Broad Breakout For The Market Of Stocks

The “median stock” in the U.S. market is finally breaking above multi-decade resistance.

Back in late July, we witnessed a barrage of U.S. stock indices breaking out to all-time highs. While large-cap indices had steadily been hitting higher highs all year, several other indices were just breaking out above 6-month trading ranges. As we warned about in a premium post on The Lyons Share, however, what looked like a convincing, broad-based breakout wouldn’t last. Within weeks, most indices had dropped back below their respective breakout levels. For the small, mid and broad-based stock indices, this represented a false breakout and triggered a move back down to — or below — the bottom of the former 6-month ranges. That was the bad news.

The good news is that these broad averages saw that false breakout — and they raised it (literally) a false breakdown. In fact, following a break below the low end of the trading range spanning the 1st half of 2017, the broad market has come back with a vengeance. And on Wednesday, we witnessed another breakout to new all-time highs on the part of these broad averages. And this breakout has been accompanied by an arguably healthier set of internal conditions.

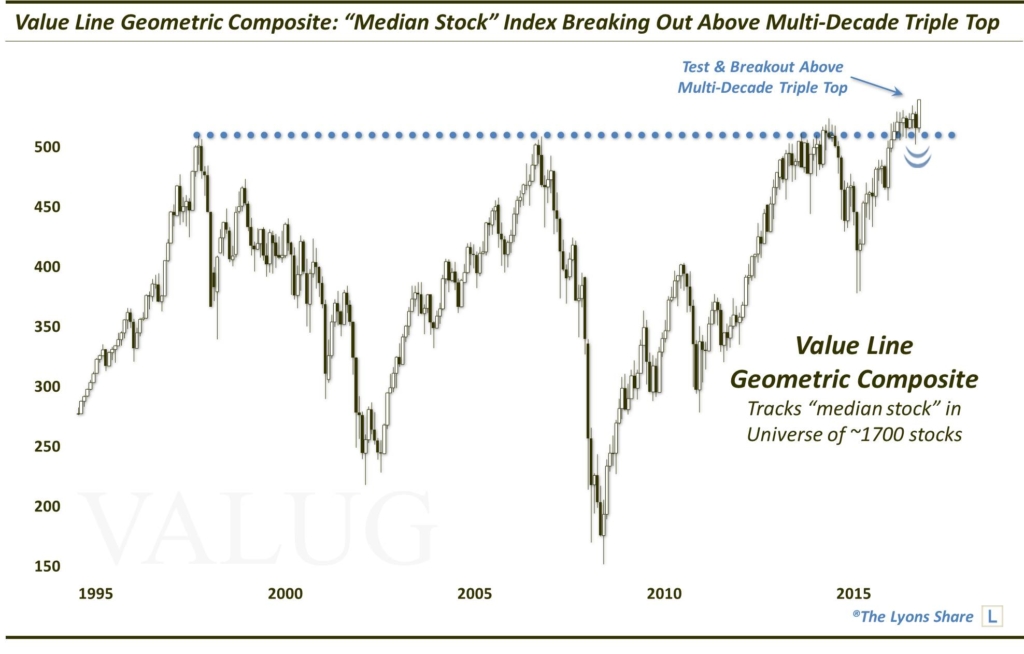

One example of this broad market breakout — and possibly the most important — is evidenced by the demonstrative new high in the Value Line Geometric Composite (VALUG). Once again, the VALUG tracks the performance of the median stock within a universe of approximately 1700 stocks. Thus, it is an extensive measure of the broad equity market and, in fact, is our favorite barometer of the health of the overall U.S. market.

As such, Wednesday’s decisive breakout by the VALUG is a potentially important bullish development. It means that not only are the top-heavy, cap-weighted stock indices at new highs, but the median stock in the market, i.e., the “market of stocks”, is breaking into new high territory. Making it even more potentially important, though, is the fact that the VALUG is not only breaking above its former 12-month highs, it is essentially breaking above its former triple top highs going back several decades.

Actually, as the chart shows, the VALUG has been attempting to break out above the post-1998 triple top throughout the first part of 2017. Each time it tried to generate any sustainable lift to the upside, however, it dropped back down to the bottom of the range. The latest pullback in mid-August looked at the time like a confirmed false breakout and an open door to a new leg down as a result.

As mentioned, however, that false breakdown has now served as a more substantial test of the multi-decade triple top breakout level and a springboard to this recent demonstrative breakout. Given that test and subsequent new high, this breakout looks more convincing — from a pure price perspective — than former multi-decade breakout attempts.

That said, as we discussed in another premium post on The Lyons Share this week, the breakout does not guarantee significant follow through to the upside (see July’s episode for example). Furthermore, there is no shortage of troubling, longer-term conditions that should negatively impact the stock market, eventually.

However, for the time being at least, the breakout above multiple multi-decade highs by the theoretical majority of stocks is about as broad-based a positive sign as bulls could hope for.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. Considering what we believe will be a very difficult investment climate for awhile, there has never been a better time to reap the benefits of our risk-managed approach. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.