New Support To Bank On? (PREMIUM-UNLOCKED)

We are unlocking this member post in real time as an example of the type of charts posts we share in identifying potential entry/exit points in specific markets and tickers.

Bank stocks are testing a potential key support level.

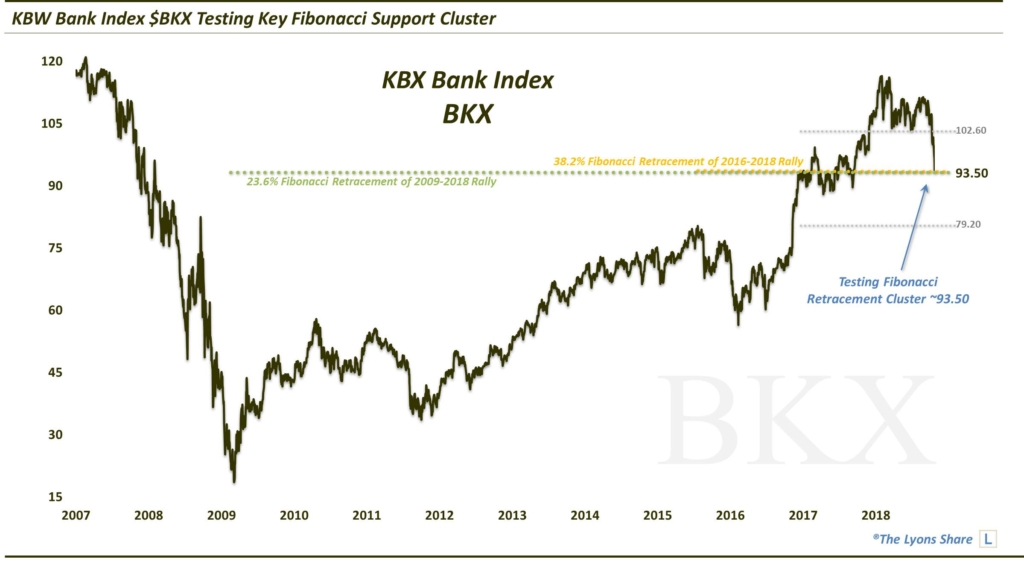

Back in late October — the last time the market was melting down — we issued a post to TLS members identifying a level in a key sector that may just be compelling enough to stop the bleeding in the market. Titled “Finally Some Support To Bank On?“, it targeted a potential support level in, you guessed it, the bank sector. Specifically, it was focused on the KBW Bank Index (BKX) and the potential support near the 93.50 level in the form of:

- The 23.6% Fibonacci Retracement of the 2009-2018 Rally

- The 38.2% Fibonacci Retracement of the 2016-2018 Rally

Here is the chart from the October 25 post:

The index would indeed find support at that level, holding the low of 93.65 set on October 24 — at least temporarily. We closed out the post by providing our likely key resistance above and next support below that 93.50 level.

For reference, the upside support level had been 102.60 and, if 93.50 is broken, the next major level to watch is 79.20.

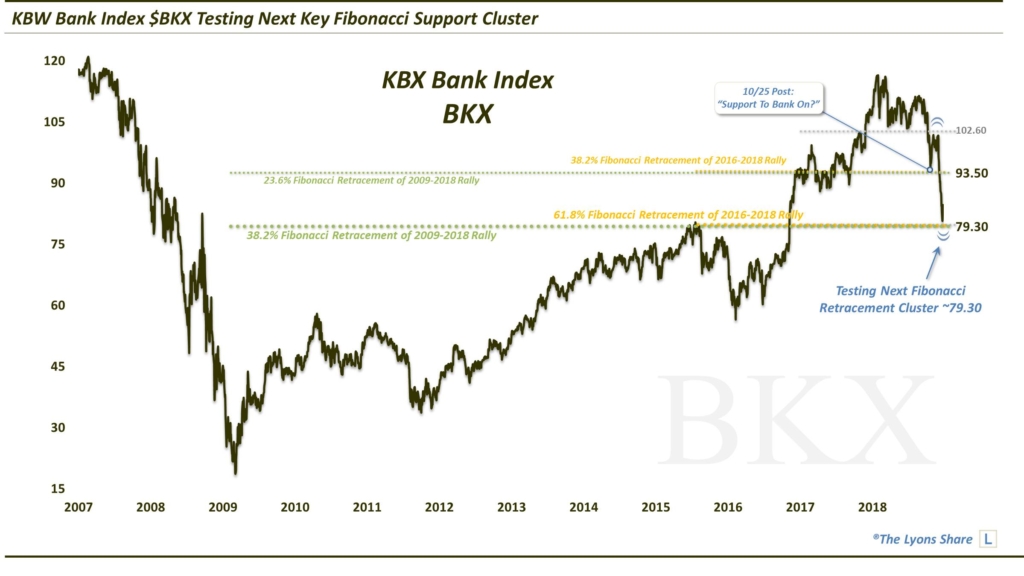

A multi-week bounce in the BKX would initially hit near the resistance target at 102.59 on November 9 before making an ultimate intraday peak at 103.14 on December 3. Then the next meltdown would ensue. In a matter of days, the 93.50 level would be broken and the onslaught toward 79.20-79.40 would be on.

Yesterday, the BKX would nearly complete the 15% decline from 93.50 to 79.20. The index hit as low as 79.85 yesterday before bouncing some 6% in an intraday rally for the ages.

As the chart shows, the next Retracement levels in the Fibonacci sequence line up near 79.30, including:

- The 38.2% Fibonacci Retracement of the 2009-2018 Rally

- The 61.8% Fibonacci Retracement of the 2016-2018 Rally

So is this 79.30-ish level new support that investors can bank on? Well, in this market, it is difficult to bank on anything. However, like the upper level at 93.50, we would expect at least a temporary hold by the BKX in the vicinity of that level — not precluding further testing of the level, FYI. And given the sector’s importance, maybe it will contribute to a boost in the overall market.

As for new upside and downside “targets”, the best levels of resistance above are now ~88.50 then ~93.50 — and support below ~68 and ~56.

If you are interested in an “all-access” pass to our research and investment moves, we invite you to further check out The Lyons Share. FYI, we are currently holding our HOLIDAY SALE, offering big savings for new members. So considering the discounted cost and the current treacherous market climate, there has never been a better time to reap the benefits of our risk-managed approach. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.