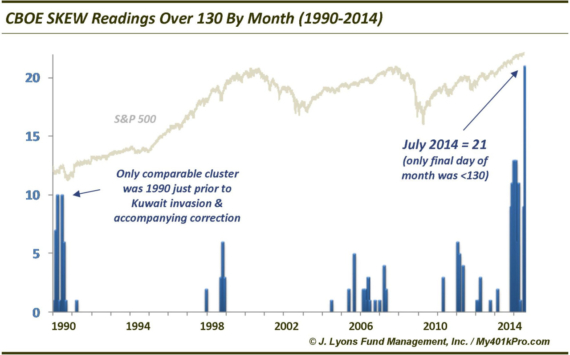

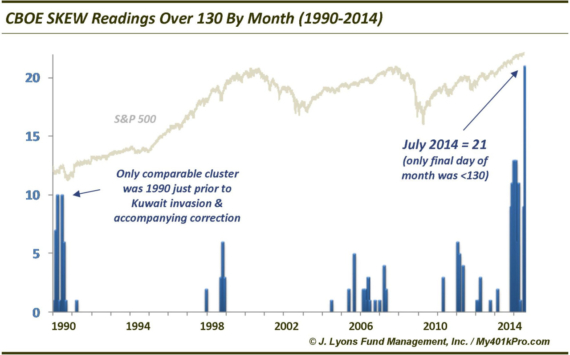

CBOE SKEW: Tail Risk Indicator Attains Dubious Record In July We’ve talked about the CBOE SKEW Index plenty over the past few months, given its…

CBOE SKEW: Tail Risk Indicator Attains Dubious Record In July We’ve talked about the CBOE SKEW Index plenty over the past few months, given its…

The stock market should underperform in the short-term but outperform longer-term…or is it the reverse? Everyone seems to be opining about the significance of yesterday’s…

Can Portugal Stocks Spark One Last Hurrah For The PIIGS? The topic of our Chart Of The Day on July 10 was Portugal’s PSI 20…

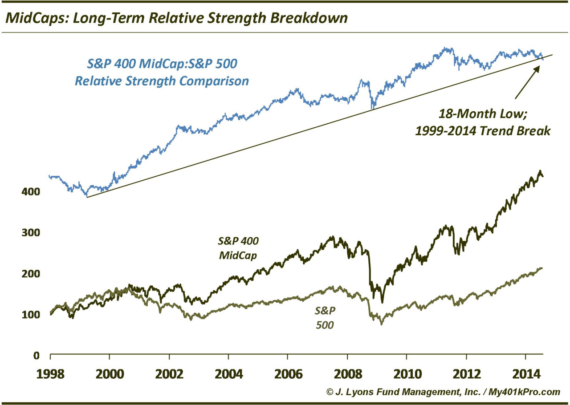

MidCaps: 15-Year Relative Strength Breaking Down Several months ago, we began noting relative breakdowns in key areas of the market. It started first in the…

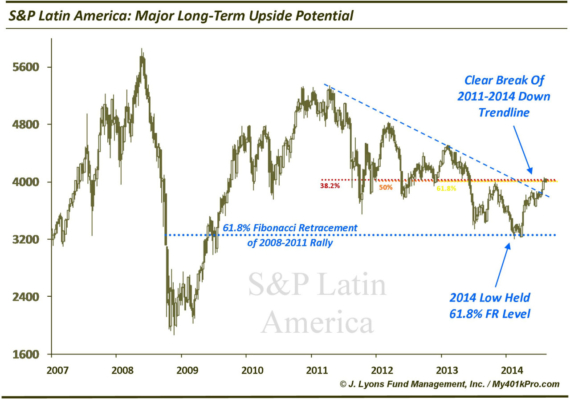

Regional Spotlight: Major Upside Potential In Latin America At times, investors get too caught up in micro-analyzing intraday price moves or reacting to noisy daily…

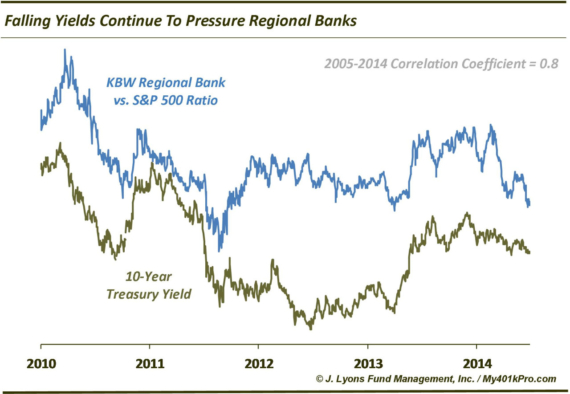

Falling Yields Continue To Pressure Regional Banks There are so many cliches and platitudes on Wall Street regarding stock market behavior (“sell in May”, “never…

Last week, China ADRs (as represented by the Bank of New York Mellon China Select ADR Index) broke out in impressive fashion to a 6-year…

The NYSE released their June margin debt update yesterday and it was a doozy. Margin debt jumped nearly 6% to just 0.3% shy of the…

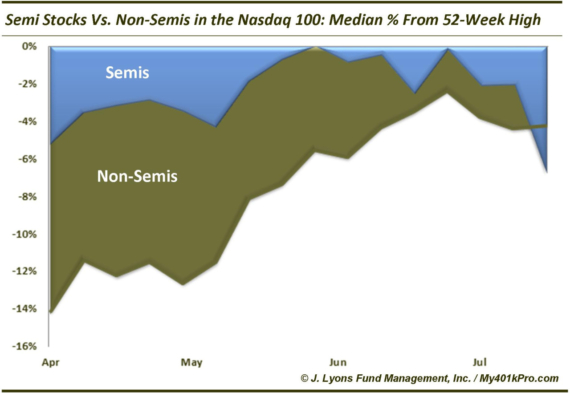

Semiconductors: From Leaders To Laggards? Our July 1 Chart Of The Day focused on the fact that the strong run in the Nasdaq 100 was…

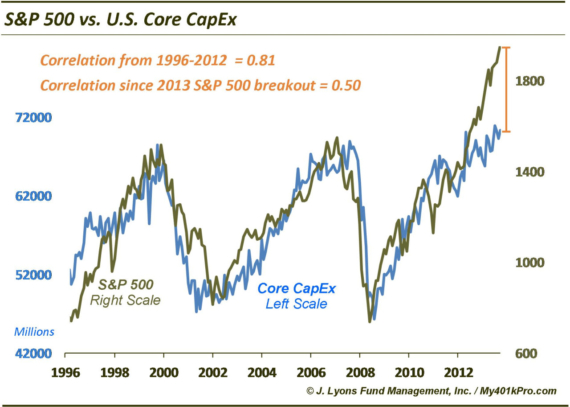

Stocks Leaving CapEx In The Dust The Commerce Department released its monthly look at business spending today and, surprise, Core Capex is still about where…