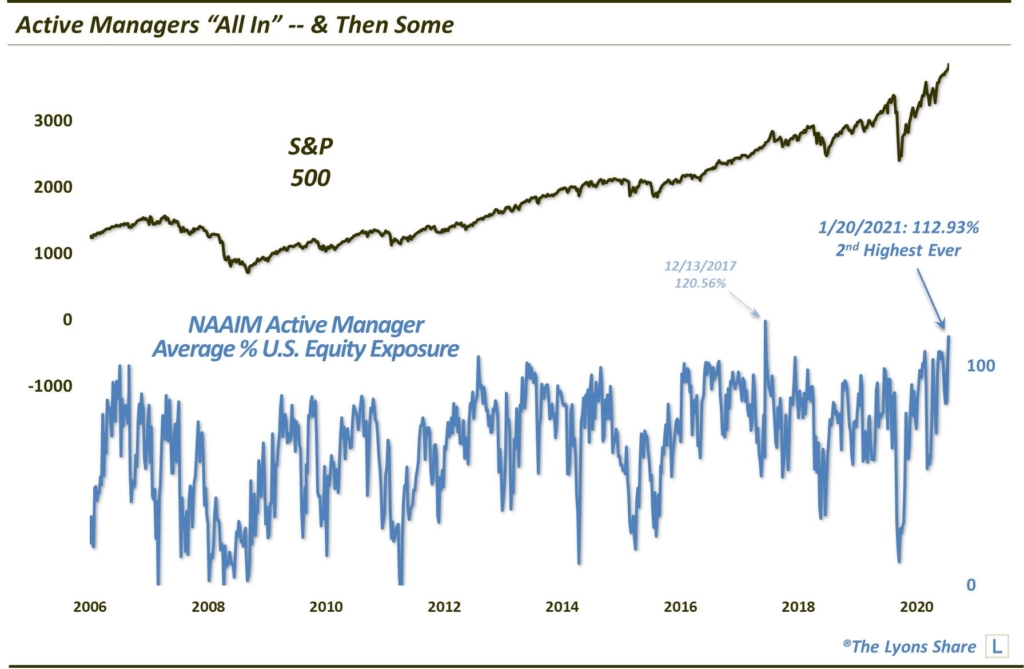

Active Managers “All In” — And Then Some

Stock exposure among active managers is nearly at all-time highs.

The latest numbers from the NAAIM Investment Exposure survey are out. As a refresher, NAAIM stands for the National Association of Active Investment Managers. These are folks who adjust their investment exposure based upon market risk and their level of bullishness or bearishness. Judging by the latest survey numbers, they are extremely bullish right now. That’s because the average NAAIM manager currently has roughly 113% exposure to U.S. stocks. In other words, the average manager is leveraged long.

If that sounds like a lot, it is. In fact, it is the second highest reading in the 15-year history of the survey, trailing only the week of 12/13/2017. For what it’s worth, the market continue to rally for another 6 weeks following that reading before a sharp, 10-day, 12% drop.

A couple other interesting notes from this week survey include:

• The most bearish manager in the survey is still 75% long. Only 2 weeks in the survey’s history showed a higher number: 9/27/2017 and 10/4/2017.

• Even the manager at the 25% quartile is presently 100% long. In other words, at least 75% of the survey respondents are fully invested. That has never occurred before in the history of the survey.

Conventional wisdom, of which we generally agree, suggests that when investor sentiment hits bullish extremes, it is bearish for the market. Presumably, that is because there is nobody left to buy. When it comes to the NAAIM survey, however, that is not always the case — or at least not immediately the case. As we have discussed often, including last August, extreme bullish readings in the NAAIM survey have more often than not been followed by positive returns in the stock market over the intermediate term. Yes, the immediate aftermath can at times be rocky. And in combination with other currently extreme — and, generally, more contrarian —sentiment indicators, the current reading is a bit alarming.

However, we will once again caution against using high readings in the NAAIM survey to justify an overly bearish longer-term posture in the stock market.

If you’re interested in the “all-access” version of our charts and research, we invite you to check out our new site, The Lyons Share. Considering we have called this the “best trading environment ever”, there has never been a better time to reap the benefits of our risk-managed approach. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.