The Breakout Of The Decade?

Of all the attempted international equity breakouts of 2017, Taiwan’s may be the most monumental.

2017 has been the year of the breakout in international equity markets. From developed markets like the UK and Germany to emerging markets like India and Indonesia, there’ve been no shortage of markets hitting new all-time highs. Whether or not these breakouts will be sustainable, or one great, big fake out, the trend has certainly been impressive. And perhaps the most impressive breakout of the year is unfolding right now.

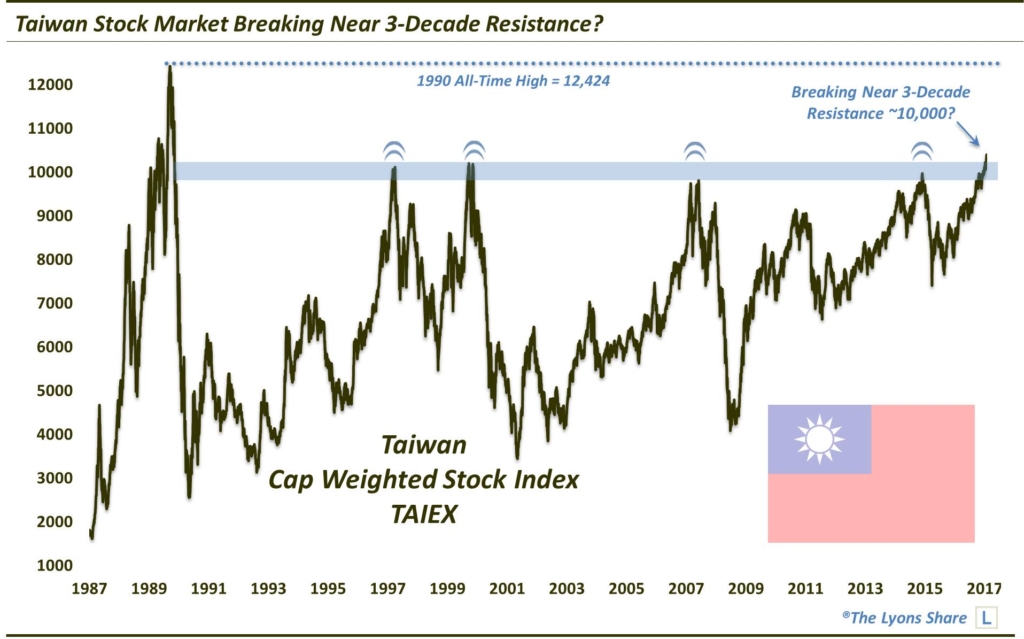

In February 1990, the Taiwan Cap Weighted Stock Index (TAIEX) capped off the monster run over the prior decade, closing at a high of 12,424. For the next six months, the index would go on to shed 80% of its value. From that point, the TAIEX would enter a trading range perhaps unprecedented in modern equity markets. For more than 2 ½ decades, the index would trade between roughly 3000 on the low end and 10,200 on the high end. At least a half a dozen times over that period, the TAIEX tested the 10,000-10,200 area, only to be rebuffed. Until this week.

For the first time in 27 years, the TAIEX closed above 10,300 – hitting a high just north of 10,400 on 6/22.

Of course, even if this breakout holds, the TAIEX will have to contend with its 1990 highs about 2000 points away. Even so, that would mark a 20% increase from current levels – not chump change. Most importantly, in our view, is the fact that the index is making a legitimate run at surpassing those peaks of the past 25 years.

If it is indeed true what they say about “the bigger the base, the higher the space”, the upside potential could be enormous here. Given the epic base in question, the “break out of the decade” consideration seems wholly reasonable.

If you want the “all-access” version of our charts and research, we invite you to check out our new site, The Lyons Share.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.