Great (Investment) Expectations

Are optimistic expectations setting investors up for disappointment…again?

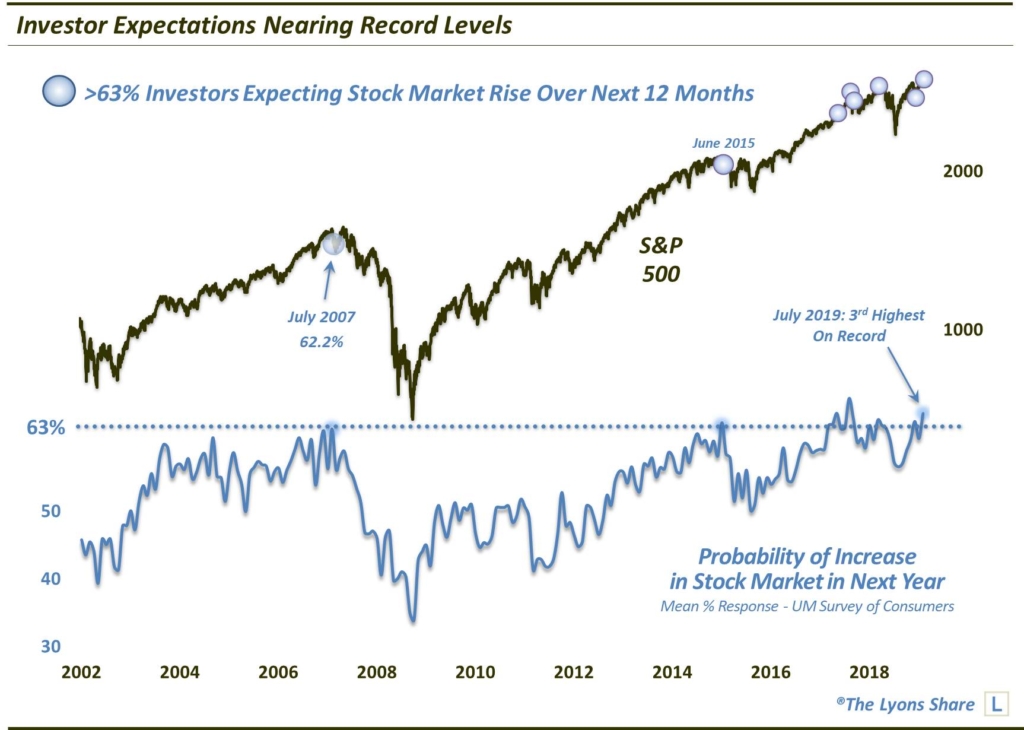

Markets like to “climb a wall of worry” as they say. Of course, the rationale is that an abundance of worry on the part of market participants suggests that there is ample money “on the sidelines” available to enter the market and perpetuate a rally. Once investors’ expectations get too high, however, it may be a sign that most of the potential investable dollars are already in the market and, thus, there is little fuel remaining to boost stock prices. We may be near that point now, according to one sentiment survey.

In the monthly University of Michigan Survey of Consumers, one of the questions asked of respondents is their estimation of the “probability of an increase in the stock market in the next year”. The mean response to the question reached record levels (or close to it) in early and mid-2018 — just before sharp pullbacks in the market. Following the 4th quarter swoon, respondents’ expectations dampened a bit during the first half of this year.

However, by July, expectations had soared back to a mean level of 64.4%. That was the 3rd highest mean response on record and just the 3rd reading ever above 64%.

Looking historically at the survey, we see that in addition to elevated readings prior to corrections in early and late 2018, high readings were also observed in July 2007 and June 2015. Obviously, those immediately preceded a cyclical top and a major intermediate-term correction, respectively.

Will the current reading result in investors’ great expectations being dashed again? TIme will tell, but the sharp pullback of the past few weeks may be the start of some painful deja vu.

If you’re interested in the “all-access” version of our charts and research, check out The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Considering the potentially treacherous market climate, there has never been a better time to reap the benefits of our risk-managed approach. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.