Swiss Franc Ready To Rebound?

A popular Swiss Franc ETF is testing a key line of potential support.

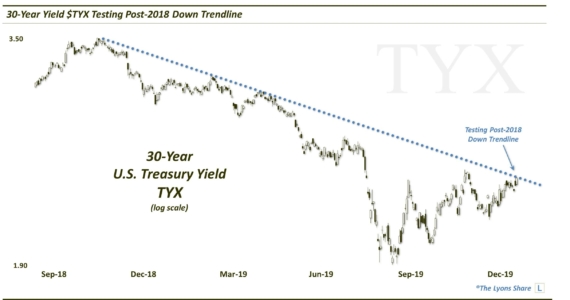

We mentioned this week in our regular #TrendlineWednesday feature on Twitter and StockTwits that many of the key trendline tests that we highlighted over the past few weeks have played out as a result of the recent bounce in stocks. Thus, we used this week’s feature to update some of the major longer-term trendline developments still unfolding in some of the other key asset classes, like gold, the dollar and interest rates. One other asset that we thought about mentioning was the Swiss Franc. However, we held off because prices hadn’t quite reached the trendline in question — until now.

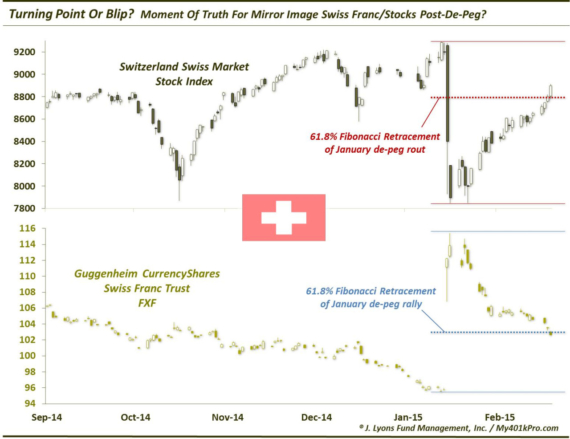

Specifically, it is an exchange-traded product — the PowerShares CurrencyShares Swiss Franc Trust (ticker, FXF) — that is in our spotlight. In January, the FXF broke out above the Down trendline stemming from the epic 2011 blowoff top and connecting the SNB-induced spasm high in early 2015 as well as the high from last fall. After spurting higher for about a month, the FXF has steadily pulled back, retracing the entire breakout move…and then some.

At the present time, the FXF is testing the top of that broken post-2011 Down trendline.

Will this former resistance line serve as support? That is the theory — and from our experience, it is a pretty reliable tendency. We also like the fact that it is approaching the 61.8% Fibonacci Retracement of the rally from the low in December 2016 to the recent peak in February. If it immediately fails and blows right through the trendline, it would certainly be a bad sign. However, especially given an equity market that may be on thin ice, or at least range bound, it may pay to look for opportunities elsewhere. And the long side of the Swiss Franc from these levels may represent a good risk/reward opportunity.

If you’re interested in the “all-access” version of our charts and research, please check out our new site, The Lyons Share. You can follow our investment process and posture every day — including insights into what we’re looking to buy and sell and when. Thanks for reading!

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.