Active Managers Move All In On Stocks

For one of the few times in its history, a survey of active investment managers is showing an average of 100% exposure to stocks; is sentiment getting too frothy?

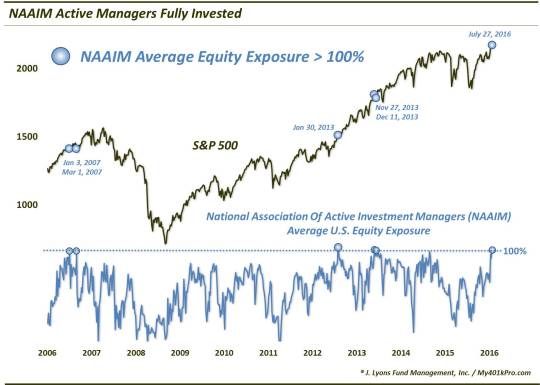

One of characteristics of the post-February rally that has contributed to its sustainability thus far has been the favorable investment sentiment – specifically, the healthy level of skepticism or disbelief. The relatively slow adoption of the rally has worked to insure a steady stream of new buyers into the market as the move progressed. As the major averages approached their previous highs, we surmised that it might take breakouts to new highs for sentiment to finally reach enthusiastic levels. As such breakouts did indeed transpire throughout the month of July, that rising sentiment scenario has begun to unfold. One example can be seen in the investment survey of the National Association of Active Investment Managers, or NAAIM.

NAAIM is made up of Registered Investment Advisors and other money managers who employ more tactical investment strategies than those represented by buy-&-hold and passive asset allocation approaches. For the most part, the goal of such strategies is to reduce investment risk by applying processes to mitigate losses. Full disclosure: our firm, J. Lyons Fund Management, Inc. has been a member of NAAIM and a participating member of the NAAIM Exposure Index for many years. In fact, JLFMI’s president, John S. Lyons, was among the group’s charter members some 25 years ago. As such, we are quite partial to the group and its philosophy (see the note at the end).

That said, regardless of the investment acumen of any group (we think it is very high among NAAIM members), once the collective investment opinion or posture becomes too one-sided, it can be an indication that some market action may be necessary to correct such consensus. As we mentioned, that may indeed be the case with the NAAIM Exposure Index, as last week’s survey indicated an average of over 100% exposure to U.S. equities by its respondents. That is just the 6th reading over 100% in the survey’s 10-year history.

Now we said this may be an example of over-enthusiastic sentiment because it is far from a clear-cut signal. So before you go and sell all of your equities, let’s consider a few “not so fast’s” pertaining to this “over-exuberance”.

First of all, the 5 prior readings over 100% average equity exposure represent the highest 0.9% of readings in history. So the current reading is certainly noteworthy in its select company. However, a sample size of just 5 makes it difficult to come to any significant conclusions.

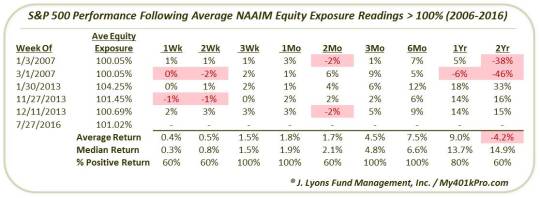

Secondly, the performance of the S&P 500 following the prior readings over 100% hardly provide damning evidence of over-exuberance. Here are the dates and subsequent performance of the index (a few of the dates were reasonably close together, but not adjacent so we considered them as separate events).

As you can see, while the first few weeks were a toss-up (a duration that short typically is), the S&P 500 was higher all 5 times after 3 weeks, 1 month, 3 months and 6 months. And while any correlation would be a bit of a reach anyway, not to mention causation, at a minimum, I think we can say that an Equity Exposure reading this high is not a death knell for a rally by any means.

If we relax the parameters a little bit to, say the top 7% of all readings, which would include all readings over 88% Equity Exposure, the S&P 500′s performance is still significantly positive. For example, after 1 month, the index was positive 74% of the time, after 3 months, 87% and after 6 months, 89%. So, again, excessive readings in the NAAIM Exposure Index are not nearly an automatic warning sign.

Certainly, there have been high readings that occurred near major tops, specifically in early 2007. Even then, however, stocks rallied further for the majority of the year before topping. On the flip side, we have the interesting reading in January of 2013 when the S&P 500 was just breaking out to multi-year highs. Of course, the index would continue to rise inexorably throughout the year, into all-time high ground.

One could arguably say that present circumstances favor both the 2007 and early 2013 events. On the one hand, we have the market some 7 years into a cyclical bull market and showing many signs of excessive conditions (ala 2007). On the other hand, we have the S&P 500 breaking out of a more than 12-month consolidation and into all-time high ground (ala January 2013). Does the present day favor either instance more closely? If we had to guess we would go with 2007. That said, again, the S&P 500 still put in several solid months of gains before its ultimate demise. Considering the recent breakout, that isn’t far fetched here.

So what is our takeaway? In our view, we would (subjectively) place it as a slight negative factor for stocks. While historical precedents do not necessarily bear it out statistically, we would rather see skeptical sentiment from most any group, rather than excessive readings. Even if the sentiment is improving (which is a positive for the stock market), we’d rather see more room above for it to go. However, it would not be unprecedented for this group of managers to continue to be correct in their heavy exposure, at least for a little while longer.

The NAAIM Organization

Speaking of being correct, we have nothing but high praise for the NAAIM organization. As mentioned, our firm (JLFMI) has been a member of the group since our President, John S. Lyons, helped form it over 25 years ago. And while there are countless managers and strategies involved among its members, they’re aim of providing solid investment returns while supplying an overlay of meaningful risk-management is at the core of our investment management beliefs.

So, while we are not trying to push investors toward any one strategy or firm (please perform all the necessary due diligence in any instance), if someone is looking for solid risk-management for their investment portfolio, they could do a lot worse than starting with the directory of managers at NAAIM. Likewise, if you are an advisor or manager who embraces the aforementioned investment philosophy, we would strongly encourage you exploring the benefits and resources available to members of NAAIM.

You can find out more here: http://www.naaim.org/.

_____________

More from Dana Lyons, JLFMI and My401kPro.

The commentary included in this blog is provided for informational purposes only. It does not constitute a recommendation to invest in any specific investment product or service. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.