A Bittersweet Setup For Cocoa?

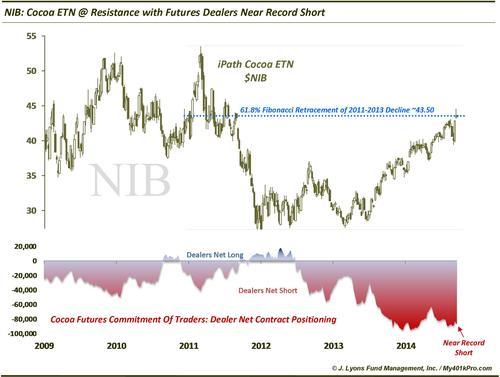

Unlike many commodities that have been getting crushed lately, Cocoa has been able to avoid the meltdown (so to speak). Through September, the iPath Cocoa ETN (NIB) was up a 22% for the year. And while its uptrend remains intact – and we are not about to fight it too forcefully – there are 3 reasons why a bittersweet counter-trend pullback may be in store for the commodity.

First, from 2011 to 2013, NIB dropped by almost 50%. Its recent rally has now reached the 61.8% Fibonacci Retracement level of that decline in the past few days. This can present a major hurdle for even the strongest of trends.

Secondly, looking at the Commitment of Traders report in Cocoa futures, we note that dealers’ net position is now close to a record short level (set earlier this year). And while dealers have been on the wrong side of the trade so far for much of the year, they are typically positioned correctly at major turning points.

Lastly, looking at seasonality we note that October is historically the weakest month for Cocoa. And it isn’t close as the following chart from sentimentrader.com shows. Cocoa is down roughly 30% of the time in October, to the tune of about 2.5%, on average.

While we would not stick a fork in the Cocoa rally without some price evidence first, considering the three points made above, we wouldn’t exactly call this a sweet spot of a long entry either.

And a bonus – this was one cocoa post without the word “ebola” in it…almost.

________

“Raw Cocoa Nibs” photo by Joana Petrova.

More from Dana Lyons, JLFMI and My401kPro.