Part 4: An Unprecedented Rally

European Space Agency image of Comet 67P as seen from the Rosetta spacecraft which recently made an unprecedented landing on the surface of the comet.

Comet Claus continues. While we did not intend to make this a 4-Part (at least) series, as long as the current rally keeps doing things we’ve never seen before, we’ll keep writing about it. And like landing a spacecraft on the surface of a comet for the first time, we don’t know quite what to expect from all of these unprecedented events. However, like riding a market trend, we’ll go along for the ride as long as it lasts.

What is today’s “unprecedented” achievement by this rally?

For the first time EVER (going back to 1950), the S&P 500 closed at a 52-week high just 4 days after closing a a 6-week low.

For reference, there have been 1205 days since 1950 on which the S&P 500 closed at a 6-week low. Never after the first 1204 occasions did the S&P 500 rally to a new 52-week high within 4 days. We have talked several times about the market’s proclivity to form swift “V-Bottom”-type recoveries of late (including Friday). The present V may as well stand for “Velocity” or “Vicious” or “Vapor Trail” as this rally sets a new historical standard for such bottoms.

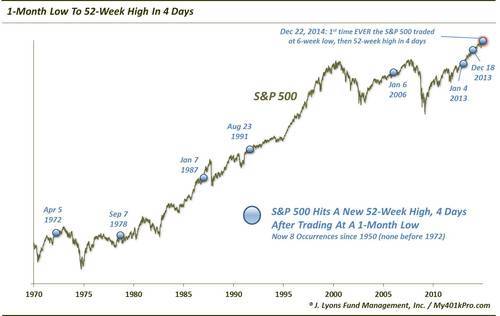

Expanding the net a bit, we find 7 previous occasions in which the S&P 500 hit a 1-month low before rallying to a new 52-week high within 4 days. Here is a chart of all of the instances (there were none before 1972 so the chart begins in 1970.):

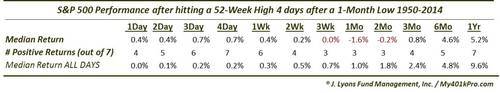

So can the previous instances give us guidance as to what to expect going forward? Given the limited number of precedents, as well as the variance in market cycles during which they occurred, probably not too much stock should be put into the historical performance following them, especially after the short-term. For what they are worth, however, here are the results following the prior occurrences:

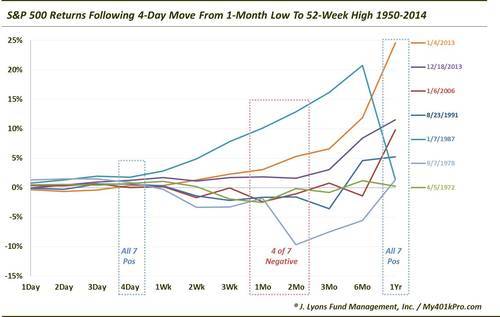

If the trends following are relevant at all, they would suggest very short-term continued strength (all 7 were higher 4 days later), followed by some giveback in the following 1-2 months (4 of the 7 were negative 1 and 2 months later, thus the negative median returns). However, by 1 year out (if at all meaningful), all 7 were positive. That said, the median 1-year return was barely half that of ALL days. That is because 3 of the gains were very small (<2%). Here is a trail of each of the 7 returns:

A few other notes about the current iteration of the “1-Month Low to 1-Year High” phenomenon:

Of the 8 times the S&P 500 went from a 1-Month Low to a 52-Week High in 4 days, the current rally is the second largest at +5.36% (1/7/1987 was the largest at +5.43%).

Of the 8 times the S&P 500 went from a 1-Month Low to a 52-Week High in 4 days, the current rally began the 2nd furthest from its 52-Week High at -4.13% (1/7/1987 was, again, the only one further at -4.19%).

Of the 6 times since the inception of the VIX in 1986 that the S&P 500 went from a 1-Month Low to a 52-Week High in 4 days, the current rally began with the highest VIX at 23.57.

Of the 6 times since the inception of the VIX in 1986 that the S&P 500 went from a 1-Month Low to a 52-Week High in 4 days, the current rally saw the 2nd biggest drop in the VIX at -35% (¼/2013 saw the only bigger drop at -39%).

Lastly, we’ll point out that now 5 of the 8 historical events discussed here occurred near the new year, i.e., either at the end of the year or at the very beginning of the year. So perhaps there is a seasonal aspect to this phenomenon. This is not surprising given the money flow trends that occur around the new year, for a multitude of reasons.

So what does this mean for the market going forward? We will reiterate that, due to the limited precedents among the events that we’re witnessing, we don’t know what to expect, except for perhaps more of the unexpected. For now, there doesn’t seem to be any reason to abandon Santa’s sleigh just yet…lest one get left in his vapor trail.

An Unprecedented Rally – Part 1: 90% UP Day From Above The 200-Day Moving Average

An Unprecedented Rally – Part 2: 2 Consecutive +2% Days In The S&P 500

An Unprecedented Rally – Part 3: 3-Day Rallies of 5% Near 52-Week Highs

________

More from Dana Lyons, JLFMI and My401kPro.