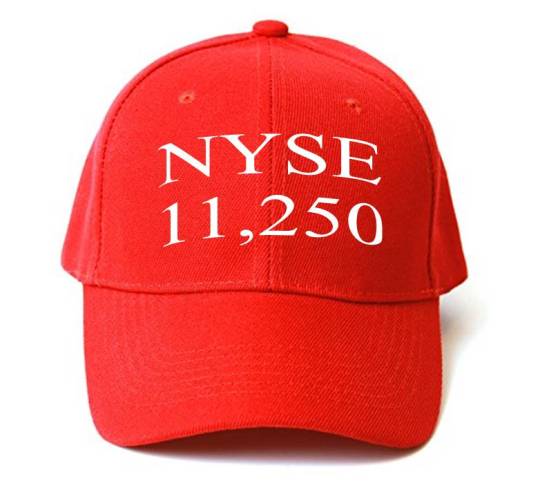

The Wait Is Over: 11,250!

While “all” eyes were on Dow 20,000, one broad market index actually registered a meaningful breakout.

For the past 7 weeks, the investment world has waited with bated breath for a price-weighted index with 30 constituents to reach a specific level because it contains 4 zeros. Yes, my comments regarding “Dow 20,000″ are again ripe with sarcasm considering it is a completely arbitrary and irrelevant event. And I’d also like to point out that most (all?) serious traders and investors that we know have in fact paid no heed whatsoever to this milestone. However, as my high school freshman football coach (and likely everyone’s high school freshman football coach) would say, while the financial media and casual observers were “playing grab-a$$ with Dow 20,000″, an actually meaningful milestone was reached.

On January 5, we mentioned that while most indices, from micro-caps to mega-caps (including the Dow), had scored new all-time highs, there were a few broad market gauges that had not quite made it to new high ground. Among them were the Value Line Geometric Composite and the NYSE Composite. That post dealt with the NYSE, specifically noting cause for optimism that the NYSE would finally break out to new highs after a 20-month wait.

That optimism was partially fueled by a potential “cup-&-handle” formation on the NYSE chart. This is a traditionally bullish pattern that generally leads to a breakout – and often significant follow-through afterward (check out that post for more color on the pattern). The “handle” consisted of the December-January consolidation occurring in the immediate vicinity of the May 2015 all-time highs just below 11,250. After 3 more weeks of consolidation at that level, the NYSE was finally able to top 11,250 today. And, in fact, it extended well beyond that level by the close, ending at 11,339.

Whether or not the chart actually consists of a variation of a cup-&-handle pattern – or an equally bullish inverse head-&-shoulders – is probably not important. The important thing is that another broad market index, this one with thousands of constituents, has broken out to new all-time highs following 20 months of consolidation. As we mentioned in our post a few weeks ago:

“The post-election “Trump Rally” does not need any more confirmation for purposes of its “validation”. The emphatic new highs in many segments of the market, from small-caps to large-caps, speak for themselves. However, if the NYSE Composite is able to break out to new all-time highs, it would be another feather in the cap for this market.”

Indeed, today’s breakout further strengthens the foundation of the post-election rally. And it is certainly far more meaningful than Dow 20,000.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.