Year-End All-Time High In British Stocks Defies Forecasts

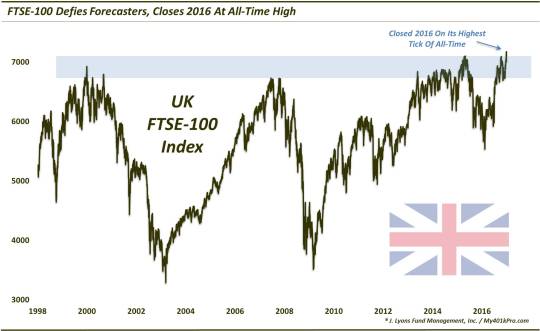

In a development you would not have seen forecast in any Brexit-related headlines 6 months ago, U.K.’s FTSE-100 closed 2016 at an all-time high.

Quick, name the only major (that leaves you out, Pakistan) global country index to close the year at an all-time high. As you’ve probably gathered by the headline, the sub-heading or the image, it is Great Britain. Considering the events of 6 months ago, that statement is beyond ironic. Of course, the events to which we are referring revolve around the Brexit vote by the people of Great Britain to leave the European Union. Prior to the vote, almost no one expected the Brexit referendum to pass. Furthermore, if it hypothetically did pass, nobody expected the U.K.’s FTSE-100 Index to fare too well in the aftermath. Thus, the fictitious newspaper shown above would have been the last thing market observers would have expected to see.

But that is one of the beauties of the market. It continuously delivers results that human nature dares not even conceive of. So it was in this instance as Brexit passed and, despite the assured forecasts by pundits, pollsters and prognosticators, the FTSE did not crash. Oh, it did plummet in the few days following the vote. However, by a week later, the FTSE-100 was above its pre-Brexit levels and on its way to all-time highs 3 months later. Another 3 months later and we see the FTSE closing the year at a new record high.

Naturally, the extensive weakness in the British Pound had something to do with propping up the FTSE – but hardly all of it. The likely biggest contribution to the FTSE rise was the consensus view in opposition to it, particularly following the Brexit vote.

Along with “BTBTD” (Back To Buying The Dip), 2016 will go down as the folly of the forecasters given the events of Brexit, then the U.S. election. And if 2016 taught us anything about the markets, it is to expect the unexpected. That is one thing we can reliably expect to see more of in 2017.

________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.