stocks have entered the 4th quarter of an election year positive YTD, they have historically continued higher through year-end.

It is normally around this point in an election year when the U.S. populace is treated to the infamous “election surprise”. To the extent that there is an imminent surprise, we have no idea what it will be (that’s why they call it a surprise, right?). However, we do have something more up our alley, and basically antithetical to surprises: quantitative, historical research. That may not sound as exciting as a surprise, but it may be more helpful for investors. And if historical trends hold true, it may be good news for investors as well.

Specifically, we looked at every election year in the last 100 years when the Dow Jones Industrial Average entered the 4th quarter showing a positive year-to-date return, as it did this year. We then looked at the subsequent 4th quarter returns revealing, perhaps, a nice surprise for stock investors.

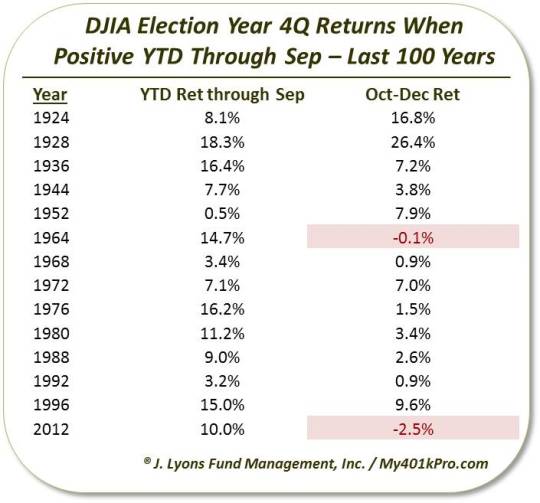

In table format:

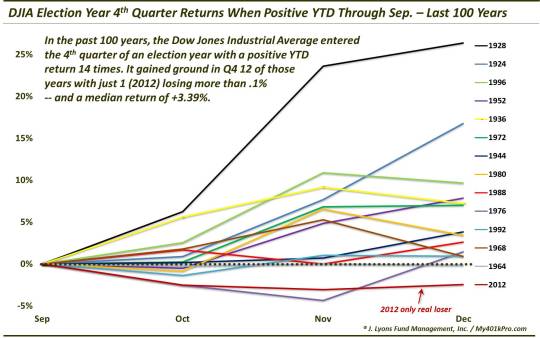

In chart format:

As the graphics reveal, since 1916, there have been 14 years meeting that criteria. Of those 14, 12 were positive in the 4th quarter as well. And essentially only one, 2012 at -2.5%, showed a negative return (1964 was down 0.1%).

Now, these seasonality and cycle trends should only play a small role in one’s investment decision-making. Indeed, every year is unique with its own set of circumstances and, in fact, we have a few reasons to be less than optimistic at this moment. That said, taken at face value, this is one trend that has historically generated positive returns an overwhelming percentage of the time. And I think we can all agree, U.S. investors deserve at least that much this election cycle.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.