High Low Friday – 3/13/2020

Here are some of the most noteworthy highs and lows from across the markets for Friday, March 13, 2020.

These are but a few of the highs and lows resulting from another historic week in the markets.

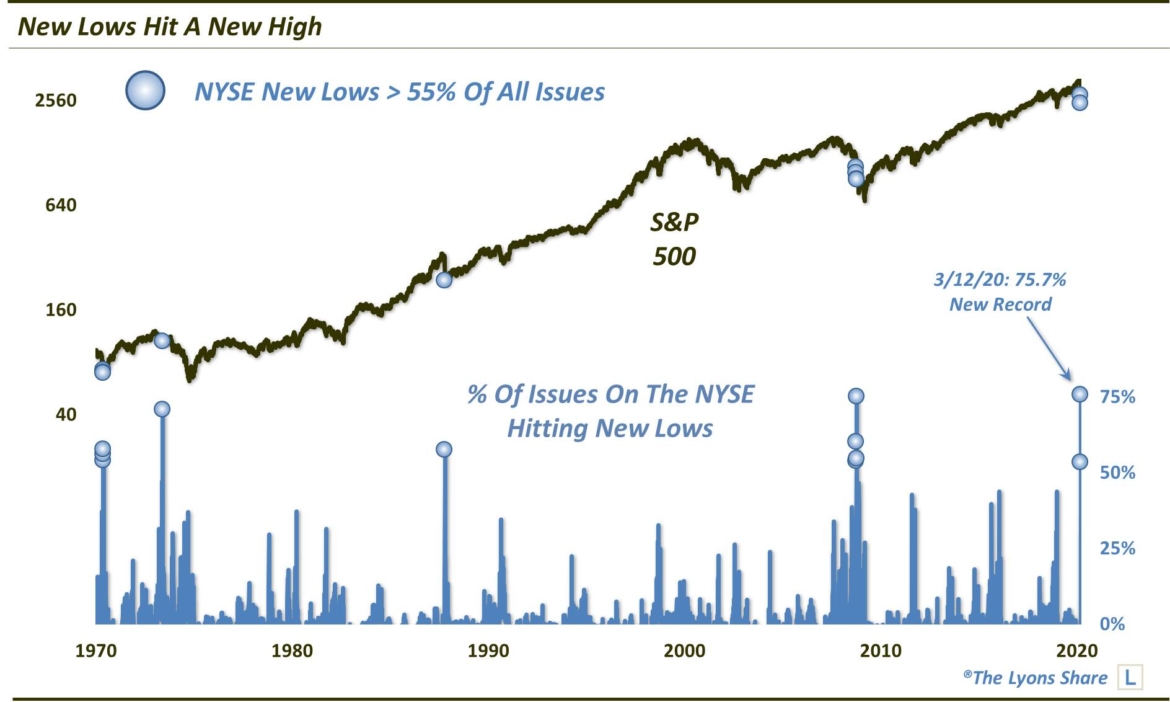

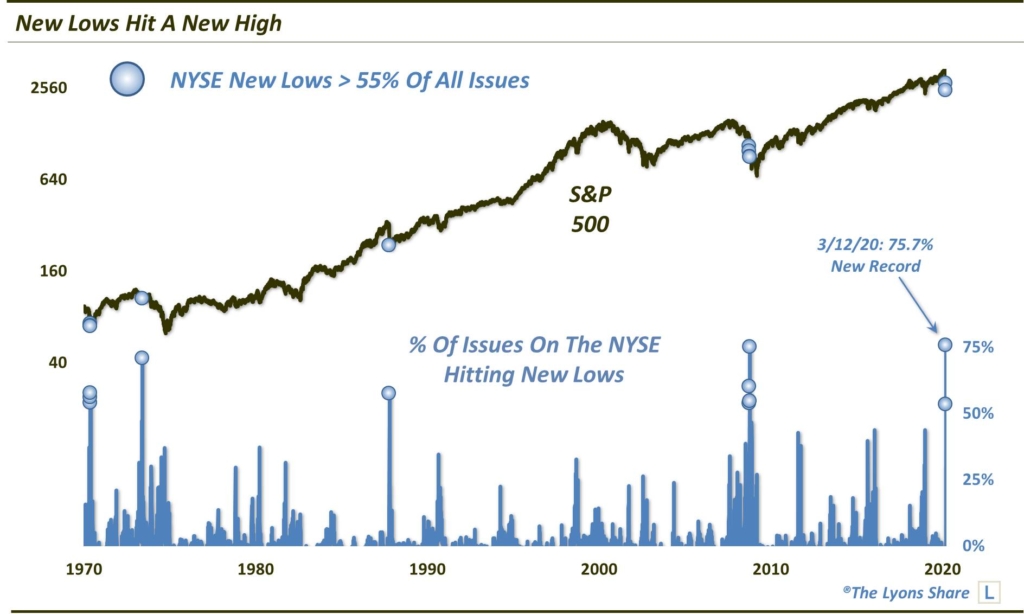

NYSE New Lows Hit A New High

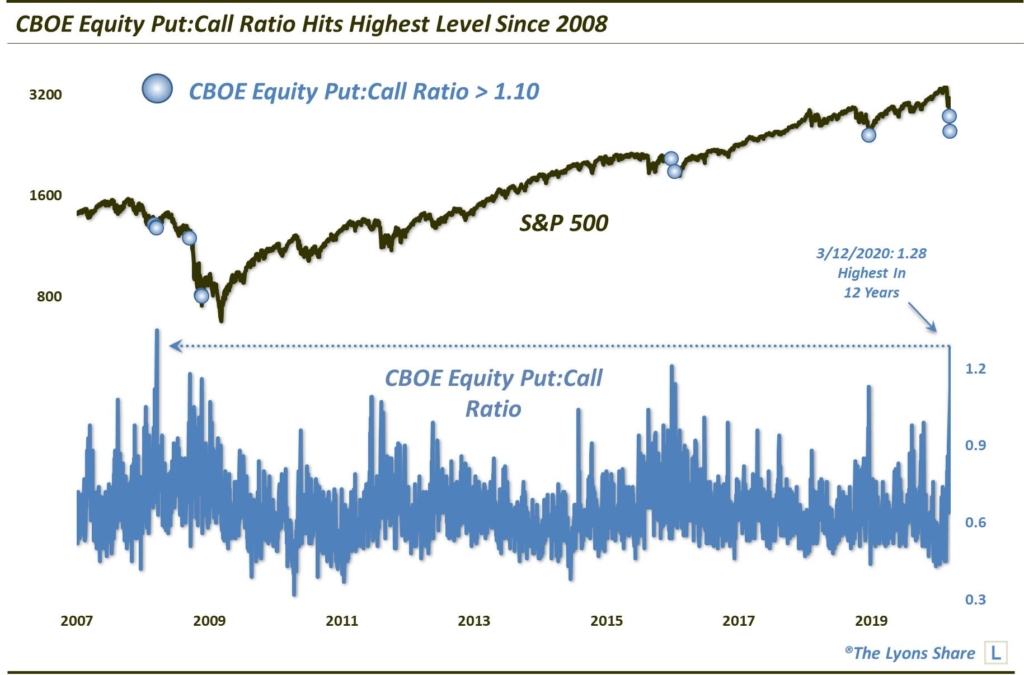

CBOE Equity Put:Call Ratio Hits Highest Level Since 2008

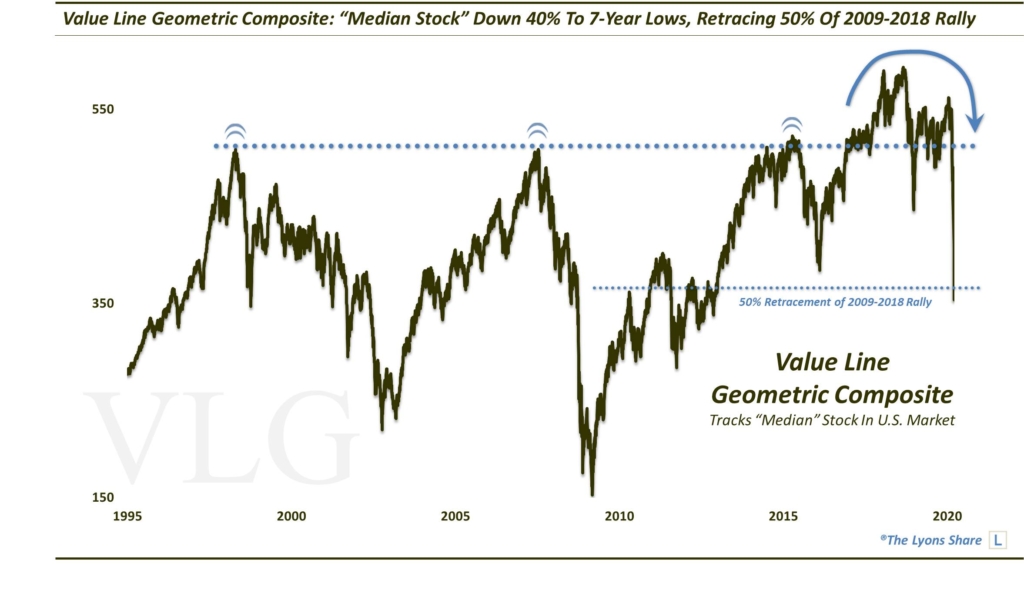

After Multi-Decade False Breakout, Value Line Geometric Composite, i.e., the “Median Stock,” Now Down 40% To 7-Year Lows, Retracing 50% Of 2009-2018 Rally $VLG $VALUG

Likewise, 3 Weeks After False Breakout To All-Time Highs, Europe’s $STOXX 600 Now At 7-Year Lows, Retracing 50% Of Post-2009 Rally

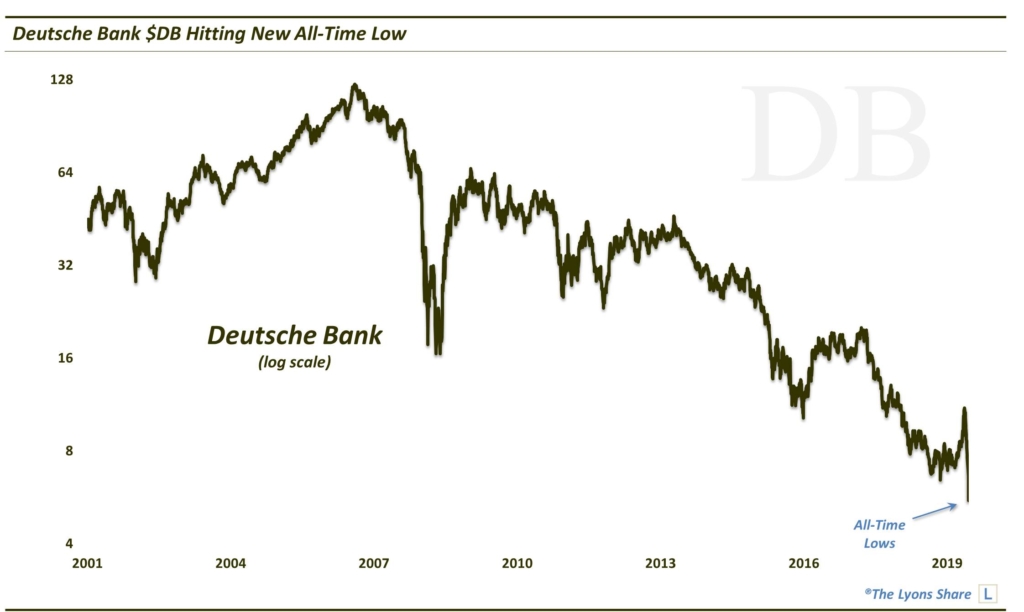

Deutsche Bank $DB Hitting New All-Time Low

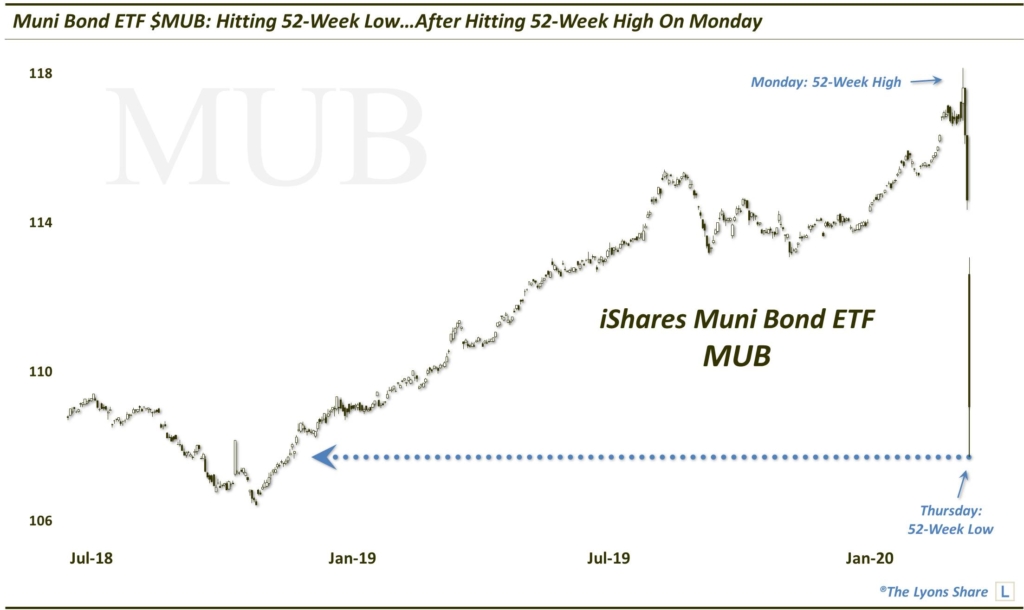

Muni Bond ETF $MUB Hit A 52-Week Low On Thursday…After Hitting 52-Week High On Monday (…same goes for $MBB $LQD $AGG)

Junior Gold Miners 3X Bull ETF $JNUG: 2 Weeks Ago, Printed Multi-Year Highs @ 105; Today, It’s At An All-Time Low @ 7.50

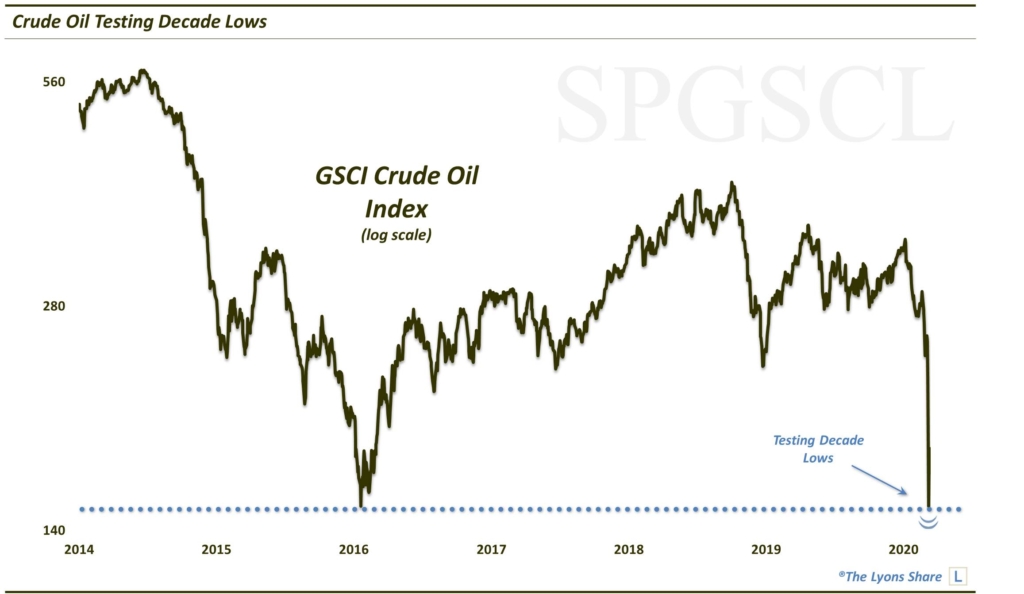

Crude Oil Testing Decade Lows $OIL

S&P 500 9-Day Volatility Index $VIX9D Topped 100, Highest Reading On Record

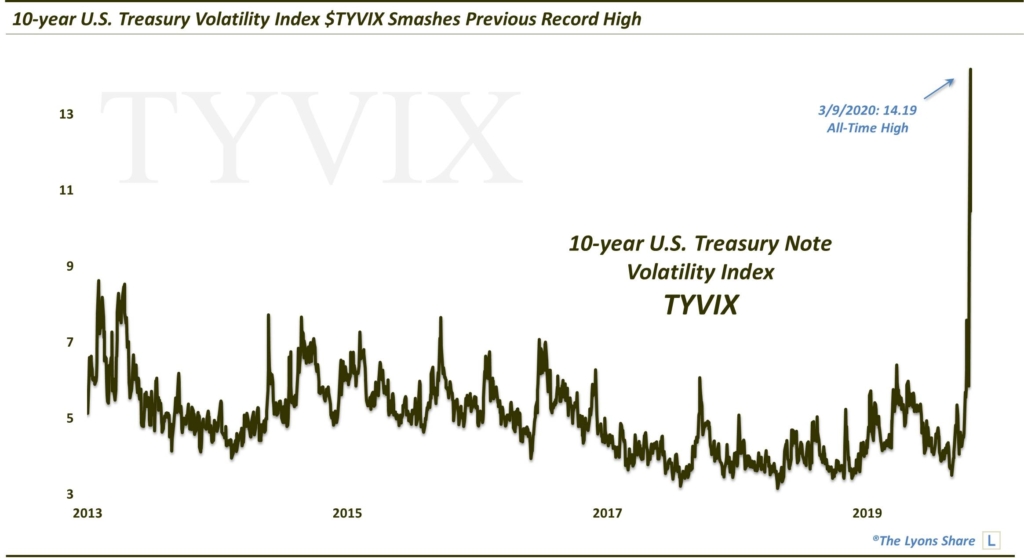

10-year U.S. Treasury Volatility Index $TYVIX Smashed Its Previous Record High

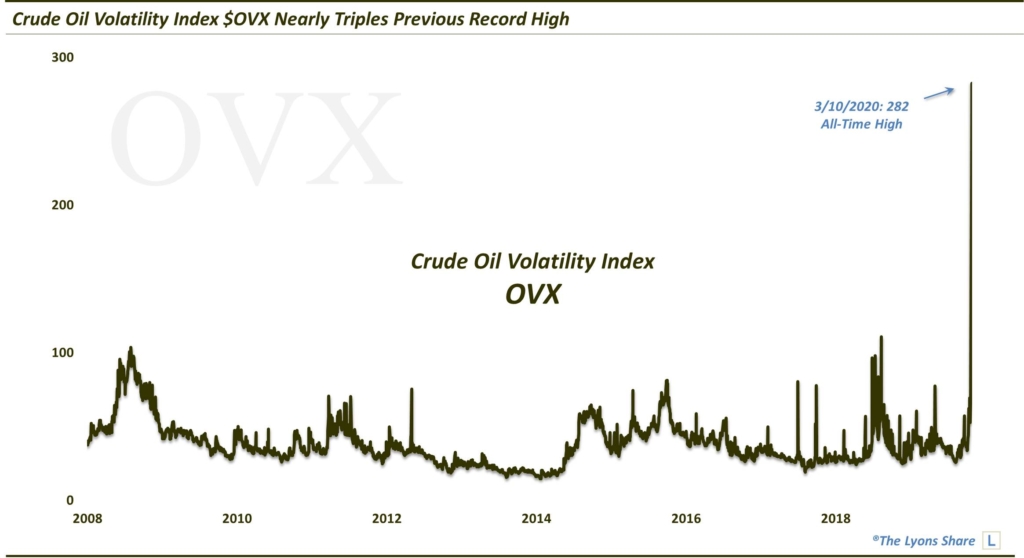

Crude Oil Volatility Index $OVX Nearly Tripled Its Previous Record High

As always, stay tuned to our DSS posts for further developments — they provide the most current updates to our investment portfolio and outlook.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.