U.S. Households Loaded Up On Stocks

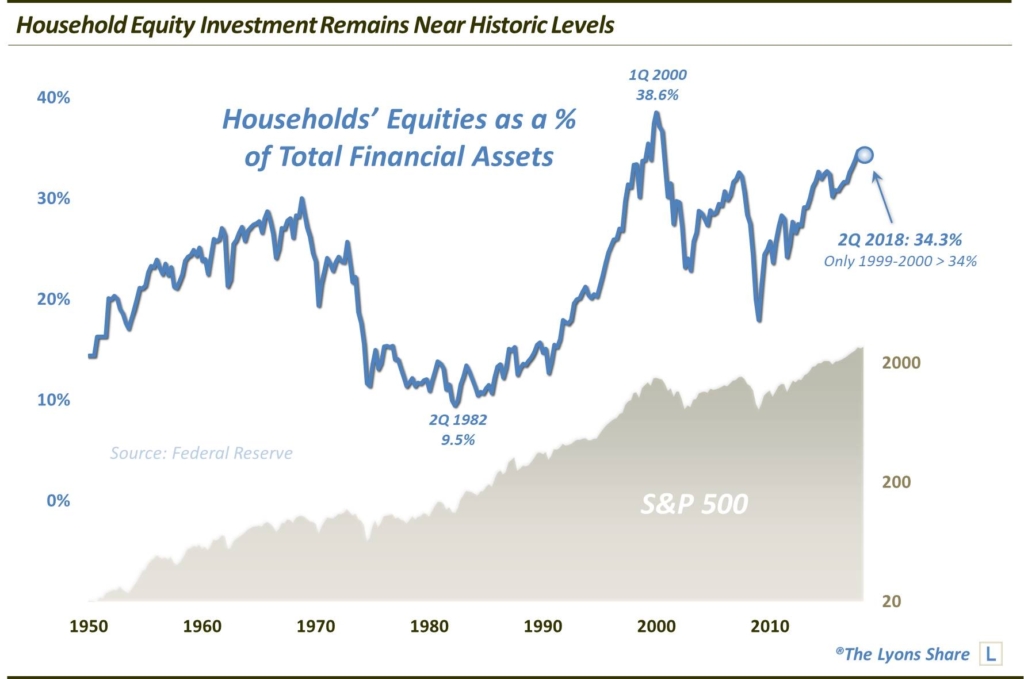

Outside of the 2000 dotcom bubble, U.S. households have never had more of their assets invested in the stock market.

The U.S. stock market, i.e., the S&P 500, soared back to new all-time highs again today — always a welcomed development for investors. And it is especially welcomed now considering the fact that investors are loaded up with stocks at the moment. That information comes courtesy of one of our favorite investment related statistics.

From the Federal Reserve’s Z.1 release, we find that U.S. Households had a reported 34.3% of their financial assets invested in the equity market as of the 2nd quarter. Outside of a slightly higher reading in the 4th quarter of 2017, that is the highest level of stock investment in the 70-plus year history of the series, other than the 1999-2000 bubble top.

What is the upshot of this series — and its current reading? As we have discussed many times, this statistic is not necessarily an effective timing tool. It is what we call a “background” indicator in that it provides an instructive representation of the longer-term potential — and risk — of the stock market.

One thing we know about the investing public (and most investor groups for that matter) is that they are notoriously poor at timing markets. For example, they generally adopt their largest allocations at market tops. Thus, based on the current, historic level of household investment, we would determine the stock market to be carrying substantial risk — in the longer-term.

Again, this is not a great timing tool. It can, and has, remained elevated for years on end prior to any household investor comeuppance. However, just as households learned the hard way in 2000 (and 2015 and 2007 and 1972 and 1968 and 1966), don’t expect them to walk away from these extreme equity investment levels unscathed.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.