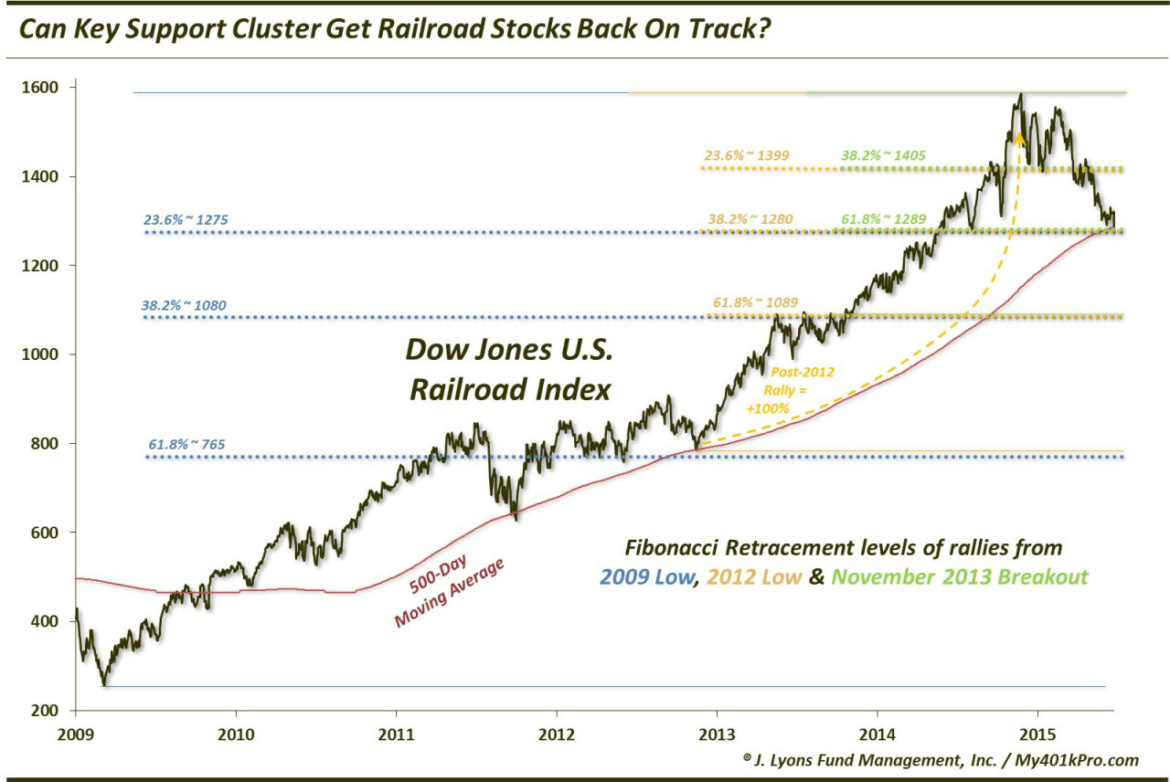

Can Key Support Cluster Get Railroad Stocks Back On Track?

One of the stars of the first stage of the post-2012 U.S. stock market rally was the railroad sector. Impressively, from the fall 2012 kickoff point to its high point last November, the Dow Jones U.S. Railroad Index was up exactly 100%. It wasn’t just the magnitude of the gain though that was impressive, but the manner in which it came. While other flashier sectors, like the biotechs and airlines managed greater gains, they were not without their hiccups along the way. The railroad stocks, on the other hand, had steadily, uh, chugged along for 2 years with nary a snag. From the last day in 2012 to March of this year, the DJ Railroad Index never even approached its 200-day moving average.

However, as I indicated that the high in the railroad stocks was last November, something has obviously changed. Specifically, the rally in railroad stocks has, er, come off the tracks. Whether or not the struggles in the railroad sector portend a deeper meaning for the economy, we don’t know. But it certainly hasn’t meant good things for the sector. A decline of 19% since November brought the DJ Railroad Index to a key cluster of potential support levels a few weeks ago. The Index was able to bounce temporarily. However, today’s action brought it right back down to the key support level around 1275-1280.

This level is marked by a confluence of the following key analyses:

- 23.6% Fibonacci Retracement of the 2009-2014 Rally ~ 1275

- 38.2% Fibonacci Retracement of the 2012-2014 Rally ~ 1280

- 61.8% Fibonacci Retracement of the November 2013 Breakout-2014 Rally ~ 1289

- August 2014 Low ~ 1275

- 500-Day Moving Average ~ 1287

Should this area fail, the next confluence of potential support comes in around 1100, as represented by these levels:

- 38.2% Fibonacci Retracement of the 2009-2014 Rally ~ 1080

- 61.8% Fibonacci Retracement of the 2012-2014 Rally ~ 1089

- November 2013 Breakout Area ~ 1100

- 50% Retracement of the 2011-2014 Rally ~ 1100

- 1000-Day (200-Week) Moving Average

- Post-2009 UP Trendline

Below there opens risk down to the sub-800 level. But now we’re way ahead of ourselves. The focus on the moment is this 1275-1280 level. If the

DJ Railroad Index can hold this level, or quickly recover it following a break below, it stands a very good chance of launching a decent bounce. However, a sustained break below there opens up potential downside to 1100, or another 14% lower.

Thus, the reaction by the railroad stocks at this key juncture could determine whether the sector can get back on track or whether it gets completely, um, derailed.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.