High Number Of Consumers See Stock Rally As Sure Thing

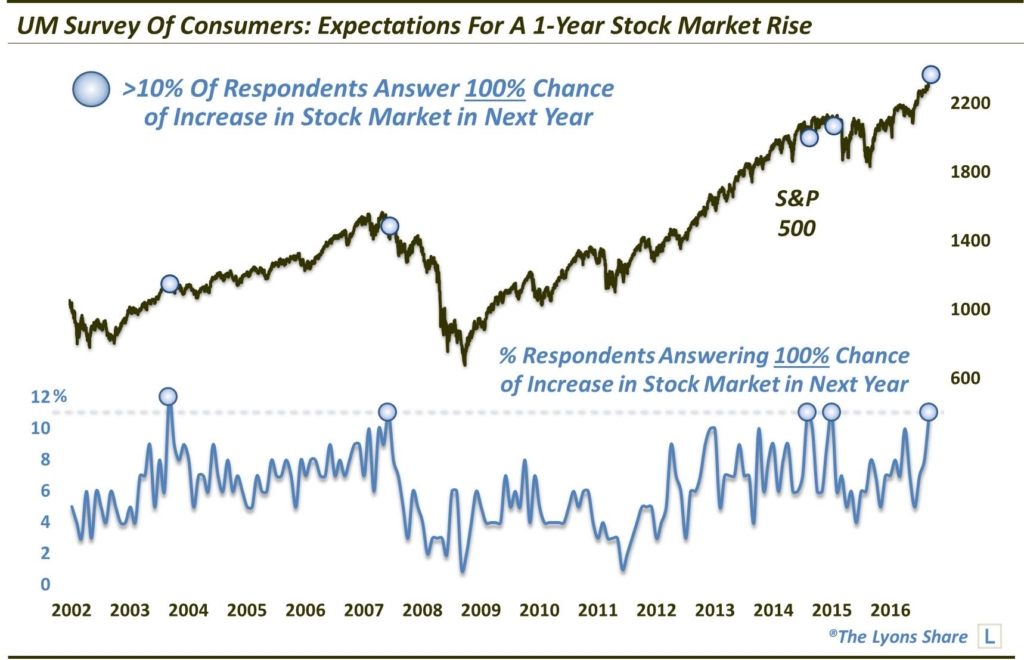

The percentage of respondents in UM’s survey of consumers who view a stock rally over the next 12 months as a “sure thing” is near record levels.

Most folks are familiar with the University of Michigan’s monthly consumer confidence survey. What they may not a is that the survey respondents RS a whole host of questions. One of these questions pertains to their outlook on the stock market. Specifically, they are asked to guess as to the “Probability of Increase in Stock Market in Next Year”. Respondents’answers are broken down into ranges of probability percentages, e.g., “1%-24%”, “25%-49%”, etc. One of the answer options is “100%” probability of a stock market increase over the next year. We like to track this statistic as a measure of public sentiment towards stocks. And based on the most recent survey, as of February, the public is relatively quite certain about the prospects of a stock market rally.

We say this because the percentage of survey respondents in the “100% probability of a stock market rally” category came in at 11%. For context, since the inception of the survey question in June 2002, there has been just one month which saw a tally exceeding 11% and just 3 others equaling that high of a number.

Here are the prior such months and the tally of respondents indicating 100% probability of a stock market rally.

- February 2004 (12%)

- November 2007 (11%)

- January 2015 (11%)

- June 2015 (11%)

With most sentiment-related statistics, extreme readings are contrary in nature. That is, the market typically moves contrary to the consensus opinion. That dynamic generally holds true here. Here are the 12-month returns in the S&P 500 following the above readings:

- February 2004 (+5.12%)

- November 2007 (-39.49%)

- January 2015 (-2.74%)

- June 2015 (+1.73%)

While 2 of the 4 precedents saw positive 12-month returns, they still paled in comparison to the median (+10.35%) and average (+8.02%) 12-month returns over the sample period. Plus the 2004 incident saw negative returns out to 8 months, and the June 2015 incident out to 9 months. So, in all 4 cases, the longer-term performance of the stock market was sub-par, at best.

Here is the takeaway for us. Gathering bullishness is great for stocks and the prospects for a rally. Once that bullishness hits an extreme, however. the prospects change. Based on the UM Survey Of Consumers, sentiment towards stocks has reached an extreme. Based on that alone, expectations for the next 12 months should be tempered.

Like our charts and research? Get an All-Access pass to our complete macro market analysis, including tons of research and ideas like this EVERY DAY, at our new site, The Lyons Share.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.