A Short Opportunity In Development? (PREMIUM-UNLOCKED)

The following post was originally issued to TLS Premium Members on June 14.

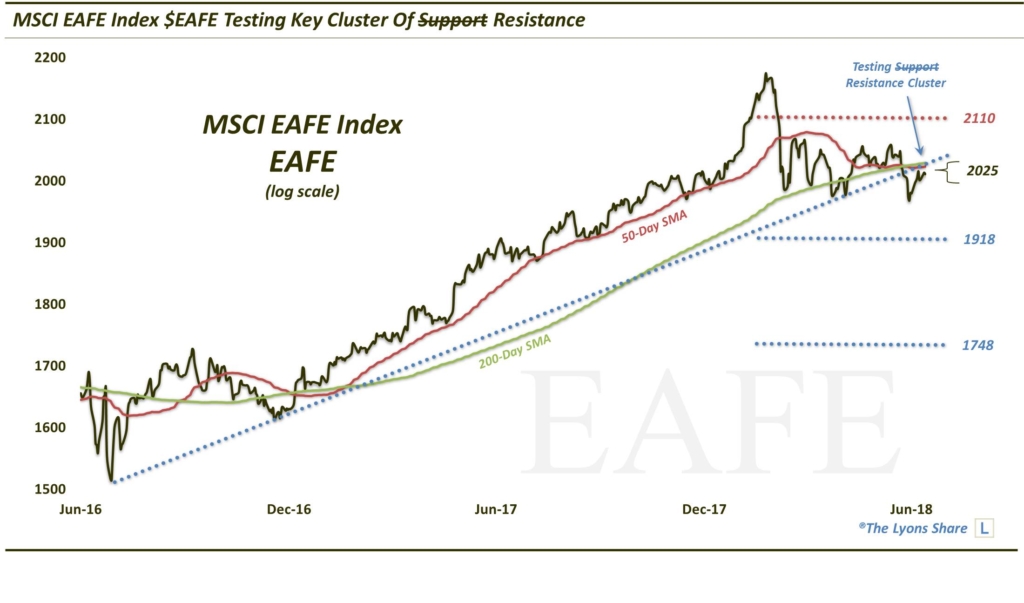

A key global equity index is testing a broken confluence of former support.

About 3 weeks ago, noted a potentially key level on the chart of the MSCI EAFE Index (EAFE), an index representing developed countries in Europe, Australasia and the Far East. At the time, the EAFE was testing a potentially important cluster of bull market support near the 2025 level. Specifically, the EAFE was testing the Up trendline stemming from its Brexit lows and connecting the post-U.S. election lows and the lows from this past March-April. Additionally, the level also represented a convergence of both the 50 and 200-Day Simple Moving Averages. As we stated in the post, “if the EAFE wants to maintain the direction and pace of its current advance, it would behoove the index to hold this key cluster of support.”

It did not hold. And within 3 days of the support break, the EAFE was testing its March-April lows near 1980. Since then, the EAFE has bounced, in dead-cat fashion or otherwise. At this time, the index is back testing that 2025 cluster level, from below.

So, will former “support” turn into resistance, as the technical analysis textbooks suggest? We are betting that it will and, thus, view this level as an attractive potential shorting opportunity from a risk/reward standpoint. Potential ways to take advantage of this opportunity would be to either outright short the iShares MSCI EAFE ETF (EFA), or buy the ProShares Short MSCI EAFE ETF (EFZ).

As mentioned in the previous post, a hold below this resistance could well usher in a drop down to the ~1918 level, which represents the next significant cluster of bull market Fibonacci Retracement support. On the other hand, a decisive move above the 2030 level would negate the short setup and at least stave off disaster in the EAFE, for now.

As we’ve built up a moderate long allocation in our portfolio (and are looking to add to it into weakness), it is nice to identify potential short opportunities that can work as a hedge in case we are wrong. Or, in some cases, the short may work out in the near-term, even if the bull market continues, in the intermediate-term. That would be our hope and expectation for this well-developed short idea.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.