A Presidential Bump (In The Road) For Stocks?

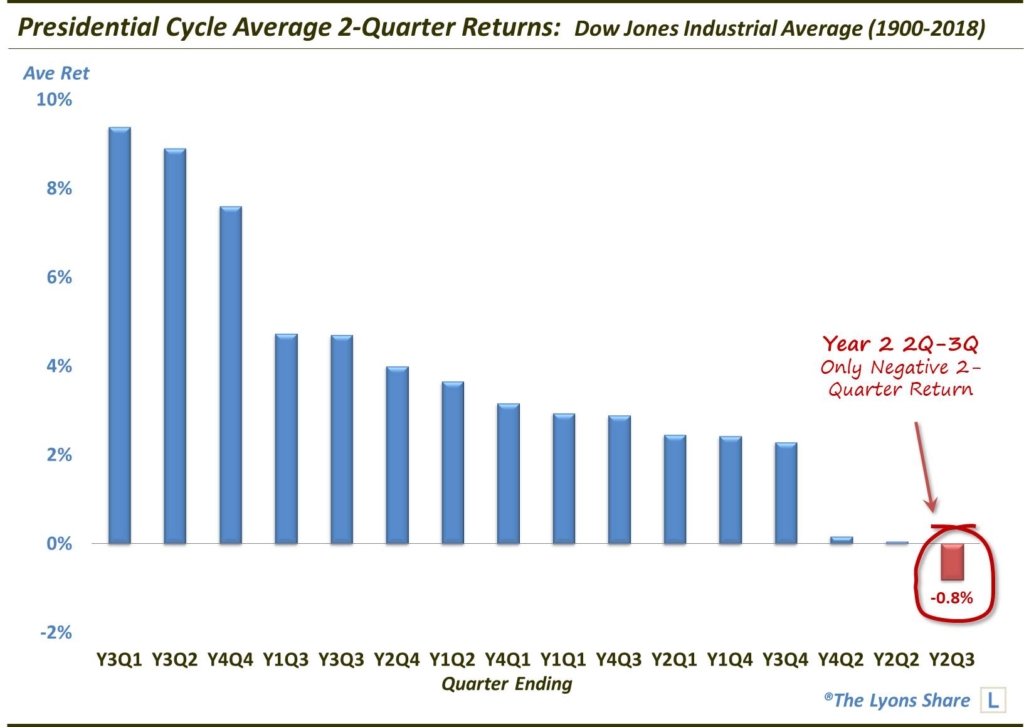

Historically, the next 2 quarters represent the worst 2-quarter stretch for stocks in the entire Presidential Cycle.

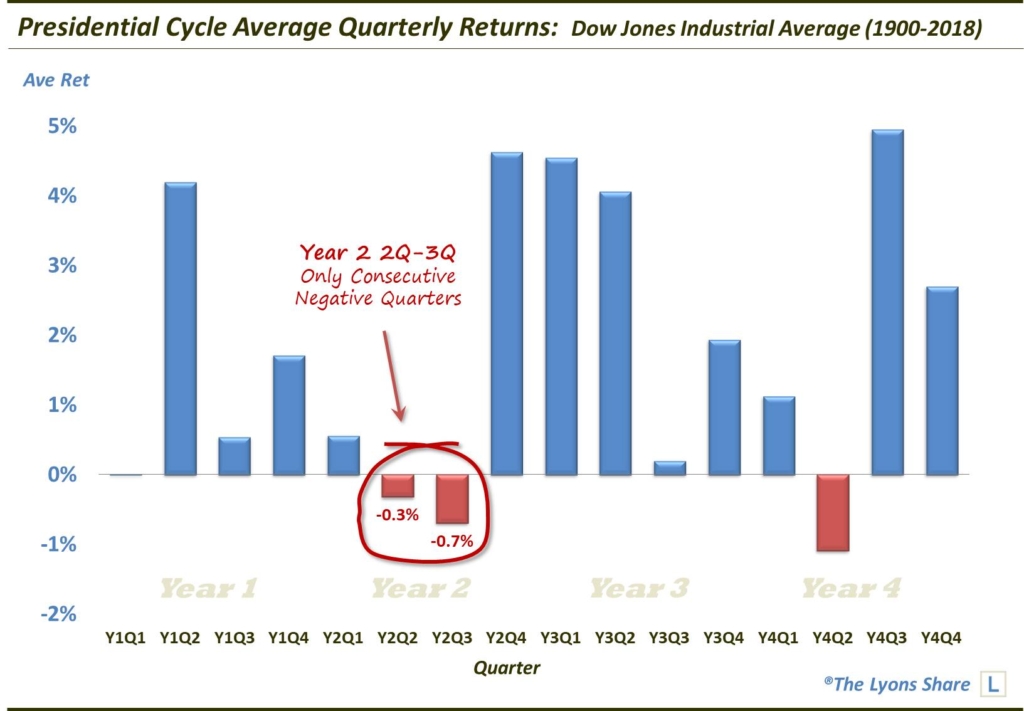

The Presidential Cycle refers to the pattern of behavior in stock prices throughout the four years of a presidential term. While there are many factors influencing stock prices during a particular period of a particular presidential term, it has been one of the more historically consistent seasonal patterns. Specifically, stocks tend to be strong during certain periods of a president’s term and weaker during others. And, historically, the worst 2-quarter stretch of the presidential cycle is the period spanning the 2nd and 3rd quarters of the second year of a president’s term. The stretch began this week.

Furthermore, in aggregate, the 2-quarter stretch ending with the 3rd quarter of year 2 of the presidential cycle is the only 2-quarter stretch with a negative average return in the entire cycle.

Of course, seasonality is only one factor affecting stock prices. Therefore, this negative historical tendency should only be treated as a gentle headwind. However, after a lengthy stretch in which bulls seemed to have just about everything going their way, more and more of these potential headwinds seem to be popping up of late.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.