Another Odd Large Cap-Small Cap Divergence

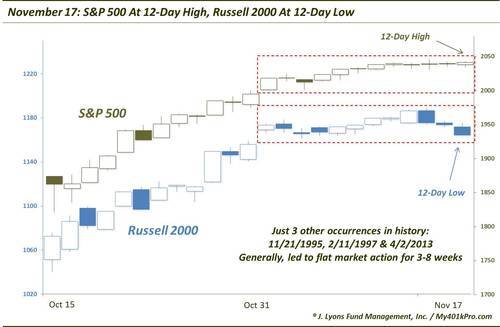

Another day, another piece of evidence of this strange, divergence-littered market environment. The subject of today’s Chart Of The Day is once again the small cap vs. large cap dichotomy that has emerged over the past 6 months or so. This example is a development that has only occurred 3 other times in history: on Monday, the S&P 500 closed at a 12-day high, yet the Russell 2000 closed at a 12-day low.

Since it’s unreasonable to draw any statistically significant conclusions about what to expect from just 3 precedents, we’ll look at each of them individually.

- November 21, 1995 The S&P 500 and Russell 2000 rallied as much as 3.5% and 5%, respectively, over the next 6 weeks before each ended up exactly unchanged around the 2-month mark. Subsequently, each rallied for several months.

- February 11, 1997 A week later, the S&P 500 and Russell 2000 were higher by 3% and 2%, respectively. By 2 months after, each was lower by about 7% before beginning huge rallies.

- April 2, 2013 Over the next month, the S&P 500 gained and lost as much as 2% before ending the month up slightly. The Russell 2000 lost as much as 3.5%, ending the month down about 1%. From there, each embarked on strong rallies.

It is again hard to make generalizations from merely 3 occurrences, but each tended to move sideways to a little lower for the next month or two before rallying.

What accounts for this odd development? Certainly part of it is just the ongoing divergence on a larger scale between the large and small caps. Part of it, however, is also helped by the recent tight 12-day range. There is not much distance between the top and bottom of the range.

Lastly, there is probably something else contributing to this and other unusual behavior between various segments of the market. What it is, however, we do not know. Whatever the dynamic is that is contributing to the many divergences and odd market behavior will probably remain a mystery until these dichotomies are resolved.

____

Photo courtesy of the Guinness Book of World Records..

Read more from Dana Lyons, JLFMI and My401kPro.