Key Economic Sector Getting Back On Track?

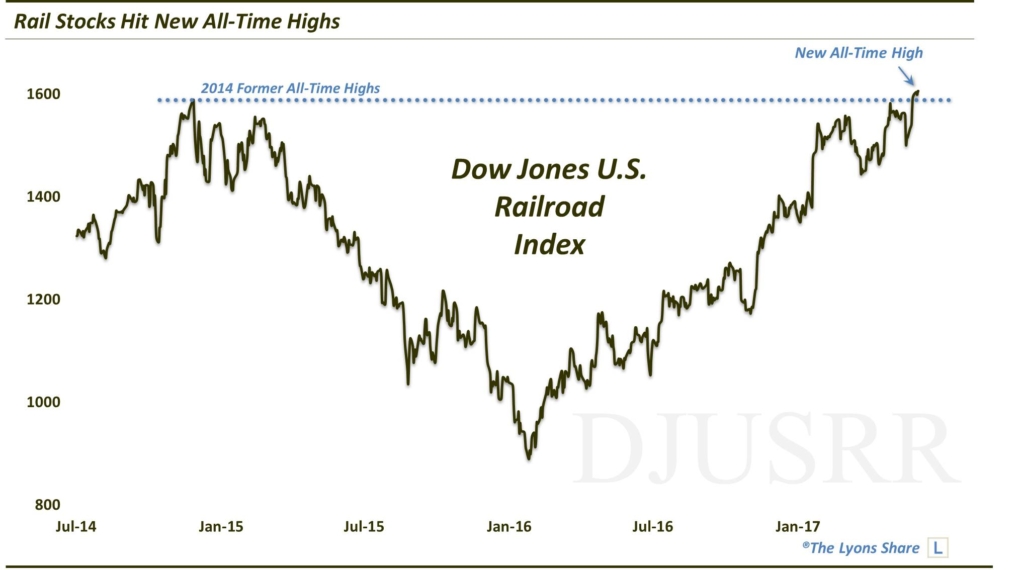

After 2 and half years, railroad stocks are finally back to new highs.

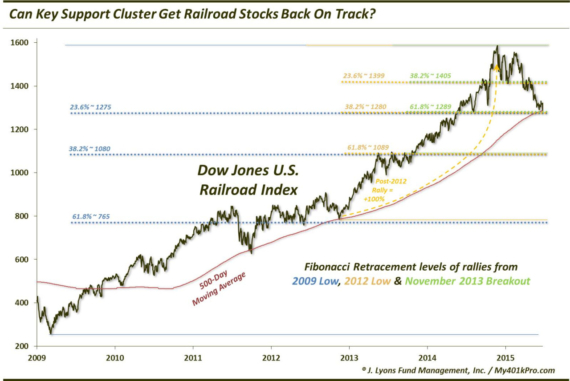

One of the underrated leaders following the broad breakout in U.S. stocks in early 2013 was the railroad industry. At least, early on and it was underrated. However, after railroad stocks doubled by late 2014, as measured by the Dow Jones U.S. Railroad Index, this space was no longer underrated. In fact, it started getting just a bit too much love from investors. And it subsequently fell subject to that which markets do once they become over-loved: a beatdown. By the market bottom in early 2016, railroad stocks and lost their entire gain of the prior 2 years.

Slowly but surely, though, the industry has gotten back on track over the last 16 months. While most areas of the market have scored new highs at some point over the past year, railroad stocks have chugged along in old-fashioned railroad style. And while it may have taken a bit longer than most market sectors, railroad stocks have finally scored new all-time highs in the past few days, eclipsing the 2014 peak.

Why should we care about railroad stocks hitting new highs? Some folks consider railroad activity to be a barometer of the state of the economy at large. Well, if you know us, you know we care little about economic conditions as they relate to the behavior of the stock market. We have found economic matters to be quite unreliable in helping one make money in the market. All we care about is what prices are doing. And with railroad stocks hitting new highs again finally, whenever the economic signal may be, it is certainly good news for investors.

Now, after a 16-month rally directly into 2 ½ year-old all-time highs, one would expect railroad stocks to perhaps pause, consolidate, digest, etc. its gains prior to an attempted sustainable breakout. Indeed, we would not be surprised to see the Railroad Index (currently trading at ~1600) pullback to either the 1500 or 1440 level, give or take. Such a pullback would allow the stocks to catch their breath and potentially refuel before moving to new highs on a durable basis.

For now, however, after a long road, railroad stocks at least appear to be back on track.

If you want the “all-access” version of our charts and research, we invite you to check out our new service, The Lyons Share.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.