ChOTD-5/30/14 Core CapEx Vs. Stock Buybacks

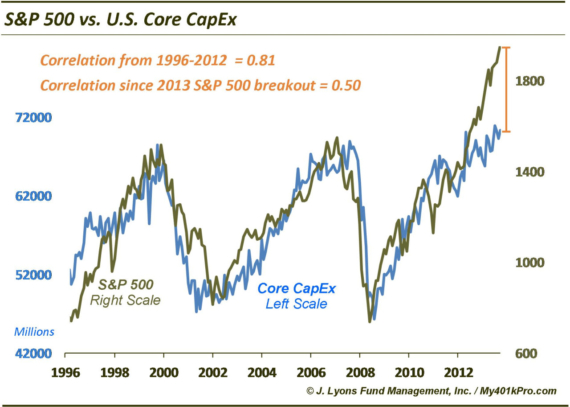

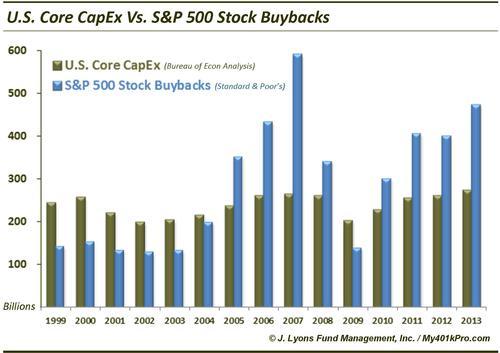

As we revealed in related charts over the past few days, CapEx has been relatively stagnant over the last decade+. Meanwhile, stock buybacks have soared during that time. Call us cynical, but with companies allocating an increasing amount of dollars to buying back stock as opposed to improving their operations, it appears that their focus is on their stock not their company. If this is the case, we’ll leave readers with a few questions to ponder regarding this trend:

1) To what extent is the rise in profits (& margins) due to benign CapEx behavior?

2) How will share prices react when companies are forced to catch up on CapEx and cut back on buybacks?

2) What happens to balance sheets in a real stock correction given the buybacks?

3) What sort of EPS theatrics will companies resort to in order to meet estimates?