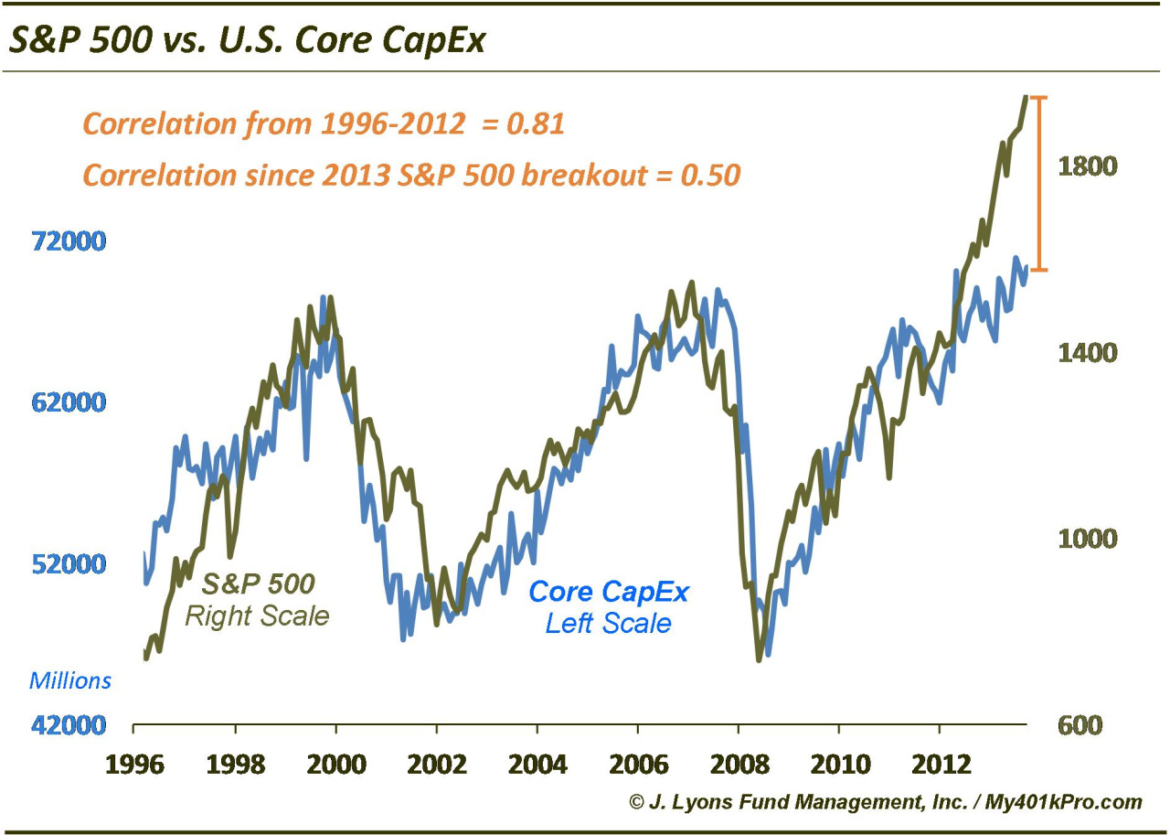

Stocks Leaving CapEx In The Dust

The Commerce Department released its monthly look at business spending today and, surprise, Core Capex is still about where it was 15 months ago (that is “Manufacturers’ New Orders: Nondefense Capital Goods Excluding Aircraft” for you wonks). And yet, stocks continue to make new highs. Whatever the reason, after tracking very closely very 17 years, the divergence between Core CapEx and stocks continues to widen since the stock market broke out last May. Is the continued stagnation in CapEx a sign of economic concern on the part of corporations? Or are corporate stock buybacks simply the expenditure of choice in the pursuit of reaching EPS expectations? To repeat the questions we posed a few months ago:

- To what extent have stock buybacks cut into CapEx?

- What happens to balance sheets in a real stock correction given the level of buybacks?

- With profits and margins at peaks (maybe), what happens when companies are forced to spend again on CapEx?

- If 2 and 3 occur, what sort of EPS theatrics will companies resort to in order to meet estimates?