Stocks Vs. Volatility – Round 1

Despite the melt-up in the Nasdaq, volatility expectations remain elevated.

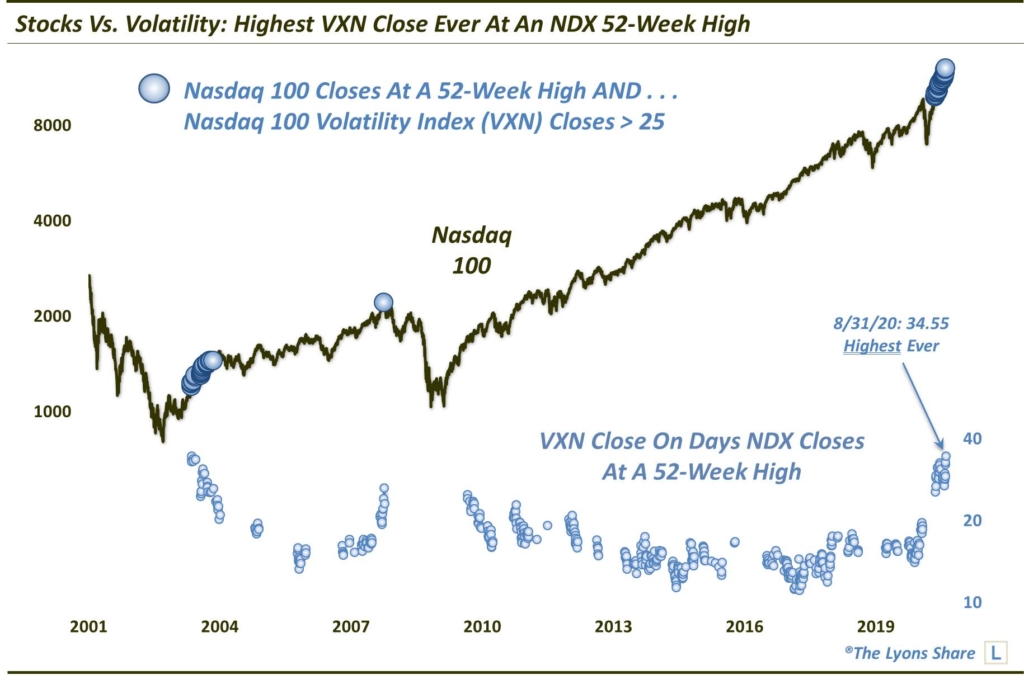

As most investors are aware, the technology-laden Nasdaq segment of the stock market is in the throes of a genuine melt-up following the full recovery of its COVID crash loss. Indeed, the Nasdaq 100 (NDX) has seemingly been registering new all-time highs every day. Try telling that to the volatility market, though, which has remained elevated despite the strong rally in stocks. This is unusual behavior for a market that generally declines when stocks move higher. In fact, such behavior is now reaching historic levels of, er, unusualness.

For example, yesterday (8/31/2020), the NDX closed at another 52-week high. At the same time, the Nasdaq 100 Volatility Index (VXN) closed higher by more than 5%. That is unusual in its own right. Furthermore, however, the closing level on the VXN, 34.55, represented the highest close in the history of the VXN on days that the NDX closed at a 52-week high.

And, as the chart shows, prior to this recent run, there have been only 2 other unique historical instances when the VXN closed higher than 25 coincident with a 52-week high in the NDX. This first was a string of incidents from June 2003-January 2004, as the NDX emerged from the 2000-2002 cyclical bear market. The only other date was in October 2007, marking the peak of the subsequent cyclical bull market.

Is the current signal another warning of potential serious trouble? It remains to be seen. However, we will say that, based on our research, the standoff between stocks and volatility is not an ideal condition for stock investors in the longer-term.

How much “stock” are we putting into this data point? How is it impacting out investment posture? If you’re interested in an “all-access” pass to all of our charts, research — and investment moves — please check out our site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

2 Comments