Was That THE Top?

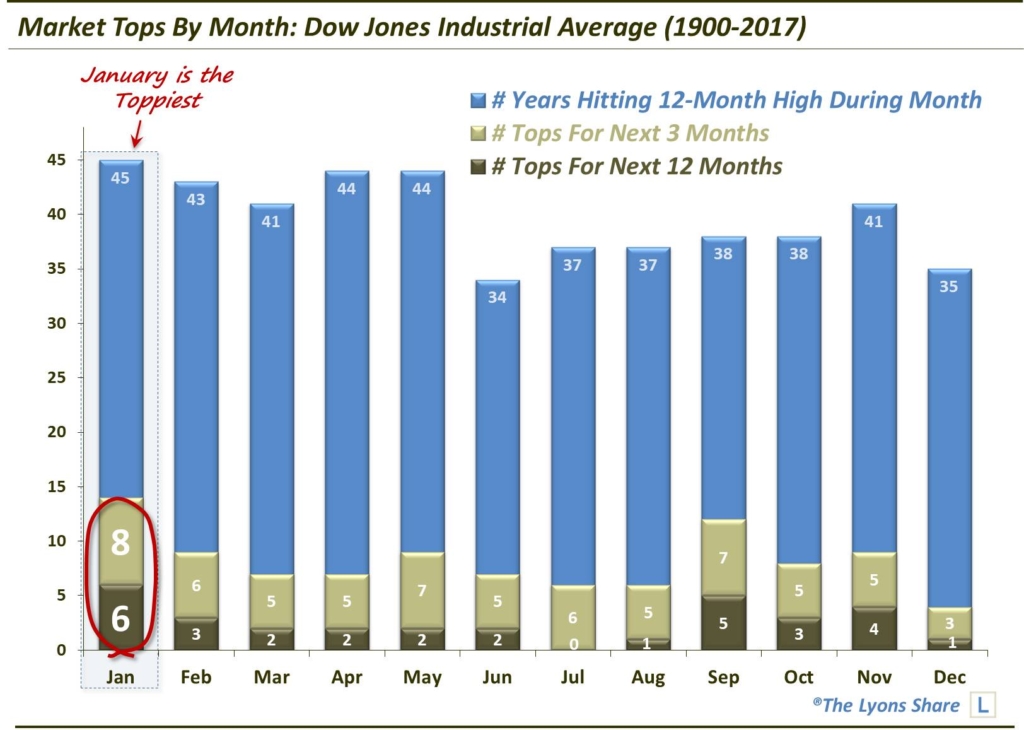

January has produced more stock market tops, short and long-term, than any other month.

The free fall in stocks over the past week clearly indicates that the late January stock market top was an important inflection point. But in what context and over what duration? Obviously those answers, at this point, require a crystal ball. From one historical angle, however, it would not be unprecedented for the recent high to signify a short or long-term top.

From a seasonality perspective, it has been more common for some months to mark significant stock market tops. Whether that is completely random or not, we don’t know — obviously there have to be winners and losers among the months. Looking historically, though, we do know which months have marked a higher incidence of stock market tops. And at the top of the list for both 3-month tops and 12-month tops is January.

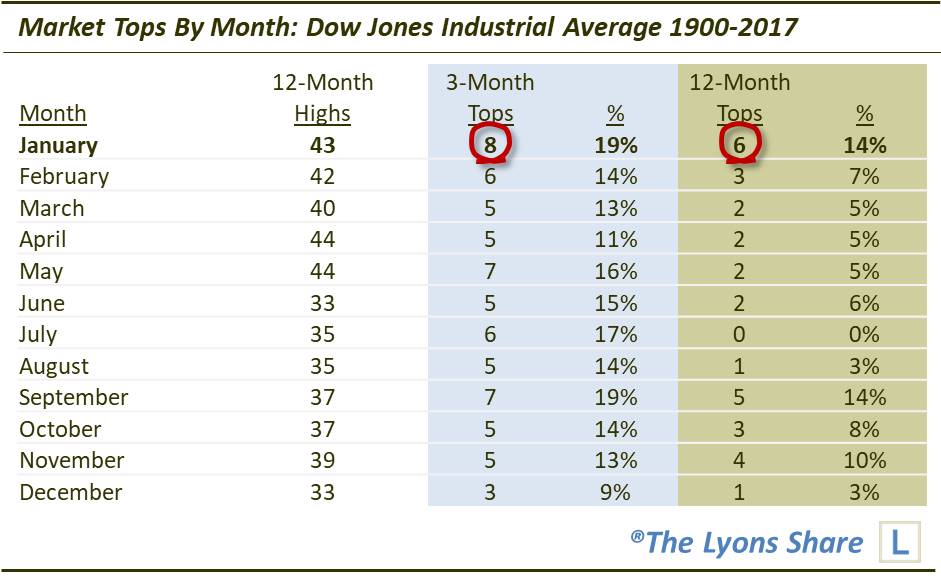

Here’s the table version:

Again, we don’t know if last month’s peak will end up being the high for the next 3 or even 12 months. And we are not making that call. Certainly the fact the the DJIA is 2000 points below the January high means it has serious work to do to retake that high. And this may all be random noise. However, considering various elements here, such as the fact that January has seen 6 12-month tops in its history while July has experienced 0, suggests to us that this dispersion is not totally random.

We have technical and other reasons to expect that stocks have not yet reached their ultimate top for this cycle. However, on a historical, seasonal basis, a top in January would fit as well as any month. That makes the possibility that last week signified THE top more plausible.

If you are interested in the Premium version of our charts and research, check out “all-access” service, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

1 Comment